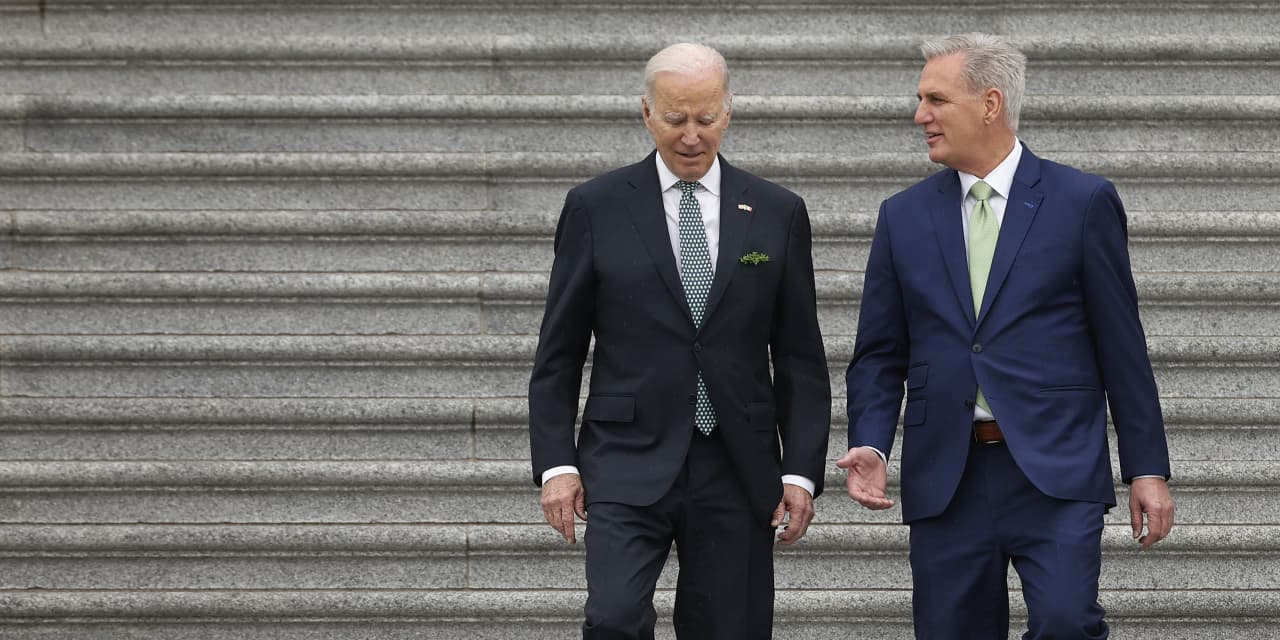

President Joe Biden and Speaker of the House Kevin McCarthy (R., Calif.) speak as walk out of the U.S. Capitol on Saint Patrick’s Day, March 17, 2023 in Washington, D.C.

Chip Somodevilla/Getty Images

About the author: Maya MacGuineas is president of the bipartisan Committee for a Responsible Federal Budget.

While Congress is locked in a cage match over whether to fund the federal government or shut it down, a welcome dose of sanity entered the otherwise dangerous and juvenile standoff: the idea of creating a bipartisan, bicameral fiscal commission to try to deal with our national debt.

First, on the shutdown.

Congress is fighting over the overall level of funding. That makes little sense given that the level was already set during the debt ceiling debate as part of the Fiscal Responsibility Act. The caps on overall discretionary spending were set at $1.59 trillion for next fiscal year, or $886 billion for defense and $704 billion for nondefense. Yet lawmakers from both parties in the Senate have moved forward with appropriations that exceed the caps, and a group of Republicans in the House have been insisting on spending below them. While it is true that the FRA didn’t save nearly as much as we need to fully address our fiscal challenges, it was a solid first start. Plus, a deal is a deal.

Sadly, governing by crisis has become the norm. It seems as though our leaders are now unable to avoid running headlong into any new showdown rather than avoiding it, giving the media yet another catastrophe clock to add to the news.

We have to do better.

Sadly, even once the government funding issue is resolved, our fiscal trajectory will still be unsustainable. The United States borrowed about $2 trillion over the past year and is on track to rack up $19 trillion more in debt over the coming decade. Interest costs on our debt are the fastest growing portion of the budget. The federal government is projected just four years from now to spend more to service our debt than on national defense. Debt as a share of the economy will soon be the highest in the history of our nation; our major programs Social Security and Medicare are headed toward insolvency in a decade; and even in the past week, there have been signs Congress is considering borrowing more.

Balancing the budget would require nearly $15 trillion in savings over the coming decade, a goal that is clearly out of reach. But even stabilizing our debt below 100% of gross domestic product—just holding the debt to below the size of the economy—would do significant good. Achieving this goal would require a challenging but doable $6 trillion of savings over a decade, which would be enough to meaningfully grow our economy, improve our preparedness for future emergencies, and strengthen our national security.

That is why it is so encouraging that in the midst of the government shutdown fight, a bipartisan group of lawmakers led by Reps. Bill Huizenga (R., Mich.) and Scott Peters (D., Calif.) introduced legislation to create a new fiscal commission.

The Fiscal Commission Act would focus on bringing down our medium- and long-term debt. It learns the lessons of past commissions—some of which have worked and others which have not—to maximize chances of success. It cleverly includes both sitting members and outside experts; has the ambitious yet attainable goal of stabilizing the debt; and requires bipartisan recommendations and then provides for an expedited decision-making process.

Perhaps most importantly, everything would be on the table—including revenue and mandatory spending. As any serious person knows, that’s the only way to truly address the debt. The legislation would also require the commission to report before we next hit the debt limit, which is a showdown we cannot afford to go through again for risk we might default.

There will be accusations that the commission is a stalking horse for tax increases. The truth is there is no conceivable way to fix our fiscal imbalances without more revenue, and those who pledge otherwise are just being reckless. And there will be accusations that this is a ploy to slash Social Security. The truth is Social Security will be insolvent in a decade, at which time the legal requirement is for across-the-board benefit cuts limiting benefits to incoming revenues, which will amount to about a 23% cut for everyone, regardless of need.

This type of baseless demagoguery shows exactly why a fiscal commission is necessary. Commissions aren’t a solution to the fiscal outlook, but a means to facilitate the necessary, adult conversation about our financial future.

Historically, commissions have shaped critical policies, both fiscal and nonfiscal alike. In the 2010s, the Simpson-Bowles commission proposed recommendations that, while never adopted in full, were the seeds of other fiscal improvements, including the spending caps enacted in 2011 and renewed by the FRA. In the 1980s, President Ronald Reagan and Speaker Tip O’Neill used the recommendations of the Greenspan commission to negotiate measures that saved Social Security from exhaustion. And the 9/11 commission and several rounds of base realignment and closure commissions have been used to keep us safe and improve national security both domestically and abroad through efforts that were at times controversial but ultimately successful.

Our fiscal challenges may be daunting, but they are not insurmountable. A fiscal commission could not only help to right our fiscal path, but it could also be a critical step in finding a way for our lawmakers to work together to solve large problems with courage, cooperation, and compromise—something we desperately need.

Guest commentaries like this one are written by authors outside the Barron’s and MarketWatch newsroom. They reflect the perspective and opinions of the authors. Submit commentary proposals and other feedback to [email protected].

Read the full article here