Having a million dollars to your name can seem very unattainable. Without the help of family inheritance, or a lucky scratch ticket, how do you get there?

The good news is that it is possible to reach a million dollars without the help of some lucky lottery numbers. It is, however, going to take a lot of hard work and years of financial discipline to reach that goal.

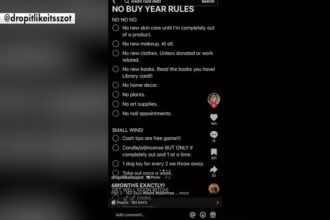

If having high savings is important to you, you’ll have to lower your spending. That means you may have to give up the shiny new sports car and massive home, at least for now.

10 THINGS YOU CAN DO RIGHT NOW TO FINANCIALLY PLAN FOR YOUR FUTURE

Below are tips on how you can make your first million.

- Make lifestyle adjustments to decrease overall spending

- Max out your 401K early

- Invest as early as you’re able and don’t be afraid to take financial risks

- Minimize debt, and don’t accumulate more

- Turn passion projects into moneymakers

- Develop several streams of income

- Automate your savings

1. Make lifestyle adjustments to decrease overall spending

If you want to have a million dollars, you’re probably going to have to make some difficult lifestyle adjustments. These lifestyle adjustments can be something as small as making coffee at home versus buying Starbucks every day, to larger changes like making the decision to buy a used car outright instead of taking out a hefty loan for the new car you wanted.

In order to accumulate wealth, you need to increase your profit margins. This term doesn’t just work for businesses: you can also apply it to your personal savings goals. Profit margins refer to how much you make versus how much you spend. To make money, you’ll need to spend less, make more and put those extra dollars away for your savings.

PERSONAL FINANCE: HOW TO SAVE $100 THIS WEEK

Making lifestyle adjustments to decrease overall spending can be extremely challenging but is entirely necessary to see an increase in overall wealth. One way to go about this is to write out all your monthly bills and how much you spend, on average, on things like eating out, subscription services and online shopping. Once you have everything written down, try to find areas where you can cut down. You will find that little changes can save you a lot of money in the long run.

2. Max out your 401K early

Retirement is something many professionals, especially during early years, don’t worry about. When retirement seems so far away, it can become an easy thing to put off and worry about later. Don’t fall into this mindset.

As soon as a 401K is available to you, start maxing it out. If you start saving early and max out your contributions, you can reach an amount of over a million dollars by the time your retire.

If you wait until closer to retirement age to start saving, you’ll have to dedicate a lot of money to it and be scrambling at the end of your career. If you start saving early, the amount you put into your 401K will be a lot lower, and you’ll have a lot of time to grow your funds.

3. Invest as early as you’re able and don’t be afraid to take financial risks

While saving for retirement is extremely important, so is investing in general. Investing your money can allow for massive growth over time.

WHAT IS AN INVESTMENT PROPERTY?

Investing can be scary since it involves a certain degree of risk, but you’re going to have to take financial risks in order for your money to grow.

There are many different ways to invest. A good starting point is with low risk investments like money market mutual funds and bonds.

Another investment that can turn into financial growth is real estate. Real estate may be a difficult investment to make early on in your financial journey since you will likely need a large down payment to make your real estate purchase. One good place to start is to consider buying a multifamily house, where you can live in one side and rent out the other to tenants.

4. Minimize debt, and don’t accumulate more

Before you can really begin to save, you’ll need to pay off your debt. However, this doesn’t necessarily mean that you can’t start saving until all your debt is paid off: you can save and pay off debt simultaneously.

That being said, the faster you are able to pay off your debt, the more money you can put toward your savings.

HOW TO PAY OFF CREDIT CARD DEBT: 6 WINNING STRATEGIES

Once you’ve paid off a debt, like a car loan, you can then take that money you were spending each month on your car and put it straight into savings.

Once you have paid off your debt, don’t automatically pursue another big purchase. Once you pay off your car, don’t immediately go and buy a new one, giving you another debt. Try to minimize the debts you accumulate if you want to build your overall wealth.

5. Turn passion projects into moneymakers

A great way to make extra income is to invest in yourself through creating your own business. When trying to come up with a business plan, think about things that you are passionate about, and brainstorm how you can transform those passions into a business.

6. Develop several streams of income

It can be difficult to build wealth from only one income source, especially early in your career. Having multiple streams of income, in addition to lowering your spending, will give you more flexibility for saving.

START YOUR OWN BUSINESS: HOW TO MAKE YOUR SIDE HUSTLE DREAM A REALITY

There are so many different ways to earn more income in addition to your main salary. For example, being a delivery driver after your shift, working at a restaurant on the weekends or starting your own side hustle are just a few of the many ways you can develop multiple streams of income.

Having several streams of income does come with compromise, as you won’t have as much free time on your hands. Earning wealth takes a lot of time, dedication and discipline, so there are going to be compromises that must be made in order to reach your financial goals.

7. Automate your savings

One of the best ways to build wealth is to not even think about it, and that’s where automating your savings comes into play.

If you are manually putting money into your savings each week, or every other week, it’s easy to forget. It’s also easy to skip weeks of putting money aside when you are doing it manually.

If everything is automated, it creates a positive financial flow, where you are saving money and building wealth without any extra effort on your part.

Most commonly, individuals put money into savings bi-weekly or monthly, depending upon whichever works best for them. A bi-weekly approach is favorable because this is often how employees get paid, so money will come straight out of their checking into their savings on payday. Automating savings on a monthly basis is another favorable option because a lot of bills are paid on a monthly basis, so it is fairly easy to calculate how much income is being brought in, what your bills cost and then calculate how much you are able to save.

Automating your savings is an extremely quick and painless process. The process may vary slightly, depending on the bank you use, but most banks allow you to easily set up recurring transfers. Once you come up with the starting amount, you can always make changes in the future as income and circumstances change.

You can automate the money that is going into your savings, 401K and your other investment accounts. You can even automate many bills, like credit card bills, to ensure they get paid on time.

Automating your money is a great way to save, without having to constantly worry about putting money aside.

When you are choosing a savings account to use, consider a high-interest savings account for more growth on every dollar you put in.

Read the full article here