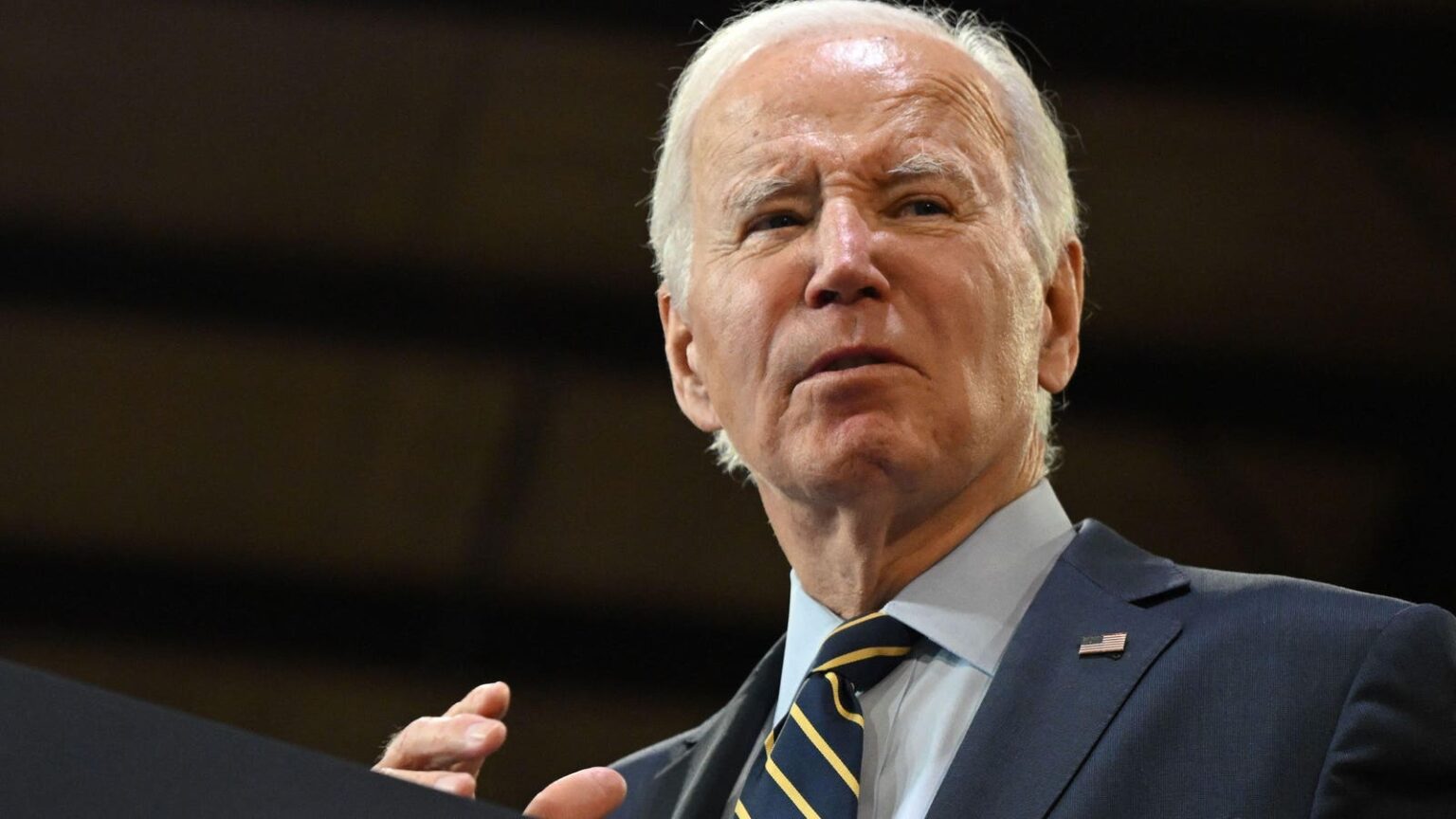

At President Joe Biden’s direction, a new student loan forgiveness plan is currently under development. And financial hardships could ultimately become a basis for receiving automatic relief.

After Biden’s first student debt relief initiative was rejected by the Supreme Court last summer, he directed the Education Department to quickly start creating a new program using a different legal authority. Since then, the department has been engaged in a rulemaking process to establish regulations governing this new loan forgiveness plan. The process involves a committee of stakeholders which holds a series of public meetings while they try to find consensus.

The rulemaking committee concluded its second round of public hearings yesterday. During these hearings, stakeholders and Education Department officials hashed out in the greatest detail yet who could qualify for student loan forgiveness under Biden’s new plan, and which hardships could allow for relief — particularly automatic cancellation.

New Biden Student Loan Forgiveness Plan Will Provide Relief To Different Groups

Biden’s new student loan forgiveness program is being developed under the Higher Education Act, a different legal authority than the one used for his initial plan that was struck down earlier this year. The HEA has a provision that allows the Secretary of Education to compromise or waive federal student loan obligations in certain circumstances, such as when the Education Department determines that a borrower would be unable to repay their loan balance within a prescribed period of time, and the costs of collection would be too high for the government to justify the efforts.

In advance of this week’s rulemaking sessions, the Education Department identified four main categories of borrowers who could qualify for student loan forgiveness under the new HEA program. These groups would include those whose current loan balances exceed the amount originally borrowed despite payments made over time; borrowers who went to a school that did not provide them with sufficient value that would allow them to repay their student loans; people who still have student loans after 25 years or longer; and borrowers who have not applied for relief under existing student loan forgiveness programs but could nevertheless qualify.

Automatic Hardship Categories For New Biden Student Loan Forgiveness Plan

The Biden administration also identified another group of borrowers who may qualify for student loan forgiveness under the HEA program: those who have identifiable financial hardships, but don’t fit within one of the other four categories and are not provided relief through current student loan programs. While the Education Department released draft regulations for the first four groups of borrowers, officials held off on writing draft rules for the hardship category, as they wanted the negotiated rulemaking committee to meet and discuss further.

At yesterday’s hearing, the rulemaking committee focused on several potential hardships that could provide the basis for automatic student loan forgiveness. Advocates on the committee argued that automated relief is critical, particularly given that the Education Department has expressed reservations about its ability to implement yet another program, particularly one based on individualized review, as the federal student loan system is already taxed and facing serious problems. Members of the committee argued that several groups of borrowers could be fairly easily identified as having a hardship and, thus, could potentially qualify for HEA student loan forgiveness automatically:

- Borrowers who are currently in an active bankruptcy status. A bankruptcy status is logged into the Education Department’s loan data system, even if the borrower is not seeking a student loan discharge in their bankruptcy case.

- Those who are currently in default on their federal student loans. Defaulted borrowers have historically been excluded from newer federal student loan forgiveness and relief programs, but the department could easily identify those are presently in a default status.

- Borrowers who received Pell grants as part of their financial aid package. Pell grants are only awarded to families with demonstrated financial need. Notably, the Biden administration used the past receipt of Pell grants as a basis for automatically enhanced student loan forgiveness as part of the President’s initial student loan forgiveness plan.

- Individuals who are eligible for (or who currently receive) federal poverty-based benefits such as food stamps, Medicaid, or Affordable Care Act subsidies for health insurance. These are people who already have demonstrated financial hardship in order to be receiving these benefits.

- Those who have a disability. The Education Department already is able to identify borrowers who receive Social Security disability benefits through a data sharing initiative with the Social Security Administration.

- Incarcerated borrowers. These borrowers were not included in the Education Department’s initial outline of possible hardship categories, but negotiators noted that borrowers in prison “can’t service their loans and often face life-long poverty.” A prison address could be the basis for automatic relief.

- Those who have a demonstrated history of being unable to repay their student loans. This could be determined through extended periods of $0 monthly payments calculated under Income-Driven Repayment plans, or long periods of hardship forbearance or deferments — all information that should be readily available in Education Department data.

- Seniors and elderly borrowers. The Education Department has borrower birth dates on file, and negotiators suggested that low-income seniors over the age of 65 should qualify for loan forgiveness.

Other Potential Hardships For Student Loan Forgiveness

The rulemaking committee also discussed other possible hardships that could qualify borrowers for student loan forgiveness. However, it would be more difficult for the Education Department to grant forgiveness automatically, and an individualized review might be necessary.

These potential hardship categories include borrowers who have experienced homelessness, those who have been harmed by poor student loan servicing practices, former foster youth or people who are from geographic areas with concentrated poverty, those who have poor debt-to-income ratios, individuals who graduated during a recession, community college students, and those who have medical issues or significant medical expenses but are not considered to be permanently disabled.

The Education Department was far more resistant about many of these hardship categories. Department representatives expressed concern that some of these categories were too broad, were not necessarily indicative of current borrower financial circumstances, or would be difficult for the department to evaluate without an intensive and taxing individualized review.

What People Should Expect As HEA Student Loan Forgiveness Process Moves Forward

While this week’s hearings have concluded, the negotiated rulemaking process to create this new student loan forgiveness plan is not over. Members of the rulemaking committee will insert comments and changes into the Education Department’s draft regulations.

The next rulemaking committee hearings will be in December, during which members will begin to vote and try to reach consensus on the regulatory language. If the committee reaches consensus, the Education Department is far more likely to adopt the committee’s recommendations. If there is disagreement, department officials have a freer hand to create rules in accordance with department priorities.

Sometime next year, the Biden administration will then publish final regulations, which will then open up a new public comment period. Once finalized, the program is expected to become available in either 2024 or 2025, depending on whether Biden authorizes early implementation.

Further Student Loan Forgiveness Reading

Major Student Loan Forgiveness Deadline Nears, But Could Get Extended

A Student Loan Borrower Got A Bill For $108,895 — What To Do If It Happens To You

Education Department Unveils Major Details On New Student Loan Forgiveness Plan

5 Student Loan Forgiveness Updates As On-Ramp Begins And Problems Worsen

Read the full article here