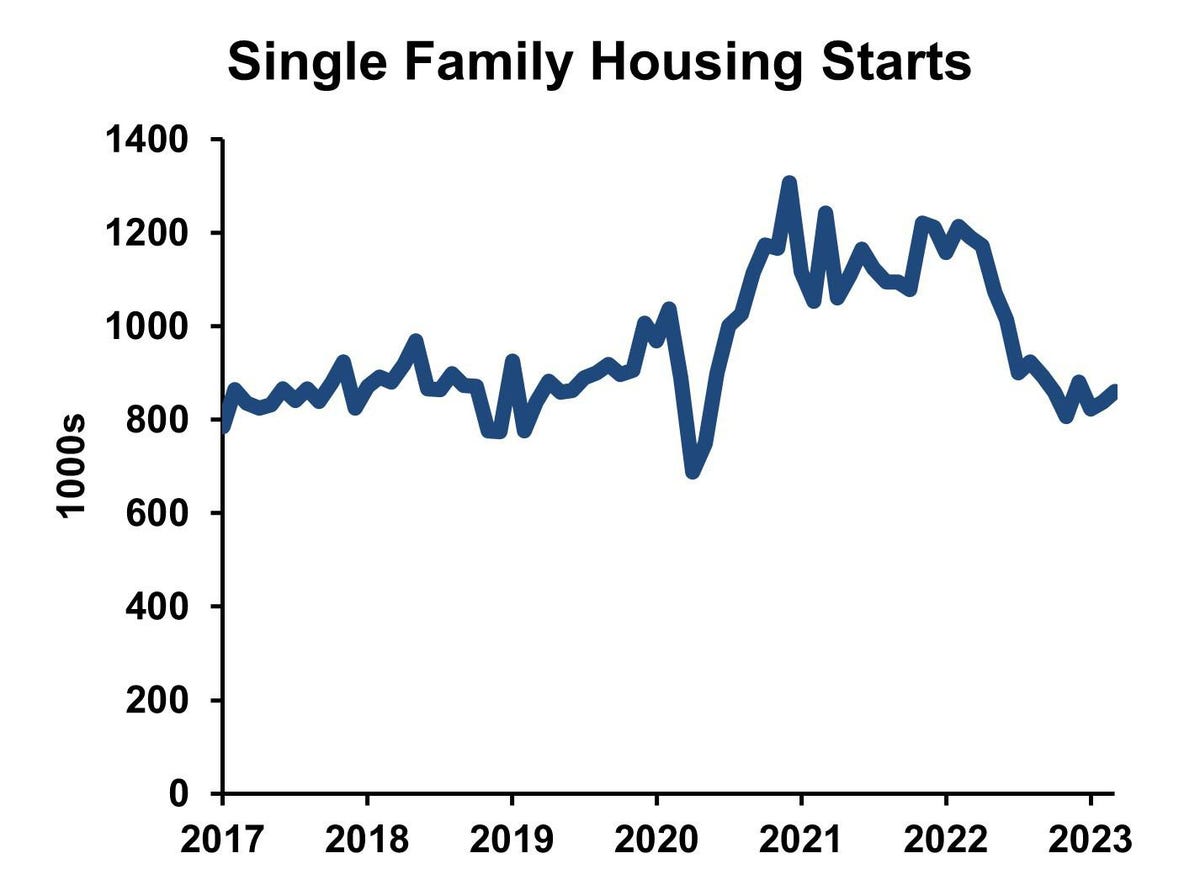

Six months ago I predicted that home prices would fall, the number of houses sold would decline, and new construction would drop. Since then, home prices have come down a little, on average, but not too badly. The number of home sales is definitely way down. And the latest data on housing construction show that single family housing starts are well below six months ago’s level and much lower than a year ago. Those are national figures, with local markets ranging above and below average.

Mortgage rates have fallen since October 2022; from 6.90% to 6.27% most recently. They dropped on expectations that the Fed will stop raising short-term interest rates. The small decline in mortgage rates prevented a steeper drop in home prices.

Looking to the future, the greatest issue is the underlying demand for housing, followed by how much of that demand was already met during the two years of extremely low interest rates.

Underbuilding has been a common theme of the housing optimists, who think that we have not been building enough. A typical point made is that we used to build about one million single family houses a year, but for over a decade we only built 650,000 a year, a decline of 40%. (The actual average from 1960 through 2007 was 949,000; in 2008-2019 it was 656,000.)

Demand, however, has been falling over the last half century. Most houses last a long time. Two-hundred year old houses are not rare in the older parts of the United States. The critical issue, then, is not replacing old housing the creation of new households. And the Census data are sobering. In the earlier period, we added 1.3 million households per year, on average, but in later years just 1.0 million households. That decline is less than the construction drop, but let’s look at multi-family building. It rose from a 29% of total housing units built to 31% of total units, taking up some of the slack.

Since the pandemic began, the United States has had extremely low population growth. Immigration (both legal and estimates of undocumented immigration) has been extremely low. Plus natural increase (babies in excess of burials) has also been quite small.

The underbuilding hypothesis certainly rings true in some communities, especially those in the northeast and the west coast that have strict limits, or high costs, on development. It’s far less true in the midwest and the south.

The statistics on housing demand show the difficulty of calculating precisely how much we have been underbuilding. First, people can live alone or with others. Young adults may live with their parents. Single people may live alone or have roommates. These are sometimes family or lifestyle decisions, but they are often influenced by finances. When stimulus payments made many people flush with cash, they ditched their roommates. Then when inflation tightened their budgets, they accepted roommates once again.

For the nation as a whole, there does seem to have been some underbuilding, but not too much, in the era before the pandemic.

The next forecasting challenge how the home-buying surge in 2020 will impact future demand. When Covid-19 hit, the Federal Reserve cut interest rates and home mortgage rates began to drop. At the same time, some families that lived in apartments changed their mind about where they wanted to live. Larger lodgings suited remote work better, and the distance from downtown wasn’t relevant when a commute was from the bedroom to the family room.

Home sales before the pandemic had been running about five and a half million per year, then soared to six and a half in late 2020, according to the National Association of Realtors. Homebuilders responded to the demand by erecting more houses. They hit a peak of 1.3 million units (annual rate) in late 2020 and kept the pace above that of 2019 until October 2022, according to the Census Bureau’s New Residential Construction report. The country’s homebuilders constructed about two million single family houses over and above the pre-pandemic trend.

Many of those two million newly-built home were sold to people who previously owned a home, but their old houses went back onto the market, and eventually a comparable number of houses went to first-time buyers. Who were they? Most of them, the overwhelming majority, were probably families who had anticipated buying a house and moving out of their apartment. They did so earlier because at rock-bottom low mortgage rates, they could afford to buy immediately instead of waiting a few years. In other words, the housing boom was simply borrowing from the future.

The future is now. Think of the families who, four years ago, seemed likely to buy their first home in 2023. Most of them bought a house already, when mortgage rates were low and prices had not fully surged to record highs. That bodes ill, very ill, for the housing market in 2023.

Mortgage rates have dropped from their peak, but at 6.26% they remain above anything seen since 2006. And though home prices have fallen, the drop has been less than one percent—after two years of gains totaling 38%. In a nutshell, houses are now very expensive, and the most likely homebuyers already have theirs.

The possible upsides are that there are a number of people in their prime home-buying years. Many of them won’t be dissuaded by the high mortgage rates, figuring that they can refinance in a few years when rates come down (which probably will happen, though it’s not a certainty). The housing market won’t collapse like in 2008-09 recession, because mortgages have been underwritten with sound principles, such as verifying incomes. So 2023 and 2024 will not be disastrous for housing in the United States, but prices will likely edge down with lackluster volume of transactions.

Read the full article here