China is currently the world’s largest emitter of greenhouse gases, accounting for nearly 1/3 of the global total. Beijing is well aware of the effect its emissions have on climate change and has pledged to be carbon neutral by 2060, with emissions peaking in 2030.

As part of its emissions reduction plan, China is introducing more eco-friendly practices in the financial services sector, but there is a steep learning curve, as loans to high-carbon industries account for a fairly high proportion of financial institutions’ assets in the country. An accelerated withdrawal or delayed exit from high-carbon sectors may result in heightened financial risks.

That said, there is a huge opportunity for sustainable finance in China given its ambitious emission reduction target. China’s green finance market in the world’s largest emitter nation has already reached US$2.3 trillion, according to UBS.

Green bond boom

To meet its net-zero emissions target, China needs RMB 140 trillion (US$21.3 trillion) of debt financing over the next 40 years, according to China International Capital Corp, an investment bank. Green bonds are an important part of the picture. According to S&P Global Market Intelligence, China issued the most green bonds globally in 2022 at US$76.25 billion, according to data from Climate Bonds Initiative. This year, China is expected to issue between US$90 billion and US$100 billion in green bonds.

Other Asian countries are much smaller players in this market. Japan and India ranked No. 7 and No. 10, respectively, on the global league table of green bond issuance in 2022. Overall, Asia-Pacific countries issued US$120.83 billion of green bonds in 2022, so China accounted for almost 2/3 of total issuance.

Data compiled by Bloomberg show that as of late 2022, China’s green bond market had reached US$300 billion in value. There were 1,029 entities made up of 1,029 bonds. About 70% of that market is made up of local notes denominated in renminbi. To improve accessibility to global investors, the rest are mostly denominated in dollars.

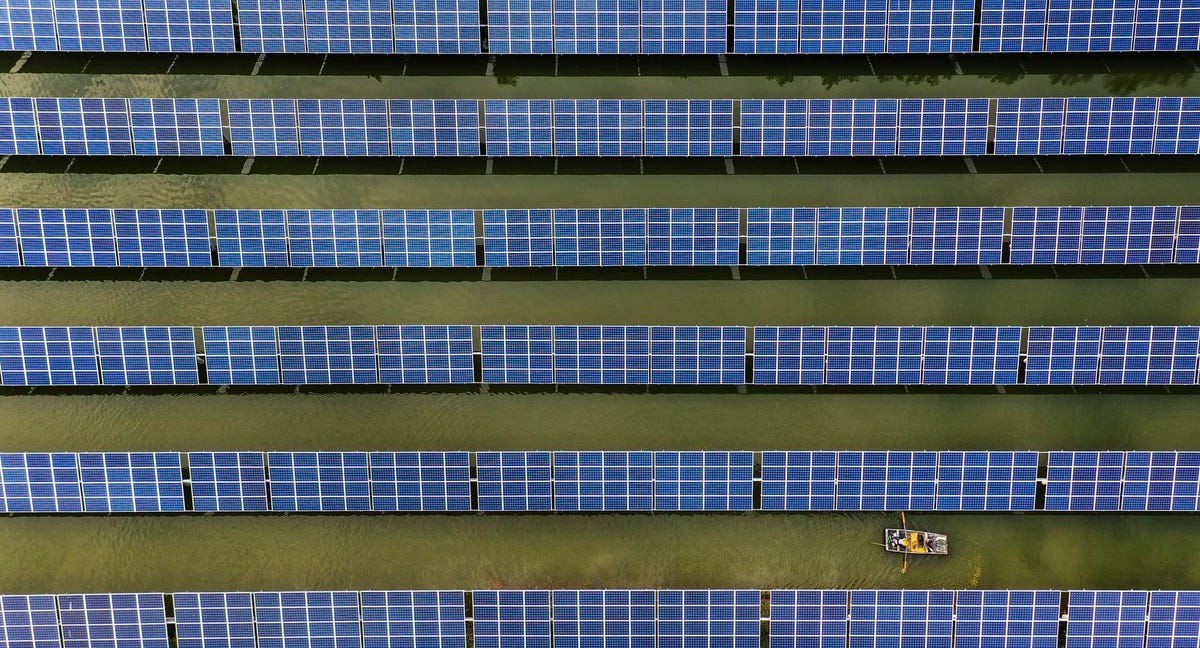

Renewable energy attracts the most funding with about 46% of projects citing that purpose for at least a portion of the funds raised.

Growing pains

While China has built up an impressive green bond market, the market is undergoing some growing pains. Transparency is often not high, raising greenwashing concerns among international investors.

Their fears are not unfounded.

A Wall Street Journal report found that in the first five months of 2021, 33 of the 127 green bonds issued in China failed to meet criteria set by Climate Bonds Initiative (CBI). CBI said that proceeds from green bonds sold in April 2021 by Zijin Mining Group and China Petrochemical Corp would be used to build solar panels – but the panels would likely support the firms’ respective traditional businesses, mining and oil extraction.

Part of the problem is regulatory. Several agencies regulate the market, and they apply different rules on how cash and disclosure are used. In China, sometimes up to 50% of the proceeds from onshore green bonds can be used to fund a business’s everyday cash needs rather than climate-related projects. The equivalent international maximum is just 5%.

In June 2022, People’s Bank of China Governor Yi Gang warned against the “greenwashing, low-cost fund arbitrage, and green project fraud” that has risen as borrowers have scrambled to meet Beijing’s top-down environmental directives.

Meanwhile, many Chinese firms remain circumspect about green bonds, because they do not see any cost advantage, and believe many green projects are too risky given uncertain market support for them.

Cautious optimism

Despite regulatory hiccups and concerns about greenwashing, China’s green bond market is continuing to grow steadily. In fact, last year, the Chinese market was an outlier. While the U.S. and European markets were weighed down by high interest rates and geopolitical tumult, China’s green bond market managed to grow 30%.

In August 2022, China took an important step to combat greenwashing: The Shanghai Stock Exchange began requiring that 100% of the proceeds from green bond issuances to be invested in green projects such as clean energy, up from 70% previously.

Additionally, the China Securities Regulatory Commission (CSRC) instructed both the Shanghai and Shenzhen exchanges to revise rules to harmonize bond issuances with the country’s new “China Green Bond Principles.” These guidelines are largely in which line with those issued by the International Capital Market Association (ICMA.

These regulatory changes are important steps in the right direction, but looking ahead, the prevalence of state-owned enterprises (SOEs) in green bond issuance could stymie Beijing’s bid to bring the market in line with global standards. Excluding financial institutions, SOEs accounted for 52% of green bond issuers in China in 2019-2022, according to the Institute for Energy Economics & Financial Analysis.

SOEs have yet to adopt the China Green Bond Principles. The National Development & Reform Commission (NDRC), responsible for supervising enterprise bonds, has not yet required SOEs to adopt these guidelines, which means that they could theoretically issue green bonds and then use part of the proceeds for something very un-green, like coal.

In fact, as the Institute for Energy Economics & Financial Analysis notes, coal-dependent power producers China Huaneng Group, China Huadian Corporation and State Power Investment Corporation regularly issue green bonds.

Without action by the NDRC to ensure SOEs comply with the China Green Bond Principles, the risk of continued greenwashing will remain high.

Read the full article here