Topline

In its report on March’s failure of Silicon Valley Bank released Friday, the Federal Reserve pointed a finger at social media’s influence on the crisis – and admitted it did not do enough to cool the situation.

Key Facts

The 114-page report listed social media-fueled panic as one of the chief factors behind the second-largest bank failure in U.S. history, primarily blaming the collapse on poor risk management at the bank and too loose supervision from Fed supervisors.

The early March run on Silicon Valley Bank “quickly accelerated as social networks, media and other ties reinforced a run dynamic that played out at remarkable pace,” the Fed said.

Also fueling the rapidly spreading panic was the bank’s highly “concentrated network of venture capital investors and technology firms” who accounted for most of the institution’s deposits, withdrawing their money “in a coordinated manner with unprecedented speed.”

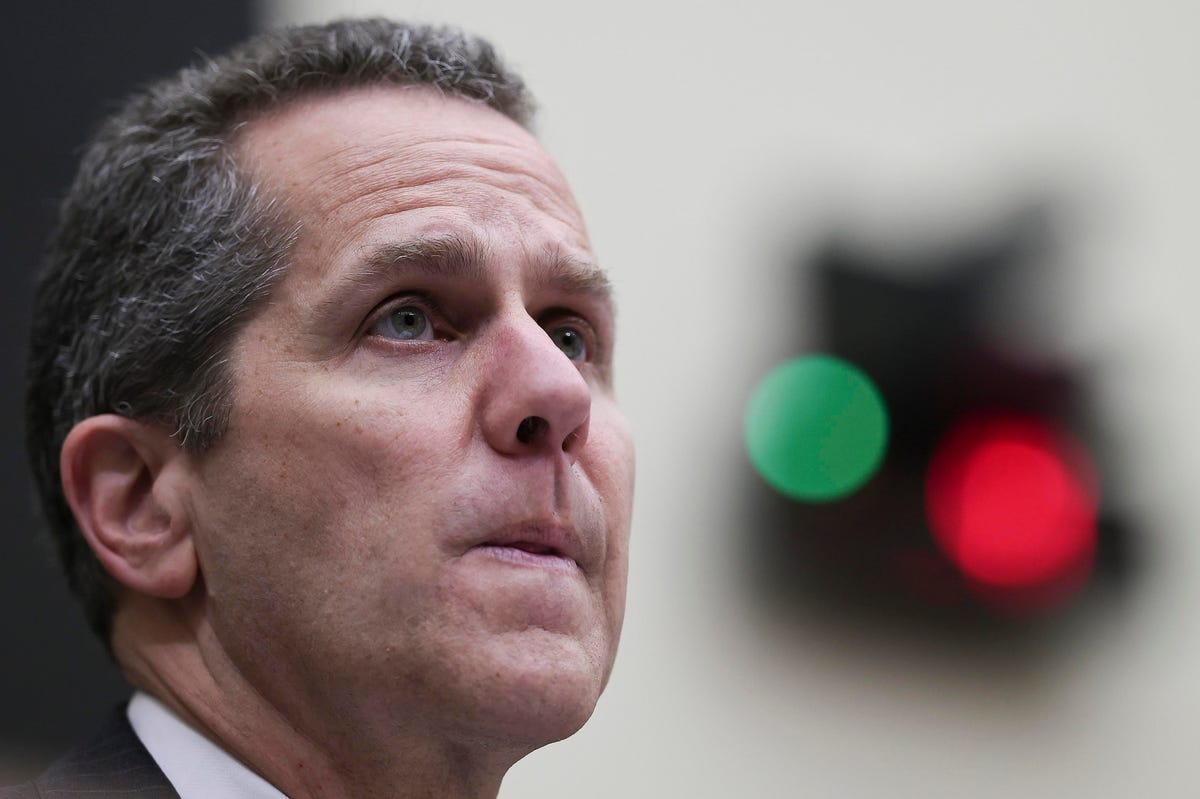

Still, it was primarily a “textbook case of mismanagement” among Silicon Valley Bank’s top executives and a failure by the Fed to “take forceful enough action” before the run on deposits as the bank’s cracks grew apparent, Michael Barr, the Fed’s top official in charge of banking regulation, said in a letter accompanying the report.

The report asserted that had the bank regulation requirements that were rolled back in 2018 still been in place, they “would likely have bolstered the resilience of Silicon Valley Bank,” possibly indicating tighter regulations on institutions may be on the way.

Crucial Quote

“The fact that the FDIC stepped in and closed SVB down in the middle of the day is a clear indication of how scary it was,” Moody’s Analytics chief economist Mark Zandi told Forbes earlier this week, referring to Silicon Valley Bank’s midday failure on Friday, March 10. Regulators “felt they had no choice” but to shut down the country’s 16th-largest bank “because deposits were fleeing so quickly,” Zandi added.

This is a breaking news story and will be updated…

Silicon Valley Bank’s Abrupt Closure Leaves Venture Capitalists And Founders Scrambling (Forbes)

Senate Banking Hearing: Officials Blame Management At Failed Banks, Tout Regional Banks As Economic ‘Strength’ (Forbes)

Federal Agencies In ‘Urgent’ Talks About Possible First Republic Bank Rescue, Report Says (Forbes)

Read the full article here