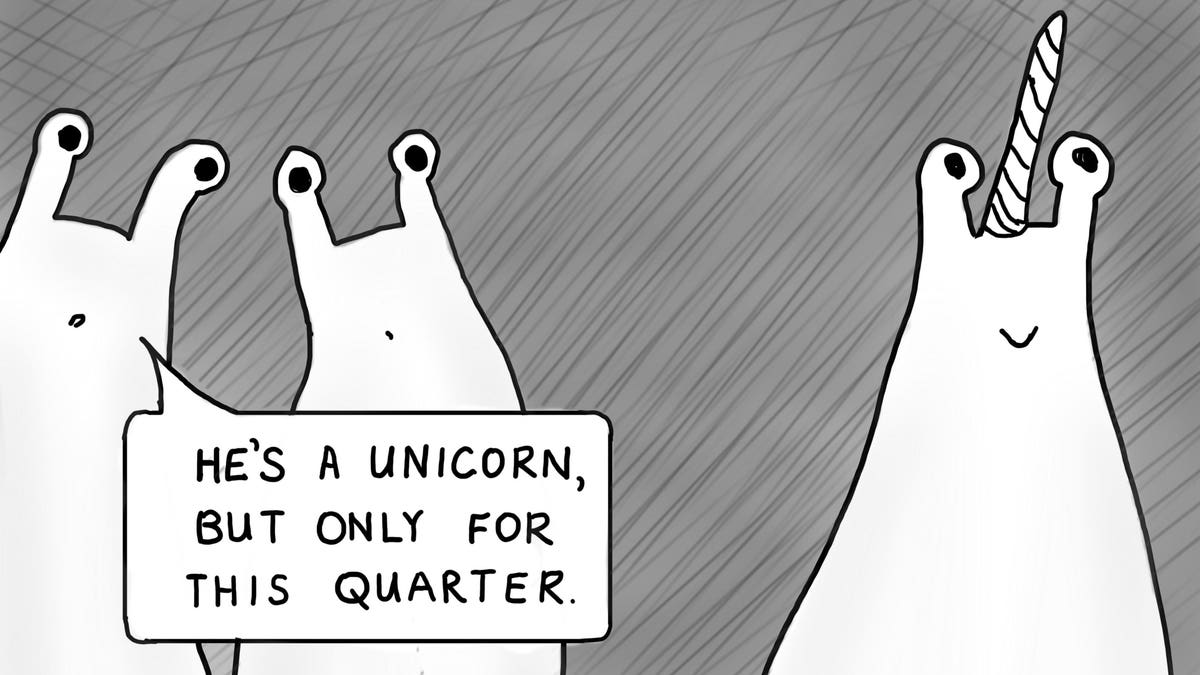

I always thought that “unicorns” was the wrong name for fintechs that reached a billion dollar valuation. After all, unicorns do not exist (sorry kids) but such fintechs do. They are not mythical, but they are rare. What’s more, they seem to be getting rarer. We probably should have called them fintech red wolves or fintech Amur leopards. Are they going extinct though? I think not.

Fintech Funding Down

Despite the obvious downturn in parts of the economy, fintech is in reasonable health. While global fintech funding fell by almost a half last year, it was still a fifth of of all funding globally, which would seem to indicate that investors remain positive. A CB Insights recently found that two of the largest global VC firms (Sequoia Capital and Andreessen Horowitz) actually backed more fintech companies in 2022 than any other category, putting around a quarter of the total investments into fintech startups.

This doesn’t mean that fintechs are heading for the stratosphere though and there are signs that some startups may be overvalued. In recent months, several high-profile fintech companies have seen investors mark down their investments. In April, Schroders devalued its stake in Revolut by about 46%, while Allianz is understood to be selling its holding in N26 at a $3 billion valuation—a steep discount to the $9 billion price tag the company picked up in 2021. While VC funding pushed up valuation in recent years, as of the first quarter of this year the median pre-money valuation for European fintech startups stood around €19 million (according to PitchBook data). So far this year, this increase has been consistent across all stages, with the notable exception of venture growth, which saw a decline of almost two-thirds.

Valuations are, some would say, becoming more realistic. This can be seen from the increasing number of fintech deals and the falling multiples across the last year. For example, the median revenue multiple range as of Q1 2023 was 1.6x – 5.5x, which is almost a half down on the 2021. Observers seem to be expecting more down rounds, or at best flat rounds, as companies who raised money in the good times look to scale.

These broad surveys correlate with my recent experiences. As someone who is privileged to sit on some boards and advisory boards as well as advise a small venture fund, I can say that broadly speaking good startups are still getting investment — in fact in the last few months I’ve made a couple of pre-seed investments myself — but that scale-up money is getting harder to come by. Getting to that billion dollar valuation is going to take a fair bit longer for many good companies.

Where is the sector going next then? Well, unicorns are not only mythical beasts roaming the fintech landscape. There are dragons out there too. A dragon is a company that deliver returns equivalent to whole of the fund that invested in it and is therefore very desirable for investors: It may not become a unicorn, but it makes more money for the fund.

I spoke to Richard Abrahams at Sprout, one of the several new platforms that helps private investors discover, invest and monitor venture and private fund investments about the “unicorns vs. dragons” debate and he told me that when it comes to mythical beasts, it is the dragons who deliver and the falling numbers of unicorns does not mean the search for funds to find dragons is slowing!

Where might we find some of these dragons? Well, while the payments space attracted $53 billion, the largest share of funding in 2022, it was actually regtech that was the fastest growing segment. Investment almost doubled to almost $19 billion and my sense of the market is that this will continue to be the focus. When you take a hard look at costs and benefits in financial services, the sexy front-end apps may attract the attention (and who doesn’t think Apple

AAPL

One thing that might help tilt the cost-benefit scales around regtecgh is digital identity. Kirsty Rutter, the Fintech Investment Director at Lloyds Banking Group in the U.K. points to that as a specific area where there may be growing opportunities this year. Numerous fintech companies have emerged working to tackle different aspects of the identity challenges across identification, authentication and authorisation and digital onboarding accelerated throughout the pandemic but so did fraud, increasing the pressure for co-ordinated national and international action here. As she says “our digital identity has become our most valuable digital asset” and so providing tools for the banks to safeguard that asset look like serious business.

Fintech Prospects Good

In the long run, what does this mean? There is no need for gloom. If you have a good idea in the fintech space, go for it. A recent Boston Consulting Group report (Global Fintech 2023) projects fintech revenues growing sixfold from $245 billion to $1.5 trillion by 2030 and suggests that the sector as a whole, which now has a 2% share of the $12.5 trillion in global financial services revenue, will account for 7% of the total and that fintechs will constitute almost 25% of all banking valuations worldwide by 2030. There won’t be an extinction. There will be more regtech red dragons and more fintech red wolves.

Read the full article here