With an end in sight to the Fed’s interest rate hiking cycle, capital seeking high returns should invest into fast-growing technology stocks.

One place to look would be companies that are growing faster than the large, untapped markets in which they compete. For example, Samsara, a provider of sensors and cloud-based software to manage vehicle fleets and industrial operations, is growing twice as fast as its market.

Although Samsara is unprofitable and burning through free cash flow, I see four reasons its stock could rise:

- Expectations-beating growth and prospects

- Significant untapped market opportunity with powerful tailwinds

- High customer return on investment

- Excellent management team

(I have no financial interest in the securities mentioned).

Expectations-Beating Growth And Prospects

Samsara beat expectations and raised guidance in its most recent financial report.

Founded in 2015, San Francisco-based Samsara develops Internet connected sensor systems. It combines plug-and-play sensors, wireless connectivity, and cloud-hosted software integrated for deployment. Its Internet of Things platform provides GPS tracking for trucks, and monitors routes and vehicle performance.

Here are the highlights of its financial report for the quarter ended January 31, according to Investors Business Daily:

- Revenue up 48% to about $187 million — $14 million more than analysts’ expectations

- Annual recurring revenue (ARR) up 42% to $795.1 million — topping estimates by 3%

- Adjusted loss per share of two cents — three cents a share below analysts’ five cents a share loss forecast

- First quarter outlook tops estimates by 6%. Samsara expects revenue of $191 million for the April 2023-ending quarter — $10 million about analyst estimates

One negative is that Samsara generates negative free cash flow. For fiscal 2023 which ended in January, the company’s negative free cash flow was $135 million. To be fair, that figure has steadily improved since fiscal 2020 from negative $230 million, according to the Wall Street Journal.

Samsara impressed one analyst with its performance in spite of macroeconomic headwinds. Derrick Wood, a TD Cowen analyst, wrote “Strength was led by larger deals, an uptick in new customer wins and continued multiproduct strength across telematics, safety, driver workflows and equipment. Despite longer sales cycles, management said that sales productivity and close rates have remained relatively stable.”

Untapped Market Opportunity And Strong Tailwinds

Samsara targets a large, fast-growing market propelled by strong tailwinds.

Its total addressable market — consisting of “connected fleet, connected equipment, and connected sites” — is expected to grow at 21% to $97 billion by 2024, according to its most recent investor day presentation.

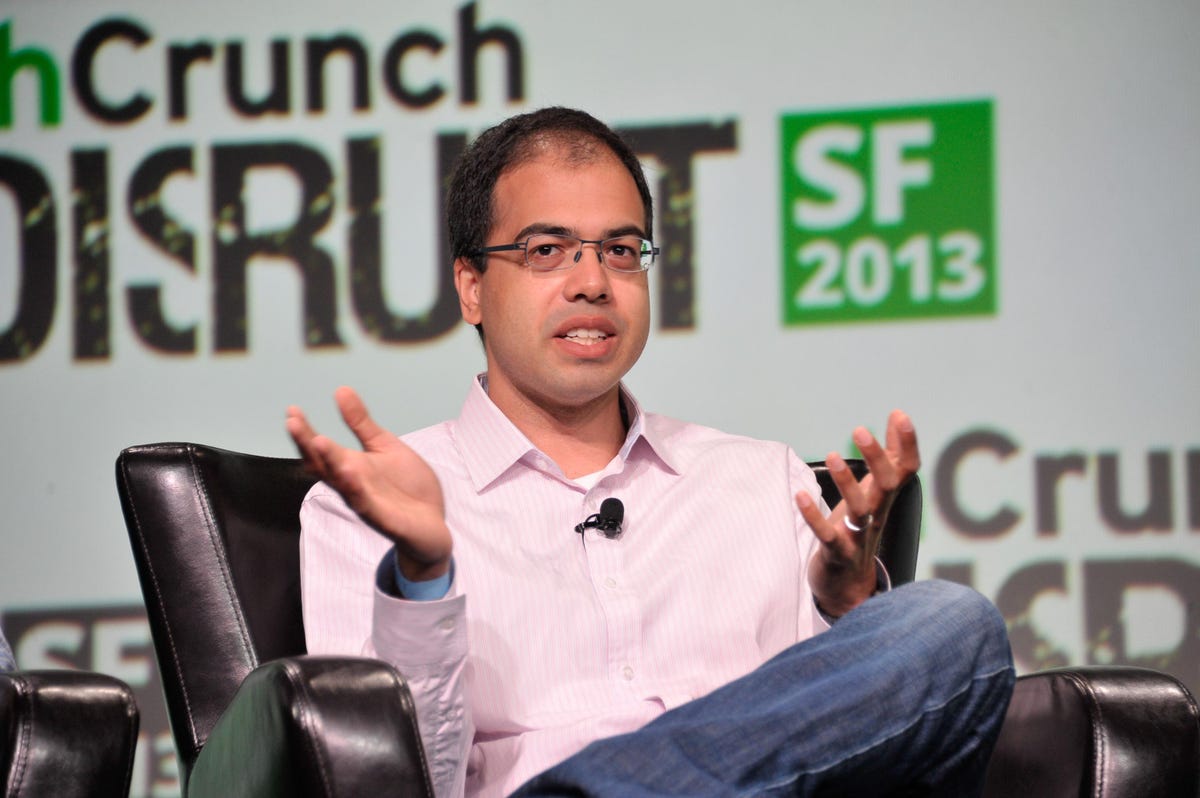

Growth comes from companies that are digitizing their physical operations. The Automobile Association of America (AAA) uses Samsara. As CEO Sanjit Biswas told me in a March 29 interview, “When a customer calls, AAA dispatches a truck driver to help. AAA needs to know where the drivers are and whether the ones closest to the customer have enough gas [to get to the customer and back to a service station].”

Samsara helps AAA streamline paperwork and increase safety. “If road conditions are icy, the trucks have to keep their distance from other vehicles. We help provide AAA with real-time visibility that makes their operations safer and more efficient,” he said.

Strong tailwinds are propelling the growth of its market. As Biswas explained, “Customers all own smartphones and the desire is there to use them to streamline operations. There is also a strong interest in systems of record for operations.”

Demand for Samsara’s services is relatively resistant to macroeconomic headwinds. “Despite high interest rates, our customers in industries such as waste management and utilities continue to operate during an economic slowdown,” Biswas said.

High Customer Return On Investment

Samsara competes with companies — such as Verizon — that provide Global Positioning Satellite (GPS) fleet tracking. Customers prefer Samsara because it offers a broader toolkit — including workflow tracking on a smartphone or tablet, reporting, and a modern system of record, Biswas argued.

Samsara’s platform delivers a quick investment payback. As Biswas explained during Samsara’s Q4 2023 Earnings Call, “Customers generate hard ROI savings by deploying Samsara with a quick average payback period [often within six months.]”

A case in point is Samsara customer Estes Express Lines, a North American freight carrier “with more than 22,000 employees over 45,000 tractors and trailers and 270 terminals,” according to the Q4 2023 earnings call transcript.

Estes expects Samsara to deliver significant operational improvements including “increased uptime, reduced costs and an improved customer experience.” Samsara’s services will automate time-intensive paper-based driver and operator processes saving time that amounts to $1 million in annual savings.

Samsara’s vehicle telematics applications will save Estes between $2 million and $3 million in annual fuel costs through a 10% to 15% reduction in idling. Samsara’s real-time alerts will enable Estes to improve driver safety, Biswas explained.

Excellent Management Team

Samsara has an experienced management team. In 2006, its co-founders Biswas and John Bicket, started Meraki, a networking company which generated $120 million in revenue before Cisco acquired it in 2012 for $1.2 billion.

Under Biswas’ leadership, Cisco Meraki continued to grow at over 100%. Three years after selling Meraki, Biswas and Bicket co-founded Samsara with the aim of building complete sensor systems that are easy to deploy and manage at scale.

In his 17 years as a CEO, Biswas has learned ways to build relationships with customers, employees, and investors that help sustain Samsara’s rapid growth.

Samsara achieves rapid revenue growth through a customer feedback loop. “We ask a lot of questions of the customers to find out listen to where they want to go. 80% of our growth comes from helping customers boost efficiency — for example, by reducing fuel consumption. 20% of our growth comes from our 200 technology partners with expertise in specific industries such as food and beverage,” Biswas explained.

Samsara’s success depends on how well it attracts and motivates its employees. “We are too big for me to meet all our people on a daily basis. We use our values — focus on customer success, build for the long-term, create a system of record, grow efficiently, and win as a team — to interview new employees and to compensate people,” he said.

Samsara executives aim to turn the values into action. Biswas explained how: “Our leadership team spends time with customers. We used to Zoom with them during the pandemic and now we travel to meet them in-person. We send notes to our team about the time we spend with customers. We celebrate successes in a town hall. Our people talk about their favorite Samsara values.”

In conversations with investors, Biswas aims to explain Samsara’s business. He talks with investors about the company’s customers, products, and its market size and growth.

He also aims to exceed their expectations, and to balance short- and longer-term goal setting and investment strategies. He sets quarterly objectives and allocates the sales and engineering capacity to exceed the objectives while investing in new products over the “next 1,000 days.”

What Analysts Say About Samsara

Samsara stock — 6% of which is sold short, according to the Wall Street Journal — has increased 17% since March 3 when it delivered its expectations-beating financial report.

That day Goldman Sachs analyst Kash Rangan upgraded Samsara — whose market capitalization reached $10.3 billion on March 31 — from neutral to buy. As he wrote in a report, “Samsara has equal opportunities in both replacement markets and to drive deeper market penetration with net new customers.”

Samsara’s platform should enable it to win more customers in a market with significant growth potential. “Addressing a large under-penetrated TAM with a modern platform with both replacement and net new markets in our view positions Samsara for durable 20%-plus top-line growth,” noted Rangan.

If Samsara keeps beating expectations and raising guidance, its stock could surpass the $28 a share peak it reached in December 2021 — 44% above where it ended March.

Read the full article here