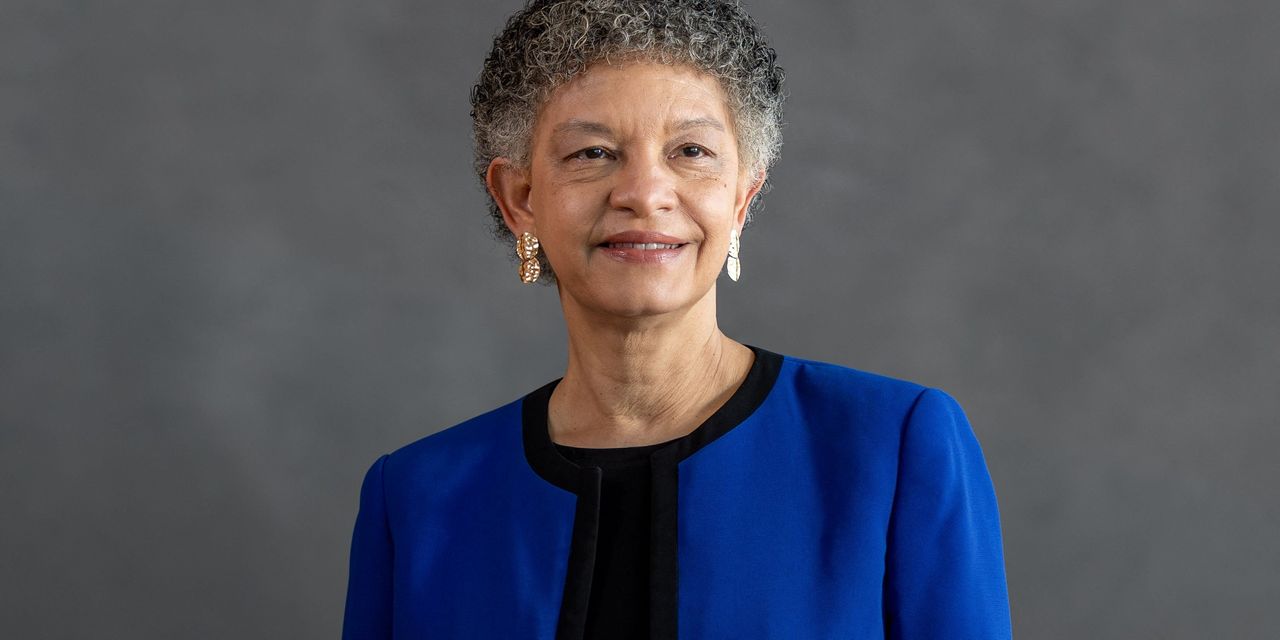

There is a risk that the Federal Reserve has not done enough to quell inflation and also a risk of the central bank overtightening U.S. monetary policy. Where does Boston Fed President Susan Collins stand?

“I would say I am somewhere in the middle,” Collins said Thursday, during an interview with MarketWatch in Jackson Hole, Wyo., where the Federal Reserve Bank of Kansas City is hosting its annual symposium.

“I would absolutely not take off the table that we will need additional [rate hikes],” Collins said.

“Are there scenarios,” she asked, “where we hold pretty close to where we are now? Yes, there are.”

MarketWatch Live: Is the Fed done raising interest rates? Maybe, Harker says.

“I know it’s frustrating, Many people would like to see a clear, preset path,” she said.

The Boston Fed president said the central bank has earned the right to take its time in making decisions. Taking more time doesn’t mean that the Fed is less committed to bringing inflation down and that there won’t be further rate hikes, she stressed.

One thing is clear, Collins said: Rates will need to stay high, or “restrictive,” for some time. “People should not expect these rates to come down anytime soon,” Collins said.

Some of the recent rise in long-term Treasury yields

BX:TMUBMUSD10Y

reflects a market coming to recognize that interest rates have entered restrictive territory, she said. “Some of that move was actually a move to be more consistent with what we had been saying, and I see that as helpful,” Collins said.

A sharp backup in global bond yields is getting much of the blame for an August stock-market pullback. The yield on the 10-year Treasury note on Monday hit a nearly 16-year high. The S&P 500 has retreated more than 4% so far in August, but remains up more than 14% for the year to date.

Collins said that she is among a large group of Fed officials that sees one more interest-rate hike this year.

She said she would need to see some slowing of the economy to be convinced that inflation is on the path back to its long-term 2% target. She had expected to see more of a slowdown in the economy, she conceded.

“From my perspective, the most important thing right now is patience and looking really holistically at patterns of data — not overreacting to, for example, the most recent retail sales,” she said.

Collins said there is a now a greater chance that the Fed can achieve a soft landing, bringing inflation down without a severe recession.

There has been some moderation in the labor market, and it has been orderly.

Collins said she had been worried that concerns about a recession were going to be self-fulfilling. With some recognition of the strength of the economy, she is less worried about that dynamic.

“The slowdown is in the forecast, not in the data. There is some early signs of some moderating, but we have a ways to go,” she said.

Collins said “it may make sense, at decision points, to gather a broader set of data.”

“We have afforded ourselves the opportunity to do that … because of how expeditiously we have raised rates,” she said. “Let’s take the time that we have earned to really assess … the full picture and not signal [that] we are locked in.”

The economy, she said, is complicated right now.

The risks of overtightening policy have increased, she said, but, at the same time, if the data are not consistent with moderating inflation, more hikes will be needed.

Regarding the Fed’s next policy meeting, in late September, Collins said there will be more data to examine before she makes her monetary-policy decision. “We will see when we have all the data in hand what I think about September,” she said.

Collins was dovish, in one sense, on the question of “lags” from the rapid increase in interest rates over the past year and a half. She said that there are reasons to think the effects of past rate hikes might still not have hit the economy.

More hawkish Fed members generally think that the impact of higher rates has already been felt in the economy.

Read the full article here