It has been a tough couple of years for the social-media site, which gives users a platform to exchange product ideas and put “pins” next to the ones they love. Pinterest’s shares (ticker: PINS) have lost two-thirds of their value since hitting a record high of around $89 in February 2021, as higher interest rates hit all growth stocks, while the end of the pandemic and a drop in advertising hit the earnings of all social-media companies. Pinterest has also had problems of its own making on the operations side—problems that led to a new CEO being installed last June.

Better times lie ahead for Pinterest stock, which closed at $27.33 on Wednesday. With new CEO Bill Ready, who arrived from

Alphabet’s

(GOOGL) Google, at the helm, signs of operational improvement are already emerging. While user growth has moderated, the $19 billion company has been taking steps to increase the money it makes off each user by making it easier and more efficient for advertisers to reach them. It has also been improving operations in its international business, which should drive additional revenue gains, even as analysts reduce their expectations.

And with the bar now so low, Pinterest looks poised to deliver the right kind of surprises. “I don’t think expectations are that extreme,” says Piper Sandler analyst Tom Champion, who has an Overweight rating and a $32 price target on the stock. Elliott Management took a stake in Pinterest last year, and there has been talk that the company could be a takeover target.

Pinterest isn’t like other social-media companies. It doesn’t let you keep up with childhood friends the way

Meta Platforms

’ (META) Facebook does, or have self-destructing messages that are perfect for the teenagers who flock to

Snap’s

(SNAP) Snapchat. It lacks Twitter’s short-form blasts, which have made it popular with anyone who has a point to make in 280 characters or less. And it doesn’t offer short-form videos like TikTok, which has been so successful that Meta, YouTube, and Snapchat have been trying to imitate it.

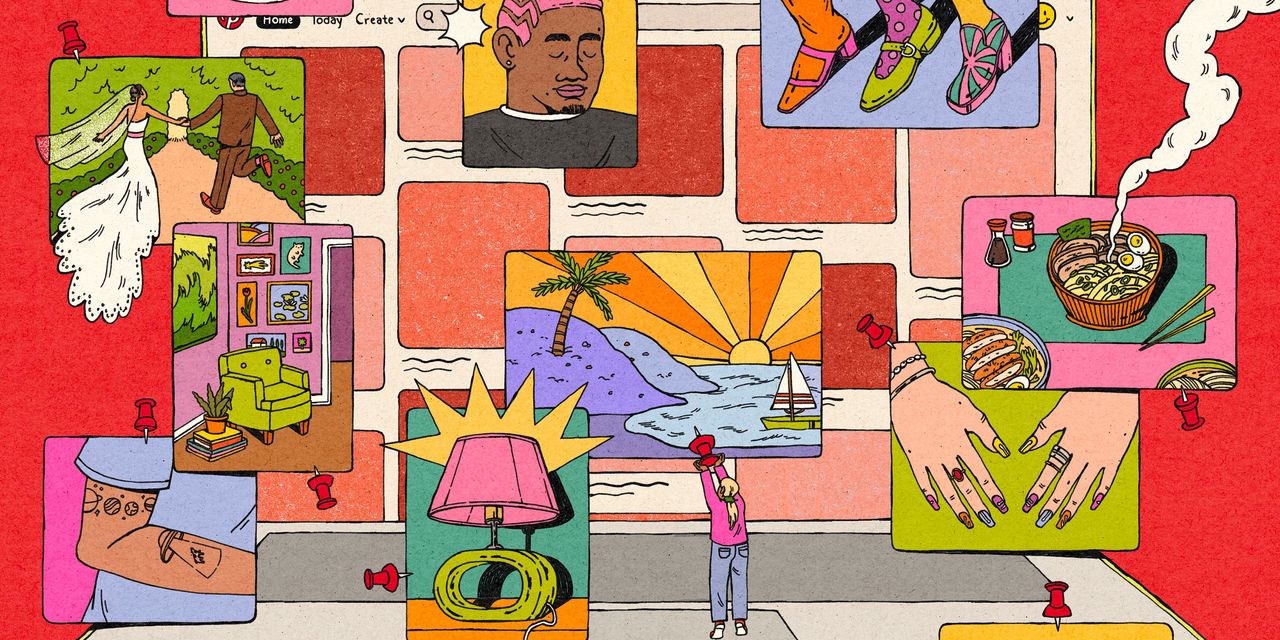

What Pinterest does have is 450 million monthly active users sharing pictures and ideas about the things they love, whether that’s clothing, sports, art, makeup, or just about anything else—and who are only a few clicks away from making a purchase. In fact, it’s a website that seems ideal for anyone trying to get their products in front of interested eyeballs.

“[It’s] a very relevant site where there’s specific information for what the user wants,” says Kimberly Scott, a senior portfolio manager at Macquarie, which owns the stock. “The Pinterest platform is a very compelling platform for advertisers.”

That, however, hasn’t translated into dollars the way it has for competitors. Pinterest reported average revenue per user of $6.36 in 2022, below that of Snap’s $12.99 or Facebook’s $10.86. It is CEO Ready’s job to close that gap. In his nine months leading the company, the company’s quarterly revenue—as of the fourth quarter of 2022—has jumped about 31%, to $877 million, since the quarter before he joined.

The improvements keep coming. In January, Pinterest announced a partnership with

LiveRamp Holdings

(RAMP), a platform that helps brands more securely measure ad-campaign performance, figure out what’s working—and what isn’t—and get new customers in the door.

“Early advertiser feedback on the LiveRamp partnership alone suggests significant improvement in ad efficacy that should drive budget, and further monetization partnerships could unlock incremental demand,” wrote UBS Securities analyst Lloyd Walmsley. “Advertisers tell us Pinterest is taking bolder steps and moving more rapidly under its new CEO.”

The bigger opportunity may be outside the U.S. and Canada. International users account for nearly 80% of monthly active users but less than 20% of revenue, with average revenue per user running below $1.50, compared with almost $25 at home. If Pinterest is able to close that gap by increasing ad load, or the number of ads on a page, and improving ad rates in those regions, average revenue per user could double. “It’s reasonable to infer that Pinterest can go higher than where it is now—like $12 or $15,” says Piper Sandler’s Champion.

If all goes well, average revenue per user could grow by around 18% annually over the next five years. Combine that with the company’s mid-single-digit monthly active user growth, which would put the total user count at just over 500 million in two years, and Pinterest’s sales could grow to over $6 billion by 2027, projects Wells Fargo analyst Brian Fitzgerald.

And that sales growth should help Pinterest do what every growth company needs to do these days—turn a profit. It’s already making progress on that front. While Pinterest lost 14 cents a share in 2022 based on generally accepted accounting principles, the company’s most recent quarter showed improvement in profitability. Its fourth-quarter adjusted earnings before interest, tax, depreciation, and amortization, or Ebitda, hit $196 million, for a 22.3% margin on sales of $877 million. Analysts see the Ebitda margin hitting close to 30% by 2027, which would mean about $1.8 billion in Ebitda by 2027 if sales can hit $6 billion.

That makes the stock look attractive at its current valuation. The company’s enterprise value—about 30 times the expected Ebitda this year—might look expensive, but even if it trades at a lower multiple in a few years as growth inevitably slows, the company could still be worth a lot more. If Pinterest is able to hit $1.8 billion in Ebitda in 2027, a 14-times multiple—which Fitzgerald uses for the last year of his 10-year valuation—it would make the company worth $25 billion. Fitzgerald’s $34 price represents about 24% upside from the stock’s current level.

And that’s a gain any investor should be interested in.

Write to Jacob Sonenshine at [email protected]

Read the full article here