Thought you wanted to be a millionaire? The “Billionaire Tax” might cause you to reconsider.

All American earners are subject to federal income taxes, but not everyone is subject to the same tax rate. While middle-class Americans pay, on average, roughly 14% in federal taxes annually, the wealthiest American families frequently use loopholes to avoid paying these tax rates. The question of whether or not the richest Americans pay enough in taxes for the amount of money they have compared to the average American’s net worth has been a hot topic of debate, in all likelihood, since July 4, 1776.

Throughout this time, there have been several attempts to tax the ultra-wealthy, some of which have even been supported by those who fall in the category of “ultra-wealthy.”

One such instance came in 2019 when Sen. Elizabeth Warren, D-Mass, proposed a wealth tax on households worth more than $50 million. In 2020, Democratic lawmakers proposed an “ambitious” plan to tax the unrealized capital gains of the richest Americans which would’ve applied an additional tax of 5% to adjusted gross income above $10 million and an 8% surtax on income above $25 million.[1] Sen. Warren, again in 2021, and this time with the support of Bernie Sanders, proposed a 2% annual tax on wealth over $50 million, and a 3% annual tax on wealth over $1 billion. President Biden’s budget proposal for FY2023 was the most recent attempt at enacting such a tax.

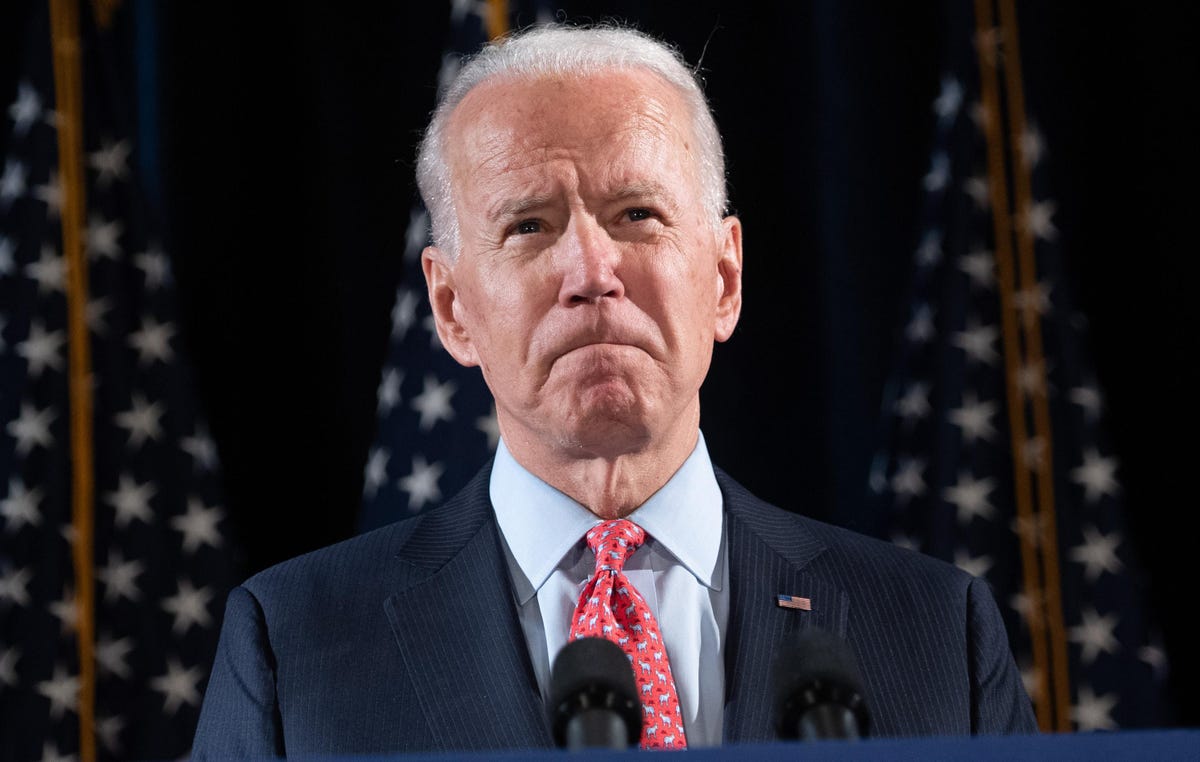

President Biden’s budget proposal for FY2023 included a provision dubbed the “Billionaire Tax.” The stated goal of the tax was to reduce income inequality and shrink the deficit. This “Billionaire Tax” would affect households having a net worth exceeding $100 million, and would impose a minimum tax rate of 20% of their economic gains, including appreciation in value of assets that are not yet sold.

Although the proposal received some support, it struggled to gain mass support even from the Democratic Party. Larry Summers, a liberal Harvard economist, the Secretary of the Treasury during the Clinton Administration, was among those who spoke openly against the “Billionaire Tax,” stating:

The billionaire’s tax is a bad idea whose time will never come. It’s mislabeled to give a kind of populist appeal…The general idea of taxing capital gains when people don’t have those capital gains-they haven’t sold the assets-is not a realistic one.

The Inflation Reduction Act of 2022, which became Public Law No: 117-169 in August of 2022, dropped many of Biden’s proposals to tax the rich, including the proposed 20% minimum tax on the wealthiest 0.01% of Americans. The removal didn’t stop Biden from trying again.

President Biden introduced his FY2024 budget proposal on March 9, 2023, and it is largely a reiteration of his “Build Back Better” economic package. One main difference from his last proposal is the minimum rate he is now proposing for the top 0.01% of Americans. If enacted, this proposal would impose a 25% minimum tax rate on households with a net worth greater than $100 million. In addition to this new tax, billionaires should also budget to entertain at least one Supreme Court Justice each year at a luxurious home and provide private jet transport, meals, and more.

Under the tax code, investments are taxed at a lower rate than earned income (wages and salaries) and aren’t taxed until sold. However, if enacted, this class of taxpayers, who typically grow their wealth primarily through investments, would be required to pay taxes on the appreciation of their investments, even those not sold, on an annual basis. Including unrealized capital gains as taxable income, and comparing that to the amount paid in taxes is known as a “true tax rate.”

A White House study from September, 2021 concentrated on the average federal income tax rate paid by America’s wealthiest 400 families.[2] The study, which focused on the years 2010-2018, included unrealized capital gains in its analysis, and estimated that the wealthiest 400 families paid, on average, a “true tax rate” of 8.2% per year on $1.8 trillion of total income over that period.[3] This assumes that during this period, each of these families received roughly $500 million in average annual income. This report estimates that this change would result in approximately a 17% tax increase for the wealthiest taxpayers, playing right to President Biden’s goal to “make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters.”

This may sound like a great idea to many, but enacting this tax would be a change to the definition of “taxable income.” Such a change would raise issues involving how to value non-tradable assets and how to treat taxpayers who don’t have sufficient cash on hand to pay this new minimum tax, but show significant paper (or unrealized) gains.

The Treasury Department, also in September of 2021, released a study on the tax gap, which is the difference between taxes owed and taxes collected, in regard to different categories of tax payers.[4] The study expresses that understaffing and lack of computer infrastructure affecting the IRS results in the inability to collect 15% of taxes that would otherwise be received by means of collection enforcement, audit enforcement, and education of the public and professionals concerning our tax laws.

Our country’s tax code currently has two sets of rules: one for the regular wage and salary workers; and one for wealthy taxpayers. The Treasury Department report indicates that the tax code generally works effectively against rank and file wage earners because of the W-2 and tax withholding system, but does not work effectively with respect to wealthy taxpayers, who are commonly able to manipulate the tax system to pay much less than the tax law actually provides for. The report further states that approximately $600 billion in taxes that would otherwise be received are lost annually.

The study shows that the top 1% of American earners were responsible for 28% of the country’s unpaid taxes for the prior year, with the top 0.5% being responsible for 20.6% of the unpaid taxes.[5] This is not to accuse these ultra-wealthy taxpayers of tax evasion, but instead emphasizes their use of loopholes (such as various tax cuts from the Trump Administration or charitable deductions) or the underreporting of their income, allowing them to limit the taxes they pay.

The argument can be made that a tax increase for the ultra-wealthy is a step in the right direction towards the goal of making everyone pay their fair share. If billionaires’ earnings are substantially higher than the average American, it would be fair to assume that they also pay significantly more in taxes.

The “centibillionaire club,” individuals with a net worth exceeding $100 billion, includes Tesla CEO Elon Musk, Amazon Owner Jeff Bezos, Microsoft co-founder Bill Gates, Oracle co-founder Larry Ellison, and Berkshire Hathaway CEO Warren Buffett.[6]

The ten richest individuals in the world, and their net worths, according to Forbes, are as follows:

1. Bernard Arnault, France, $226.7 Billion[7]

2. Elon Musk, USA, $197.0 Billion

3. Jeff Bezos, USA, $125.8 Billion

4. Larry Ellison, USA, $116.0 Billion

5. Bill Gates, USA, $109.8 Billion

6. Warren Buffett, USA, $106.1 Billion

7. Carlos Slim Helu, Mexico, $94.5 Billion[8]

8. Michael Bloomberg, USA, $94.5 Billion

9. Francoise Bettencourt Meyers, France, $90.1 Billion

10. Steve Ballmer, USA, $89.7 Billion

In the years preceding 2021, the average American household earned around $70,000 per year while paying 14% in federal taxes. The ultra-wealthy, however, have been known to pay a rather significantly lower rate.

In a study by Propublica, it is reported that, between 2014 and 2018, the 25 richest Americans saw their wealth increase by a collective $401 billion.[9] The report illustrates that those 25 people paid a total of $13.6 billion in federal income taxes, which is only a true tax rate of 3.4% despite seeming like an astonishing amount. One of those 25 people is none other than Warren Buffett, who coincidentally has been one of the ultra-wealthy to vocalize support for increased taxes for the top .01%. Buffett was quoted in a 2019 interview stating:

The wealthy are definitely undertaxed relative to the general population. As we get more specialized, the rich will get richer. The question is: How do you take care of a guy who is a wonderful citizen whose father died in Normandy and just doesn’t have market skills? I think the income tax credit is the best way to address that. That probably means more taxes for guys like me, and I’m fine with that.

Warren Buffet’s wealth increased by $24.3 billion (with a reported income of $125 million) from 2014 through 2018, and he reported paying $23.7 million in taxes, which ironically only works out to a true tax rate of about .01%, or roughly $1 for every $1,000 increase in wealth.

The study shows that, within this same time frame, middle-class households (wage earners in their early 40s with an average amount of wealth for their age) saw a wealth increase of approximately $65,000 per year, and their tax bills over that five year period were nearly $62,000 because a majority of earnings in middle-income households is salary.

Billionaires such as Jeff Bezos, Elon Musk, Michael Bloomberg, and likely many more, have, despite their wealth showing substantial increases, paid $0 in federal income taxes in some years.[10] From 2006-2018, Jeff Bezos saw a wealth increase of $127 billion, according to Forbes, but he only reported a total income of $6.5 billion. He paid $1.4 billion in federal taxes on that amount, which, while still a massive number, accounts for only a 1.1% true tax rate. Even comparing Bezos’ $1.4 billion in taxes paid to the $6.5 billion he reported as his income, he still only paid taxes in the 21.5% bracket. One of the years Bezos paid $0 in federal income taxes, 2007, Amazon’s stock more than doubled, causing his wealth to jump $3.8 billion.

Jeff Bezos is not the only “centibillionaire club” member who has escaped years with $0 in paid federal income taxes. According to ProPublica’s report, Elon Musk managed this feat in 2018. Between 2014 and 2018, Musk’s net worth increased by $13.9 billion dollars, but he paid $455 million in taxes during that period, which is a “true tax rate” of just 3.27%. Michael Bloomberg, number 8 on Forbes’ “real time billionaires” list, paid a “true tax rate” of 1.3%, as he saw a wealth increase by $22.5 billion over this period, while only paying $292 million in taxes.

The current owner of the NBA’s Los Angeles Clippers and former Microsoft CEO, Steve Ballmer, had a wealth growth of roughly $2.8 billion in 2018. Though he reported only making $656 million for income purposes, on which he paid $78 million in taxes.[11] That puts his federal income tax rate show as 12%, which is still lower than the average American, and only equates to a “true tax rate” of 2.8%.

It brings the question, how can the people with the most wealth pay the lowest percent of income taxes? Despite the broad range of reactions and opinions regarding Biden’s proposal, such drastic tax increases have been, or are currently being, used by both different countries and state legislatures.

While everyone was impacted by the COVID-19 pandemic, Argentina was among a group of countries that were particularly affected. As of December 2020, had 1.5 million infections and nearly 40,000 deaths attributable to the virus.

In an effort to ease the financial burden placed on the lower classes by the pandemic, Argentinian Senators, in early December 2020, passed a one-off levy that they called the “millionaire’s tax.” Under the new tax, those individuals, roughly 12,000 people, with assets greater than 200 million pesos ($2.4 million), would be subject to a one-time additional tax of up to 3.5% on wealth held within Argentina, and up to 5.25% on wealth held outside the country. Argentinian President Alberto Fernandez hoped that this tax would raise 300 billion pesos for the economy.

Similarly to President Biden’s billionaire tax proposal, the Argentina proposal also faced its fair share of opposition. According to Bloomberg, some people subject to this tax, including soccer star Carlos Tevez and the family of late soccer star Diego Maradona, took legal action against the government to avoid payment.[12] Centre-right party Juntos por el Cambio is reported to have described it as “confiscatory.” Carlos Caicedo, the senior principal analyst for Latin America at IHS Markit, stated, “[h]istory shows that once these benefits are introduced it would be very difficult to remove them. Overall, the new tax would further undermine Argentina’s already deteriorated business environment.” The government’s claim that this tax would be “one-time levy” was rejected by many others as well.

The tax was passed, despite numerous opinions opposing it, and was arguably quite successful for its intended purpose. Many of the country’s millionaires resisted the payment right up until the government’s deadline to do so, but according to Bloomberg, the government still collected 223 billion pesos (roughly $2.4 billion), 74% of its target.[13] If a tax of this nature can be successful in another country, why can’t America implement something of the sort to even out the percentage of taxes paid by all taxpayers?

Even though Biden has proven unsuccessful in getting a tax of this stature passed federally, Massachusetts has its own “millionaire tax” that is known as the “Fair Share Amendment” to Article 44 of the State’s constitution.[14] In addition to the state’s current flat tax rate of 5%, the new law, effective as of January 1, 2023, adds a 4% tax on annual income above $1 million.

The language of the amendment does not place constraints on the application of the tax. Thus, it applies to an individual who earns at least $1 million annually on a regular basis, and a household who has an unusually high-income year, such as if one were to sell a business or a property.[15] In 2020, according to Forbes, this amendment would have affected about 16,000 Massachusetts taxpayers, or .47% of taxpayers who filed a return.[16]

Any amount that the sale of a business or property carries a household’s net income to over $1 million would be taxable at this additional rate. For example, take a couple that has an annual household income of $400,000. Let’s say they own a property that they paid $300,000 for, and sell that property for $1.3 million, recognizing $1 million in income from the sale. That would bring their yearly income to $1.4 million. The entire $1.4 million would be taxed at the flat state rate of 5%, and the amount over $1 million ($400,000) would be taxed an additional 4%.

While the success, or lack thereof, of this tax is still to be determined, multiple state legislatures, including California, Connecticut, Hawaii, Illinois, Maryland, New York, Oregon, and Washington, have now introduced similar proposals.[17]

Frankly, everyone has the desire to be one of America’s wealthiest people, but would President Biden’s proposal cause them to rethink this?

As one of America’s wealthiest people, Bill Gates is one of the few billionaires who has spoken out against this unfair tax treatment on several occasions. In his annual “end-of-year post” for 2019, Gates spoke on how he believes he is disproportionately rewarded for the work he’s done stating, “[t]hat’s why I’m for a tax system in which, if you have more money, you pay a higher percentage of taxes. And I think the rich should pay more than they currently do, and that includes [my wife] and me.”[18]

The wealthiest Americans would start to see some loopholes close nder President Biden’s proposed budget for 2024. Biden argues that America’s tax code is unfair and that it rewards wealth, not work. By including a tax like this in his proposal, he intends to ensure that all Americans pay their fair share in taxes, even the billionaires. However, some may argue that a tax of this sort may raise more questions than answers. How do you require taxes to be paid on income that you haven’t received? What happens if one of these people sees their investments grow by an amount that requires taxes exceeding their liquid cash assets? As Congress decides the fate of the President’s latest budget proposal, don’t hold your breath, as these are questions that may forever go unanswered.

Special thank you to Branon Galvao with his hard work on this article.

[1] See: https://www.forbes.com/sites/giacomotognini/2021/10/29/these-billionaires-might-have-just-dodged-a-333-billion-tax-bullet-thanks-to-revised-tax-proposal/?sh=6814bdb5fbde

[2] Study can be found at: https://www.whitehouse.gov/cea/written-materials/2021/09/23/what-is-the-average-federal-individual-income-tax-rate-on-the-wealthiest-americans/.

[3] The study notes that estimates of this nature are highly uncertain and that this one varies from other commonly cited estimates due to analyzing a smaller group of families and including unrealized gains.

[4] Study can be found at: https://home.treasury.gov/news/featured-stories/the-case-for-a-robust-attack-on-the-tax-gap#ftn1.

[5] Id. (See study for a table breaking down the percentage of unpaid taxes for each level of workers.)

[6] Current billionaire rankings and net worth found at: https://www.forbes.com/real-time-billionaires/#7a66d9f93d78.

[7] Bernard Arnault is the Chairman and CEO of LVMH Moёt Hennessy Louis Vuitton

[8] Carlos Slim Helu, Mexico’s richest man, is the Chairman of América Móvil, Latin America’s biggest mobile telecom firm.

[9] Statistics found at: https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax.

[10] It is reputed that the Tesla founder and new Twitter owner pays taxes only when he Musk.

[11] Statistics found at: https://www.propublica.org/article/the-billionaire-playbook-how-sports-owners-use-their-teams-to-avoid-millions-in-taxes.

[12] See: https://www.bloomberg.com/news/articles/2021-05-03/argentina-wealth-tax-fought-by-millionaires-raises-2-4-billion.

[13] Id.

[14] Exact language of the amendment can be found at https://massbudget.org/fairshare/.

[15] See: https://www.choate.com/insights/understanding-the-new-massachusetts-millionaires-tax.html.

[16] See: https://www.forbes.com/sites/matthewerskine/2023/02/14/planning-for-the-millionaires-taxnot-just-for-massachusetts/?sh=38ad45d3f184.

[17] Id.

[18] For this quote and more on Gates’ opinions on our tax system, see: https://www.gatesnotes.com/Year-in-Review-2019.

Read the full article here