Whether it’s corporate credit cards, home improvement loans or travel expenses, these 10 companies are shaking up the banking establishment—even as the industry faces bouts of crisis.

Three of the largest bank failures in history rocked financial markets this year, but these 10 fintech startups offering banking services to other businesses only doubled down during the turmoil—facilitating billions of dollars in transactions, picking up deposits and in some cases, even benefiting directly from the crisis.

Returning to Forbes‘ Fintech 50 list this year, four-year-old neobank Mercury picked up more than $2 billion in deposits within days of Silicon Valley Bank’s sudden collapse in March. CEO Immad Akhund worked over the weekend, onboarding new customers as startled startup founders rushed to find a new home for their cash. That same week, longtime list staple Brex announced it would begin offering up to $6 million in FDIC-insured deposits by spreading them out through various banks. The startup, which also offers working capital loans and venture debt, processed more than $1 billion in emergency loans for startups affected by the bank failure.

Elsewhere on the list, fintechs have continued to broaden their services—both within and outside the traditional banking realm. Federally chartered Column now offers international payments via SWIFT, and TripActions rebranded to Navan, consolidating its services to allow users to search and book trips, change or cancel flights, and submit expenses—all in one app. Meanwhile, corporate credit card startup Ramp has continued to show massive growth, with annualized payment volume eclipsing $10 billion after a record performance last year that saw revenue grow four-fold.

Still, B2B banking fintechs haven’t been completely immune to broader turmoil. There were three drop offs on this year’s list: influencer funding app Creative Juice, Clearco and Pipe, the latter two suffering from high-profile executive resignations as the broader fintech industry felt the burn of high interest rates and a slower economy.

In their place, however, two startups are new to the list. Fintech infrastructure firm Unit, founded by two former software engineers for the Israeli military, works with partner banks to help build financial products for retirees, schools, nonprofits and more. And a team of ex-Square executives are helping fintechs expand their banking offerings after acquiring Kansas City-based Lead Bank in November; Ramp and Self are already customers.

Here are the most innovative business-to-business banking companies in fintech:

Brex

After launching with a simple business charge card, Brex now offers a suite of products, including a no-fee corporate card with travel rewards and expense tracking; bill pay; and startup debt financing. Its cash management account allows customers to keep their cash in a money market fund and/or an FDIC-insured account that spreads deposits across dozens of banks to insure up to $6 million in deposits. Last summer, Brex ditched its small business customers and doubled down on startups and enterprise clients. This year, it processed more than $1 billion in emergency payroll loans for startups caught in Silicon Valley Bank’s March collapse.

Headquarters: San Francisco, California.

Funding: $1.5 billion from Y Combinator, DST Global, Kleiner Perkins and others.

Latest valuation: $12.3 billion.

Bona fides: Tens of thousands of customers, including Coinbase, Airbnb and Indeed.

Cofounders: Co-CEOs Henrique Dubugras, 27, and Pedro Franceschi, 26, launched Brex after dropping out of Stanford.

Column

Federally chartered bank works with fintech startups to underpin their banking services—by holding customer deposits, processing bank-to-bank transfers, and helping them offer loans. Its tech also allows customers—including Brex, Lili and Settle—to build and manage their own financial products (like credit cards and lending programs), and then sell those loans to Column (just once or on a recurring basis). This year began offering fintechs international payments via SWIFT and online check deposits.

Headquarters: San Francisco, California.

Funding: $50 million plus from husband-and-wife cofounders.

Bona fides: Annualized revenue has more than doubled to $22 million, from $9 million in 2021.

Cofounders: Co-CEO William Hockey, 33, a one-time billionaire who cofounded Plaid in 2013 and sold some of his Plaid shares to finance Column; Co-CEO Annie Hockey, 33, a former Bain consultant and Stanford MBA.

GoodLeap

The nation’s top provider of residential solar loans, its platform and app have dealt over $20 billion in financing to about 700,000 homeowners making green home upgrades—up from 380,000 a year ago. Contractors and vendors use GoodLeap’s point-of-sale app to get customer loans instantly approved for more than 20 types of sustainable improvements—including solar panels, battery storage and water-saving turf; GoodLeap makes the loans and then partner banks, including Goldman Sachs and now Citi, securitize the debt to sell to investors.

Headquarters: Roseville, California.

Funding: $1.8 billion from New Enterprise Associates, West Cap Group, MSD Partners and others.

Latest valuation: $12 billion.

Bona fides: Its app is used by more than 22,000 home-improvement businesses, including software company ServiceTitan and HVAC-manufacturer Daikin North America, up from 18,000 at the end of 2021.

Cofounders: Chair and CEO Hayes Barnard, 51, and Chief Revenue Officer Matt Dawson, 49, two longtime executives at SolarCity (now Tesla Energy); and Chief Risk Officer Jason Walker, 49, a veteran mortgage broker.

Lead Bank

A 95-year-old FDIC-insured bank acquired by a cadre of ex-Square execs in August, it now moves money, issues loans and processes payments for fintech and crypto startups, as well as for multinational consumer companies. Clients pay variable fees based on transaction or loan volume, and like any other bank, Lead also gets interest revenue from cash deposits, which totaled $675 million at the end of last year.

Headquarters: Kansas City, Missouri.

Funding: $100 million from Ribbit Capital, Coatue Management, Andreesen Horowitz and others.

Latest valuation: $450 million.

Bona fides: More than 2,600 customers, including Ramp and Self.

Cofounders: CEO Jacqueline Reses, 53; CTO Ronak Vyas, 52; Chief Product and Strategy Officer Homam Maalouf, 40; and Chief Legal Officer Erica Khalili, 38—team of execs who built a bank at fintech Block (formerly Square).

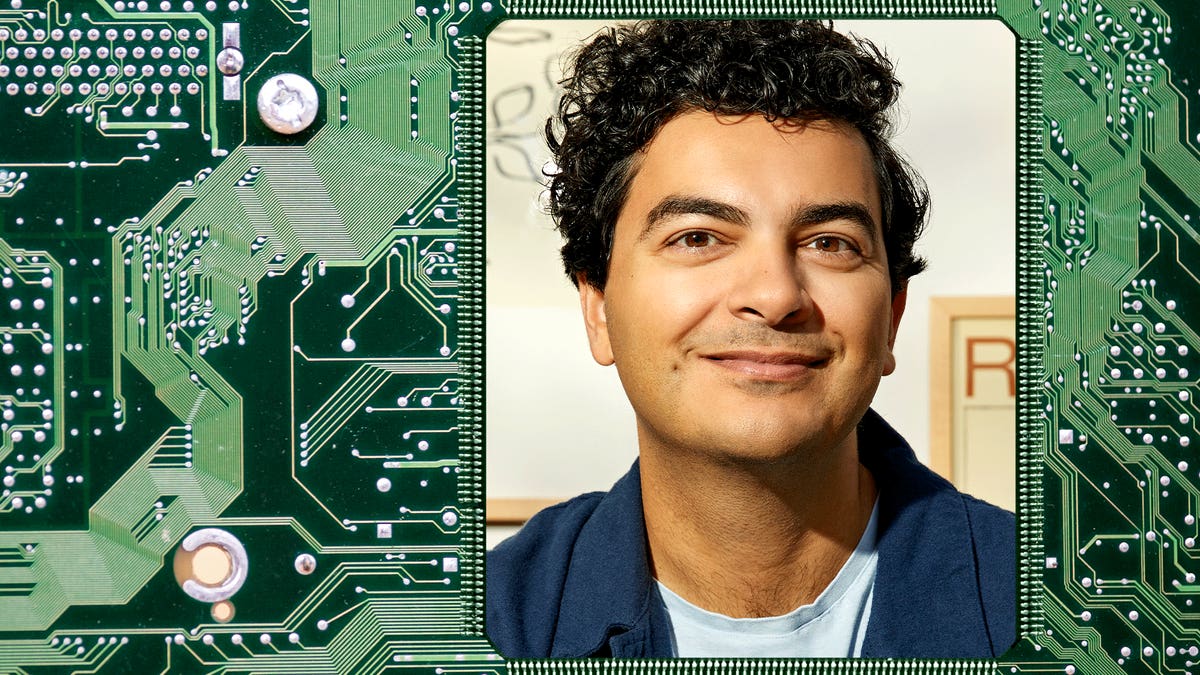

Mercury

Digital banking platform for startups, offering no-fee checking and savings accounts, debit cards, venture debt financing and Treasury investments. Cash management account spreads deposits across 20 banks, making customers eligible for up to $5 million of FDIC-insurance on their funds; Mercury’s Treasury account can move funds above that into mutual funds like a Vanguard money market fund. Within days of Silicon Valley Bank’s failure, Mercury picked up more than $2 billion in deposits. Customer base has swelled to over 100,000—more than double the number at the end of 2021.

Headquarters: San Francisco, California.

Funding: $163 million from CRV, Coatue Management, Andreessen Horowitz and others.

Latest valuation: $1.6 billion.

Bona fides: Processed over $50 billion in transactions last year, more than doubling from $23 billion in 2021.

Cofounders: CEO Immad Akhund, 39, a software developer turned entrepreneur who sold his mobile advertising startup for $45 million in 2016; COO Jason Zhang, 32, and CTO Max Tagher, 31, who both worked for Akhund before Mercury.

Modern Treasury

Back-end payments software used by companies—including ClassPass, payments app Splitwise and travel fintech Navan—to move over $25 billion in and out of bank accounts each year through wire transfers, ACH and Real-Time Payments transactions. Customers pay a flat fee according to features used. Launched international ACH payments in March and partnered with Goldman Sachs in September to help more middle-market companies embed its payments technology into their systems.

Headquarters: San Francisco, California.

Funding: $183 million from Altimeter Capital, Benchmark, Y Combinator and others.

Latest valuation: $2.2 billion.

Bona fides: Now counts nearly 160 enterprise customers, up 70% over the past year.

Cofounders: CEO Dimitri Dadiomov, 38; CTO Sam Aarons, 30; and chief product officer Matt Marcus, 29. The trio met at mortgage marketplace LendingHome (now Kiavi), where they built a retail investing platform that sold more than $300 million worth of mortgages.

Navan

Formerly TripActions, the travel and expense software startup has its own corporate card and an expense management app that reimburses employees for out-of-pocket business travel in just 24 hours. Companies pay a subscription fee to use the app, which also lets users book from thousands of airlines, hotels and car-rental services. Now features a customer service chatbot named Ava, which uses OpenAI to field queries from travelers and company finance teams.

Headquarters: Palo Alto, California.

Funding: $1.55 billion from Andreessen Horowitz, Greenoaks, Lightspeed Venture Capital and others.

Latest valuation: $9.2 billion.

Bona fides: 6,300 corporate customers, including Unilever, Adobe and Netflix—up from fewer than 3,900 at the end of 2021.

Cofounders: CEO Ariel Cohen, 47, and CTO Ilan Twig, 49, Israeli-born executives who met at Hewlett-Packard before cofounding StreamOnce, a business collaboration platform they sold in 2013.

Novo

Provides free checking accounts and other banking services for more than 200,000 small businesses, primarily those with less than $250,000 in annual sales and without venture capital backing. Makes money through interchange fees and opened a new revenue stream last year—lending $25 million in working capital to more than 3,000 small businesses. Last May, launched Boost service that gives customers same-day access to ACH and Stripe payments.

Headquarters: Miami, Florida.

Funding: $171 million from GGV Capital, Stripes, Valar Ventures and others.

Latest valuation: $720 million.

Bona fides: Revenue more than doubled to $17.2 million last year, from less than $8 million in 2021.

Cofounders: CEO Michael Rangel, 36, former head trader at Fairholme Capital Management; CTO Tyler McIntyre, 31, a fellow University of Miami alum.

Ramp

Fast-growing suite of products includes a flagship corporate credit card offering unlimited 1.5% cash back on all purchases, a travel-booking service and a free expense-management platform that uses machine learning to flag wasteful spending (Ramp claims it helps shave an average of 3% from expenses each year). In May, the firm debuted services that use OpenAI’s GPT-4 to extract data from vendor contracts, summarize them and tell customers whether something is a good deal. Other new AI offerings include a chatbot with cost-cutting advice and a Microsoft Outlook integration that automatically identifies and scans email receipts to process expenses in real time. Microsoft CEO Satya Nadella and Quora cofounder Adam D’Angelo have come on board as investors.

Headquarters: New York, New York.

Funding: $1.37 billion from Founders Fund, D1 Capital Partners, Coatue Management and others.

Latest valuation: $8.1 billion.

Bona fides: Founded in 2019, Ramp has picked up more than 15,000 clients—including Glossier, Betterment and Planned Parenthood—who made over $10 billion in transactions over the past year, doubling since early 2022.

Cofounders: CEO Eric Glyman, 33; CTO Karim Atiyeh, 33; and chief product officer Gene Lee, 32. The longtime friends started Ramp after selling online savings startup Paribus to Capital One.

Unit

Tech companies—including AngelList and financial software company Bill.com—use its technology to offer their own customers banking products like checking accounts, credit cards, loans or payment services. Launched in December 2020, Unit works with five partner banks and now counts more than 200 customers, who pay a monthly base fee to access the platform and additional fees based on the number of users, transactions and applications they push through it. Last year, Unit processed over $4 billion in transaction volume, and deposits climbed to more than $370 million.

Headquarters: New York, New York.

Funding: $170 million from Insight Partners, Accel, Aleph and others.

Latest valuation: $1.2 billion.

Bona fides: End customers using Unit technology skyrocketed 170% last year from 300,000 to 810,000.

Cofounders: CEO Itai Damti, 37, and CTO Doron Somech, 38, serial entrepreneurs who met as software engineers for the Israeli military and then cofounded a software-as-a-service firm.

MORE FROM FORBES

Read the full article here