Personal Finance

State Exit Taxes And Other Innovative Way To Tax Former Or Departing Residents

Before moving from a state or establishing a second home, know how the state you currently reside in will react. States with net losses of…

Your best advisor to finance and money management.

Explaining Finance is your one-stop website for the latest news, updates, and tips about finance.

Latest News

Mortgage rates rise for fourth straight week

Mortgage rates continued their upward trajectory this week, climbing for a month straight while further pushing down demand in the…

Apple and Goldman Sachs ordered to pay $89M over Apple Card failures

The Consumer Financial Protection Bureau (CFPB) on Wednesday ordered Apple and Goldman Sachs to pay $89 million over mishandled transaction…

Bipartisan Concerns Unite Americans On Retirement Security

The upcoming election is only days away, and the two presidential candidates remain in a statistical dead heat. Control of…

Will We Ever Expand Medicare To Cover Home Care For Elders?

Subsidizing home care for aging adults has been discussed in decades past. Now it is part of the political discussion…

Credit card companies now charging extra fees for paper statements

A new push to move credit card users to a digital statement will now come with a penalty for those…

Trump Would Undermine Social Security By $2.3 Trillion

As the 2024 election approaches, candidate Vice President Harris and Former – President Trump promise to protect Social Security, but…

Why mortgage rates are going up despite the Fed's interest rate cut

Americans saw mortgage rates soar during the Federal Reserve's aggressive campaign to fight inflation, leading many to hope for a…

The Financial Planning Recommendation Every Person Needs

There aren’t many absolutes in financial planning. There are, however, many—MANY—opinions. Advisors, personal finance gurus, and online opine-ers regularly die…

How IRAs Can Help Retirees Reduce Or Avoid Estimated Tax Penalties

Estimated tax requirements are a frequent problem for retirees, with many incurring penalties for underpaying their estimated taxes. Fortunately, there’s…

Biden administration forgives $4.5 million in student debt for 60,000 borrowers

Another 60,000 student loan borrowers will receive student loan relief in the coming weeks. The Biden Administration announced $4.5 billion…

7 Common Retirement Spending Mistakes To Avoid

Many pre-retirees and retirees make serious mistakes regarding their retirement income and spending for living expenses. This is very understandable,…

Insulin Coverage: What Medicare Beneficiaries Need To Know For 2025

Since January 1, 2023, there has been a cap on insulin for Medicare beneficiaries. The cap applies to those who…

Mortgage rates march higher for third straight week

Mortgage rates continued their upward climb this week, further hindering demand in the housing market amid elevated rates and high…

Biden rolls out $4.5B more in student loan handouts for over 60,000 public workers

The Biden-Harris administration on Thursday announced another round of student loan handouts, removing $4.5 billion in debt for more than…

Did The Medicare Prescription Payment Plan’s Fix Make It Worse?

The Medicare Prescription Payment Plan (MPPP, M3P or MP3) will take effect January 1, 2025. It will allow those who…

Medicare Open Enrollment Is Full Of Surprises And Traps For Members

The start of the Medicare Open Enrollment Period revealed major changes in the availability of plans and pricing. The biggest…

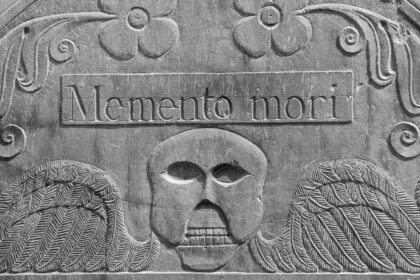

The Power Of Death In Financial Life Planning

“Evaluating your life through the lens of your death is raw, powerful, and perhaps a bit scary,” writes author and…

My Trainer Thinks All His Mom Needs Is A Simple Will

Introduction So, I joined a new gym and am working with a personal trainer. During any workout trainers and clients…