Personal Finance

California Ended Its Medicaid Long-Term Care Asset Test. What Happened?

This year, California took the second of two steps to allow residents with unlimited assets to participate in its Medicaid long-term services and supports (LTSS)…

Your best advisor to finance and money management.

Explaining Finance is your one-stop website for the latest news, updates, and tips about finance.

Latest News

A Missouri jury goes after the real-estate industry’s commission structure. Here’s what that could mean for homeowners.

A Missouri court found the National Association of Realtors and two real-estate brokerages guilty of conspiring to inflate real-estate commissions,…

Why You Need To Check Your Aging Parent’s Credit Report

For a long time, we were entitled to only an annual credit report from the three reporting agencies: Equifax EFX…

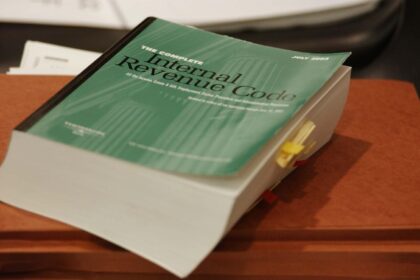

IRA Energy Credits, Part 2: Proposed Regs And What’s Next

In the second of a two-episode series, Tim Jacobs of Hunton Andrews Kurth continues his discussion of the energy credits…

Dow Industrials: 3 Months Of Down With Major Stocks Breaking Support

October is joining September and August for months this year that the Dow Jones Industrial Average made the journey from…

Tax Planning For Your Second Home: 6 Things To Know And Some Options To Explore

People with second homes might not give much thought to the estate taxes that could be due when they die;…

Conservation Easements – New Regulations, New Law, New Questions

Many people are baffled about the status of conservation easement donations, which is logical given all that has happened recently.…

Home prices continued to gain momentum in August: Case-Shiller

Home prices once again defied affordability challenges, posting the seventh consecutive monthly gain since prices bottomed in January 2023, according…

Americans keep falling behind on their bills — just in time for the holiday shopping season

Americans’ past-due bills are stacking up, and their newly-delinquent debts saw a marked increase in September. The rise in freshly…

If A Drug Copay Is Outrageous, Maybe Your Part D Plan Doesn’t Cover It

We are only two weeks into the Open Enrollment Period, and I have encountered four clients who are very dissatisfied.…

Mastering Debt Management in Estate Planning

Amidst the financial strain since the Covid-19 pandemic, families and businesses are grappling with mounting levels of debt. When considering…

Many Americans feel stuck in their finances and struggle to build savings: survey

Two years of living under high inflation has many Americans feeling stuck when it comes to making financial progress, according…

Here’s who could benefit under the Biden administration’s new student debt relief proposal

The Biden administration provided the most detail yet about who could be eligible for student-loan forgiveness under its second stab…

A quarter of student loan borrowers said they’d boycott repayment

As millions of student loan borrowers prepare to get their first student loan bills in more than three years, some…

My mother claims I’m in her will, yet refuses to show it to me. How do I make sure she won’t cheat me out of my inheritance?

My mother is in her late 80s and owns her home outright. Let’s call my half-brother “Matt.” Matt has been…

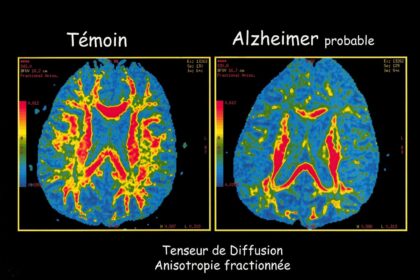

NIH Steps Away From Sponsoring Alzheimer’s Disease Diagnostic Standards

The National Institutes of Health’s Institute of Aging has dropped its sponsorship with the Alzheimer’s Association of a controversial project…

Who Gives A CRAT About Certain Tax-Planning Strategies? The IRS.

There is nothing inherently wrong with forming and utilizing a charitable remainder annuity trust (“CRAT”) for tax-planning purposes; people do…

Today’s mortgage rates hold steady for 30-year terms as 15-year terms fall

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the…

Exclusive: In our ‘hyper-polarized’ political climate, 20% of the S&P 500 is now doing this

As the U.S. continues to look polarized politically, a growing number of S&P 500 companies have made the effort to…