Taxes

IRS Disallows 20,000 ERC Tax Refund Claims As Enforcement Tightens

As part of continuing efforts to combat dubious Employee Retention Credit (ERC) claims, the Internal Revenue Service is sending an initial round of more than…

Your best advisor to finance and money management.

Explaining Finance is your one-stop website for the latest news, updates, and tips about finance.

Latest News

Lies For Likes: Evaluating Social Media Tax Scams

Professor Samuel Brunson of Loyola University Chicago discusses social media tax scams highlighted in the IRS’s 2023 “Dirty Dozen” list…

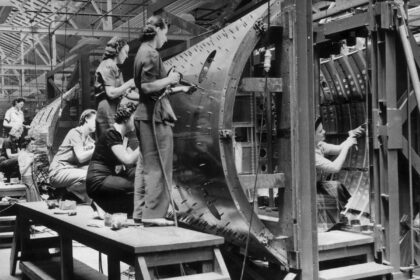

R&D Tax Credit — An Update On A Lifeline For Small And Medium Business

A cornerstone of U.S. tax policy (and for many other countries) has been to encourage and support research and development…

Initial Impressions Of The United Kingdom’s Digital Services Tax

Some time ago, these pages predicted that digital services taxes would prove to be sticky things. That is, once governments…

Ask Larry: How Much Will My Wife’s Social Security Spousal Benefit Be?

Today's Social Security column addresses questions about how spousal benefits are calculated, survivor's benefits after taking reduced retirement benefits and…

Many Tax-Exempt Orgs Face May 15 Filing Deadline

Tax season isn't over just yet. Tax-exempt organizations with a calendar year-end (December 31) must file a return or request…

Know The Tricks And Traps Of The “Wash Sale” Rules

Few taxpayers were interested in or needed to know the “wash sale” rules, until recently. When stock prices rose steadily,…

How Is The IRS Spending $80B In New Funding?

Now that the tax deadline has passed, have you ever paused for a moment to consider how all of the…

Fox $787M Dominion Settlement Tax Write Off Is No Surprise

The $787 million settlement by Fox FOXA News and Fox Corporation to resolve the Dominion defamation suit made big news,…

A Two-Step Solution Can Defuse The Debt-Ceiling Crisis

After months of dithering, Washington is finally beginning to grapple with the need to raise or suspend the federal debt…

IRS Completes Its 2023 ‘Dirty Dozen’ Tax Avoidance And Fraud List

The IRS recently released its 2023 “Dirty Dozen” tax avoidance and fraud list consisting of nine consumer-targeted fraud schemes and…

Monthly Payments Could Provide Low-Income Families With More Transparency Than Unpredictable Tax Refunds

In a previous Urban Institute study, researchers spoke to parents with low incomes about how these dynamics affected their lives.…

Cannabis Culture On 4/20—A Look At Efforts To Legalize And Tax America’s Most Controversial Crop

Today is 4/20, a counterculture holiday based on the celebration of cannabis. A few years ago, the day would have…

Plan On Having The Death Tax Live On

Senators Kevin Cramer and John Thune, Republicans who represent Dakota, North and South respectively, have introduced the Death Tax Repeal…

Fixing The IRS Will Require Much More Than Hiring Additional Staff

As usual, the politicians are missing the point: Success or failure of the IRS’s ambitious plan to spend $80 billion…

The Challenges For Treasury To “Legislate”

Last week, the U.S. Treasury surprised almost no one by concluding in Revenue Ruling 2023-02 that IRC section 1014’s basis…

Analyzing The IRS’s Inflation Reduction Act Spending Plan

Former IRS Commissioner Fred Goldberg, now with Skadden, Arps, Slate, Meagher & Flom LLP, shares his thoughts on the IRS’s…

Is Traditional Banking History?

Traditional banking is unsafe at any speed. The Great Financial Crisis was proof positive. Yet our politicians rebuilt the system…

The Last Minute Scramble: What You Need To Know About Filing Your Return On Tax Day

If you plan to file your federal income tax return today, you're not late—yet. If your return is in good…