Taxes

IRS Disallows 20,000 ERC Tax Refund Claims As Enforcement Tightens

As part of continuing efforts to combat dubious Employee Retention Credit (ERC) claims, the Internal Revenue Service is sending an initial round of more than…

Your best advisor to finance and money management.

Explaining Finance is your one-stop website for the latest news, updates, and tips about finance.

Latest News

Best And Worst States To Buy An Electric Vehicle

The Biden administration is shooting for 50% of all new car sales to be electric vehicles by 2030. Thanks to…

How Aging Billionaires Are Making Sure Their Money Doesn't Go To Uncle Same

Boomers and their elders control $93 trillion, or two-thirds of America’s household wealth. Forbes 400 members Phil Knight, Charles Koch,…

Your CPAs Guide To The New ERC Crisis

IRS Announces Moratorium on the Employee Retention Credit and Provides Guidance for Civil Penalty Amnesty to Withdrawing Improper Claims, Also…

Is Working From Home Falling Or Stabilizing? Both.

Is working from home (WFH) falling, signaling that workers have to go back to the office? Or is WFH now…

Who Is Stuck With Tax Tab For Bang Energy Monster Sale?

Seems like everything becomes a tax story eventually and so it goes with the colorful controversial Jack H Owoc and…

Questioning Universities’ Tax-Exempt Status Over Their Middle East Views Is Dangerous

House Ways & Means Committee Chair Jason Smith (R-MO) has questioned the tax-exempt status of universities that, in his opinion,…

Questioning The Tax-Exemption Of Universities Over Their Mideast Views Is Dangerous

House Ways & Means Committee Chair Jason Smith (R-MO) has questioned the tax-exempt status of universities that, in his opinion,…

With Next Tax Season Approaching, It’s Time To Apply For Or Renew PTINs

It's October, so we're thinking about… tax season? Even though that doesn't feel like it should be right, it is.…

Original Landowners Move To Forefront In Conservation Easement Battles

Disputes focused on “syndicated” conservation easement transactions have existed for years, but they are far from repetitive for several reasons.…

IRA Energy Tax Credits, Part 1: History And Early Guidance

In the first of a two-episode series, Tim Jacobs of Hunton Andrews Kurth discusses the energy credits enacted in the…

Real-Time Tax Reporting Is Coming To The U.S.: Are Businesses Ready?

There is a big data revolution quietly brewing inside the U.S. Federal Reserve that’s going to fundamentally change the way…

Pro Bono Week Offers Opportunities To Make A Difference In Tax And Law

In a pivotal scene in the movie On The Basis Of Sex, Judge Doyle, portrayed by Gary Werntz, advises, "The…

Government Surrender Leaves Questions About Foreign Gifts And Trusts

Tax laws are created by Congress, with the Internal Revenue Service (“IRS”) often required to add details by issuing regulations,…

Fast Cars And Loose Taxes: Does Bernie Ecclestone Belong In Jail?

“I want to be a dad again at 90, and I don’t need Viagra.” That quote is from U.K. billionaire…

Untangling The Hairy Situation Between Beauty Salons, Restaurants And The IRS.

Congress created a big incentive for restaurants and bars to report employees’ tips, which can be good for workers, too—even…

U.N. Vs. OECD: The Clash Of Global Tax Visions

Robert Goulder of Tax Notes and Sharon Katz-Pearlman of Greenberg Traurig discuss the ongoing friction between the United Nations and…

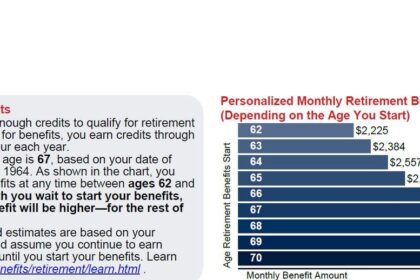

Is Social Security’s Website Suddenly Saying It Owes You Far Less?

I just received two emails, which I copy below without identifying their authors. Both authors are keeping careful track, over…

To Withdraw Or Not To Withdraw Your ERC Claim? Get The Facts Here

The IRS recently made an important announcement on October 19, 2023 regarding the withdrawal process for Employee Retention Credit (ERC)…