ChatGPT has delivered a shocking verdict on the Bitcoin price as brittle volatility creeps back into the market, and high-yielding coin offerings like Bitcoin Minetrix begin to loom large as more attractive alternatives for crypto traders.

Bitcoin jumped to $26,800 today, but no sooner had it reached those intraday heights than it had fallen down to Earth to trade back where it started the day, at $26,150.

But ChatGPT reckons it could fall to as low as $13,000 if the worst risk on the horizon were to come to pass.

Wild gyrations in the Bitcoin price or in the broader crypto market are nothing new, but that doesn’t make it any less unnerving for those seeking capital preservation. After all, one of the selling points of Bitcoin is that it is a store of value.

But yield-bearing assets that deliver an income stream for investors who stake their coins continue to be popular as a way of hedging capital risk.

In particular, Bitcoin Minetrix stands out as a unique stake-to-mine offering where stakers earn credits that can then be used to cloud-mine Bitcoin. Investors have funneled $116,000 into BTC Minetrix in the past couple of days.

Indeed, YouTube analysis channel Crypto Gains, with 108k subscribers, thinks Bitcoin Minetrix is a good candidate to disrupt Bitcoin mining, and that’s a huge value proposition.

But back with Bitcoin and the downbeat mood. More delays related to the spot Bitcoin ETF, although expected, have soured near-term sentiment while other areas of uncertainty continue to gnaw at the nerves of crypto market participants.

But there’s an even bigger worry to think about – Binance.

If Binance collapses Bitcoin could go to $13,000, but Bitcoin Minetrix balances out the risks says ChatGPT

Chief among the worries and unknowns is the situation at Binance, the world’s largest crypto exchange, as a steady outflow of executives adds to the suspicion that there is no smoke without fire.

Persistent negativity continues to be dismissed by Binance supporters and, of course, by founder and CEO Changpeng Zhao (aka CZ), but the executives keep leaving regardless.

Before coming to the attractions of crypto that pays a yield and the role it should play in a balanced portfolio, we asked ChatGPT Pro (GPT4) what would happen to the Bitcoin price if Binance were to collapse. Its answer was not pretty:

ChatGPT brought into the equation five factors to make its judgment call: panic selling, trust, secondary effects, regulatory impacts and historical references.

Its historical reference mentions the collapse of Mt. Gox, which we would agree is the only worthy comparison in the historical record. ChatGPT identifies secondary effects that would lead to transaction congestion and a spike in fees – the other factors speak for themselves.

To cut to the chase, ChatGPT sees Bitcoin falling into a price band bounded by $13,000 at the lower end and $18,200 at the top.

“In a scenario where Binance collapses, Bitcoin could potentially see a drop of 30% to 50% in a short period, taking its price to a range of $13,000 to $18,200. This is a speculative estimate based on the magnitude of the event, but the actual drop could be more or less severe.”

‘Advisable to diversify investment… by holding yield-bearing ones like Bitcoin Minetrix’

We then asked ChatGPT if it could give its best guess on how Bitcoin Minetrix might perform under the same circumstances. Astutely it observes that all crypto will be affected because of the strong correlation that exists across the asset class.

ChatGPT also thinks, correctly in our view, that there is a flight to safety which means that large-cap coins, especially Bitcoin, would fare better than the smaller fry, like Bitcoin Minetrix presumably.

On balance, ChatGPT says it could be “advisable to diversify investments to balance out risks and rewards”, and therefore to hold “both established assets like Bitcoin and yield-bearing ones like Bitcoin Minetrix”.

“Comparison with Bitcoin:

While Bitcoin doesn’t provide a direct yield, its extensive track record, security, and position as the leading cryptocurrency offer a form of stability (relative to other cryptos, not traditional assets). This stability can be its own form of ‘yield’ in the sense of preserving value over time.

In Conclusion: The advantage of a yield-bearing asset during market downturns is valid. However, the overall risk and return profile of the investment should be considered holistically. Both the capital appreciation potential and the yield should be weighed against the risks associated with the project’s fundamentals, the broader market, and external factors.

It’s always advisable to diversify investments to balance out risks and rewards. This might involve holding both established assets like Bitcoin and yield-bearing ones like Bitcoin Minetrix.”

For those not entirely convinced by the predictive powers of ChatGPT, you may want to take note of a regular free blog by the team at Launchpad.xyz – they called for shorting today’s Bitcoin pump, and were right on the money.

As well as the ChatGPT findings cited above, traders are no doubt also attracted by the implications of Bitcoin Minetrix’s stake-to-mine yield because of its potential to alleviate selling pressure when $BTCBSC lists, while also incentivizing long-term adoption.

Within a few hours of the presale opening, more than $100,000 was contributed to the soft cap initial fundraise goal of $15.6 million. There are 10 stages to the presale – from Stage 2 onwards the token price increases 10% at each stage.

At the current run rate, the presale could sell out its first stage, in which $3,080,000 is targeted, within a week. There really is no time to lose in locking in the lowest prices.

You can stay in touch with the progress of the presale and how much has been staked by following the official X (formerly Twitter) account and joining the Telegram and Discord groups.

Bitcoin Minetrix targets popular Bitcoin investment themes – mining and staking

By combining the popular themes of new cryptocurrency ERC-20 token staking and Bitcoin mining, Bitcoin Minetrix has struck upon a rich seam with a pitch to market participants that is sure to appeal.

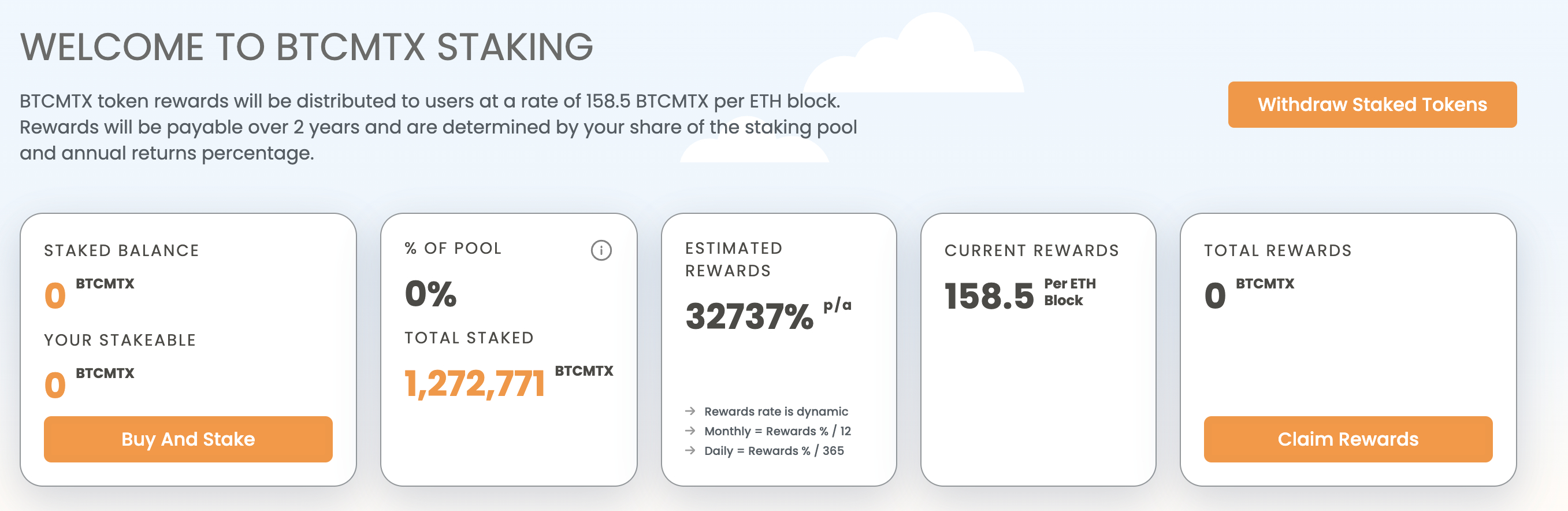

There are already 1,272,771 BTCMTX staked in the Ethereum-based smart contract, according to the desktop dashboard.

Rewards for stakers are generated at a rate of 158.5 BTCMTX per ETH block, over a two-year period. The current annual percentage yield (APY) is 32,737%, although this will reduce as more stakers join the pool.

The exact size of the rewards earned by individual stakers is determined by the APY and the proportion of the total staking pool owned.

BTCMTX penny crypto provides strong return potential

Priced at just $0.011, $BTCMTX token is an ultra-low-cap penny crypto positioned to capture the value of a Bitcoin-like price explosion that can turn small-time investors into millionaires.

As the Bitcoin price continues to trade sideways during a period of restrained liquidity and low volatility, traders are increasingly looking to Bitcoin alternatives.

Evidence of this phenomenon is apparent in the rise over the years of so-called Bitcoin derivative and clone coins.

From Bitcoin Cash to more recent varieties such as Bitcoin 2.0 and BTC20, these tokens are created to offer something different, namely a value differential when measured against Bitcoin.

In the case of Bitcoin Minetrix the unique selling points stacked up over Bitcoin are crystal clear and strongly utilitarian by design in a way that maybe is not apparent for many other derivative/clone offerings.

Certainly, where a coin has a good story to tell and transmits a readily digestible use case, traction can be immediate. BTC Minetrix is definitely one such coin.

Bitcoin derivative coins pack a punch – BTCMTX will be among the big hitters

The recent launch of BTC20, which witnessed a 5x price surge shortly after its listing, is testament to the power of the Bitcoin brand.

Other recent Bitcoin derivative launches have also made waves, such as Bitcoin 2.0, which saw an 189,000% (1,890x) increase on its decentralized exchange listing price (see the price chart below).

But while BTC20 has a clear use case as a staking coin, Bitcoin 2.0 has none and quickly lost its parabolic gains.

Bitcoin Minetrix’s novel stake-to-mine feature catapults it into the first rank of quality Bitcoin derivative coins, such as Bitcoin Cash (BCH) and Bitcoin SV (BSV).

BCH and BSV derivatives are both forks of the original blockchain. Although BTCMTX is not a fork, it is directly related to the Bitcoin network by contributing to its hash power – the measure of how much computing power is devoted to running its proof-of-work protocol that verifies transactions.

Tokenization of Bitcoin cloud mining is $BTCMTX’s unique use case

For sure, there are plenty of cloud-mining services available, but many are scams and none have the advantages that flow from the tokenized approach of the ERC-20 Ethereum-based BTC Minetrix token.

Because of its decentralized architecture, no money changes hands. Instead, claims on the BTC Minetrix cloud platform are secured in proportion to the amount of tokens staked.

Also, the stake-to-mine system puts the user in control, where they can determine for themselves how much Bitcoin mining power (hash power) they want to own because this is directly related to the number of credits earned, which, in turn, is related to the amount of BTCMTX tokens staked.

And because Bitcoin Minetrix is built on the Ethereum blockchain, costs are lower and efficiency higher. These benefits enable the network to auto-manage user allocations using smart contracts.

In addition, Ethereum is the most secure smart contract platform in existence, which makes BTCMTX the safest Bitcoin cloud mining solution.

Cloud mining is notorious for scammers – Bitcoin Minetrix fixes that

Scammers are everywhere in the cloud mining sector, so the chances of being defrauded are high.

However, there are no such risks with Bitcoin Minetrix because the smart contract is fully audited by Coinsult – an audit it has passed with no major issues.

Because Bitcoin Minetrix is fully decentralized with user-owned tradable tokens, there is no need to take the risk of cash deposits.

Also, blockchain technology makes withdrawals easy, and the tokens are seamlessly convertible into crypto, stablecoins or fiat.

Cloud mining products will often also have complicated contracts that make it difficult to work out how much can really be earned from mining. By contrast, Bitcoin Minetrix puts an emphasis on simplicity.

There’s a lock-in period that is easily controlled by the user, unlike the fixed timeframes of traditional cloud mining platforms.

Best of all, perhaps, is the low cost of entry, which for BTC Minetrix has the flexibility to invest any amount in the presale as opposed to the large minimum costs associated with traditional cloud-based Bitcoin mining.

How to buy Bitcoin Minetrix ($BTCMTX)

Bitcoin Minetrix is in its phase 1 presale stage of its four-part roadmap. The other three phases cover development, launch and mass adoption.

Although not slated until Phase 2 and 3, negotiations with cloud providers and scoping of the stake-to-mine dashboard for mobile app and desktop has already begun.

To buy the $BTCMTX token all that is required is ETH, USDT, BNB or a bank card. If you plan to purchase with ETH and start staking-to-earn straightaway, then make sure you have a small amount of ETH to pay the gas fees.

If you are looking for a high-yield but low-risk crypto project with a strong use case to diversify your portfolio, then Bitcoin Minetrix is the one for you.

Buy Bitcoin Minetrix today

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Read the full article here