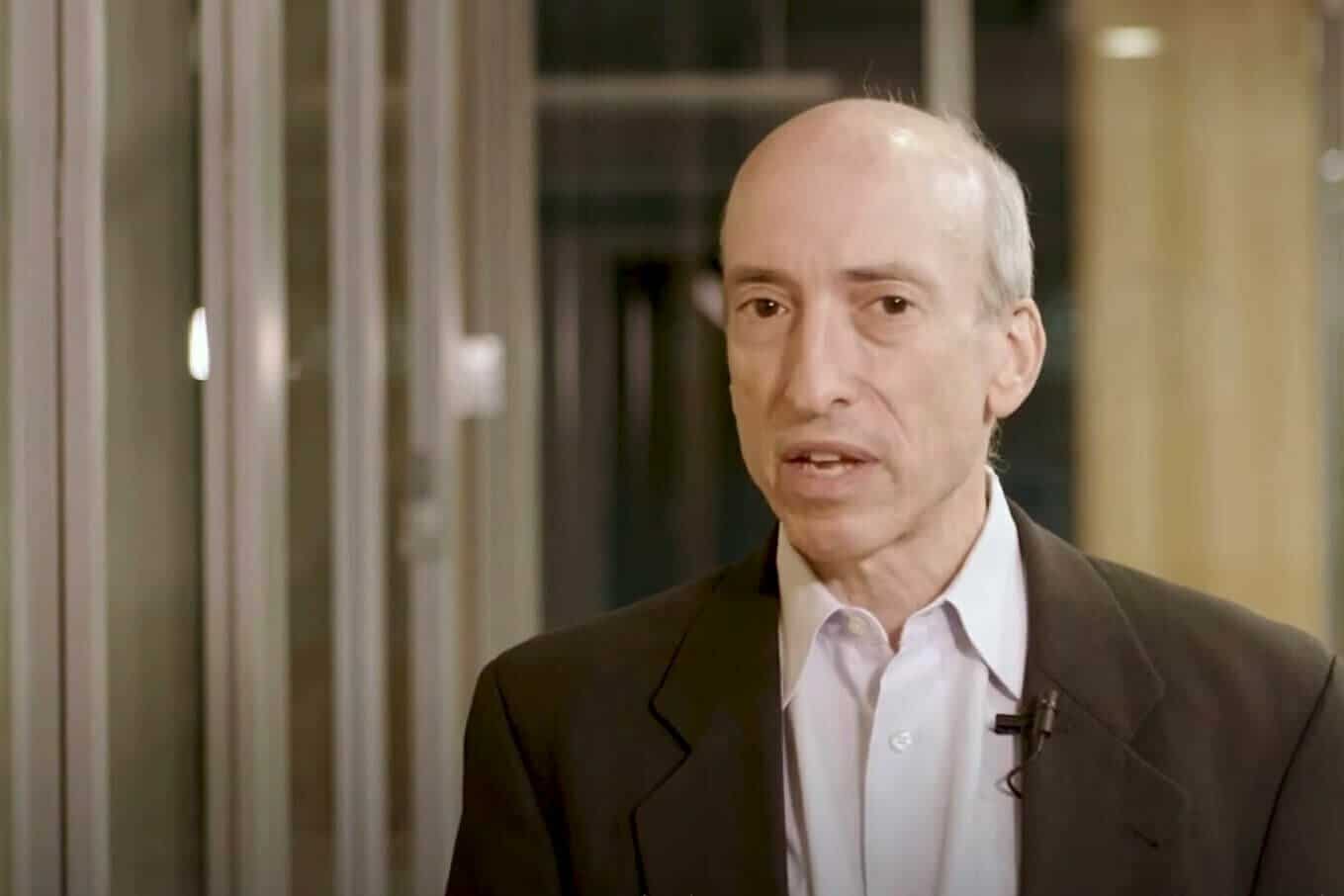

When the Securities and Exchange Commission (SEC) decided to approve Spot Bitcoin ETFs for public trading on Wednesday, the deciding vote fell to chairman Gary Gensler.

After years of criticizing and rejecting such products, what caused the chairman to change his mind? Based on his recent comments, it would seem that the legal system forced his hand.

In a statement following the approvals, Gensler said that “circumstances have changed” while referencing the SEC’s court loss to Grayscale in August. At the time, the agency “failed to adequately explain its reasoning,” for rejecting the latter’s ETF application.

“Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares,” wrote Gensler on Wednesday.

At the beginning of his statement, the chairman emphasized that the SEC “acts within the law and how the courts interpret the law.”

He also made clear that the agency hasn’t reformed its pessimistic view on the crypto industry more broadly. The approvals, he said, “should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities.” He added:

“As I’ve said in the past, and without prejudging any one crypto asset, the vast majority of crypto assets are investment contracts and thus subject to the federal securities laws.”

As much hate as Gensler received leading up to ETF vote, at the end of the day you have to give him credit that he did the right thing https://t.co/m8ikf1xucP

— WhiteBelt (@WhiteBeltCrypto) January 11, 2024

Gensler Blasts Bitcoin

Yet even Bitcoin – the sole cryptocurrency that Gensler has explicitly labeled a “non-security commodity – did not escape his criticism. “We did not approve or endorse bitcoin,” he wrote, arguing that it poses “myriad risks” to investors.

Though Bitcoin has often been likened to “digital gold” by BlackRock’s CEO and other proponents, Gensler noted ways in which it may be inferior. He wrote:

“Though we’re merit neutral, I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast, bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing.”

Gensler’s criticisms aligned with many of his fellow Democrats who speak on crypto, such as Elizabeth Warren, who frequently calls for strict controls on blockchain software users and their ability to move money or dodge sanctions.

Nevertheless, more crypto-supportive politicians across the aisle were supportive of Gensler’s ETF approval. Representatives Patrick McHenry and French Hill of the House Financial Services Committee called Bitcoin ETFs a “historic milestone” for the industry.

Read the full article here