Apple

AAPL

It’s Apple, It’s News

There’s no reason to doubt that Apple will make a success of this. Despite the fact that it is not in the top ten of best interest rates, the fact is that as Ted Rossman from Bankrate says, while higher yield savings accounts have been around for a while, this while resonance in the mainstream and “The fact that Apple is involved makes it news”. Indeed.

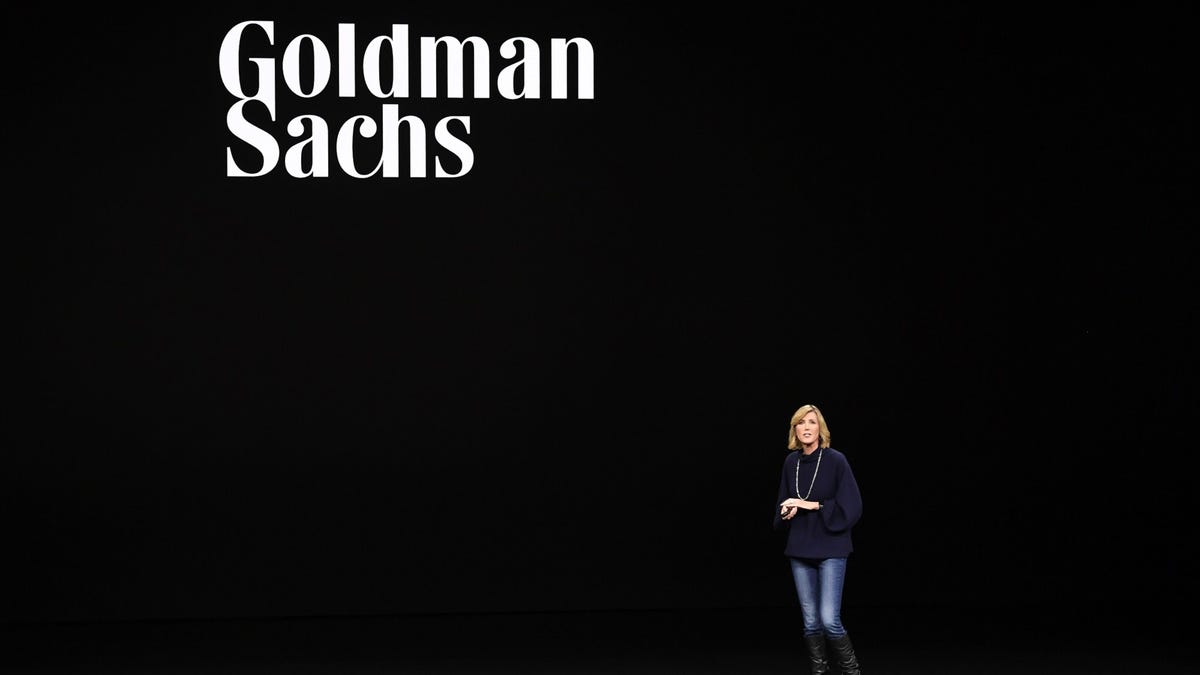

The techfins are more than happy to have banks, for example, do the boring, expensive and risky work with all of the compliance headaches that come with it. Big Tech does not care about the manufacturing of financial products, what it wants is the distribution side of the business. Given that they have no legacy infrastructure (e.g. branches), their costs are lower and the provision of financial services helps to keep their customers within their ecosystems. As I wrote back in January, it is very easy to imagine a future where you use an Apple checking account (actually provided by JP. Morgan) and an Apple credit card (actually provided by Goldman Sachs, whose consumer credit division lost more than a billion dollars last year primarily because of the Apple Card) and an Apple loan (actually provided by Wells Fargo

WFC

That kind of data is a key reason can why brands are looking at the world of embedded finance. First of all, it is growing. An FIS

FIS

AMZN

GOOG

C

The key is to such brand-led propositions is trust. Survey after survey shows that however much consumers dislike banks, they do trust them. The Edelman Trust Barometer for 2023, a survey of more than 32,000 people across 28 countries, shows that trust in sectors ranging from technology to food and healthcare to retailing remains higher than trust in financial services (in fact, in the survey, only social media had lower trust than financial services) so it is not really that difficult to envisage financial services delivered and the point of need by Apple, CVS and Cigna

CI

Financial Health

What really caught my eye about this new product was Jennifer Bailey’s comment that the Apple’s goal was to deliver tools to help consumers “lead healthier financial lives”, which reinforced my view that we are seeing a fundamental change in the financial sector as the fintech focus shifts from delivering individual products and services to delivering financial health.

(Plex was also billed as a new way to bank, with an emphasis on simplicity and financial wellness with no monthly or overdraft fees.)

So where does this leave the banks then? They have to make decision: Can they deliver financial health — which means using open banking, open finance and open data strategies to integrate across consumer’s financial lives — or simply retreat from the customer interface? That may sound drastic, but for banks the optimum strategy is clearly going to be delivering a high-volume, low-cost regulated utility service with a high quality of service: A focus on the manufacturing and packaging that leaves the distribution to those like Apple that have the trust and the touchpoints.

Read the full article here