Albemarle stock has fallen 55% over the past 12 months.

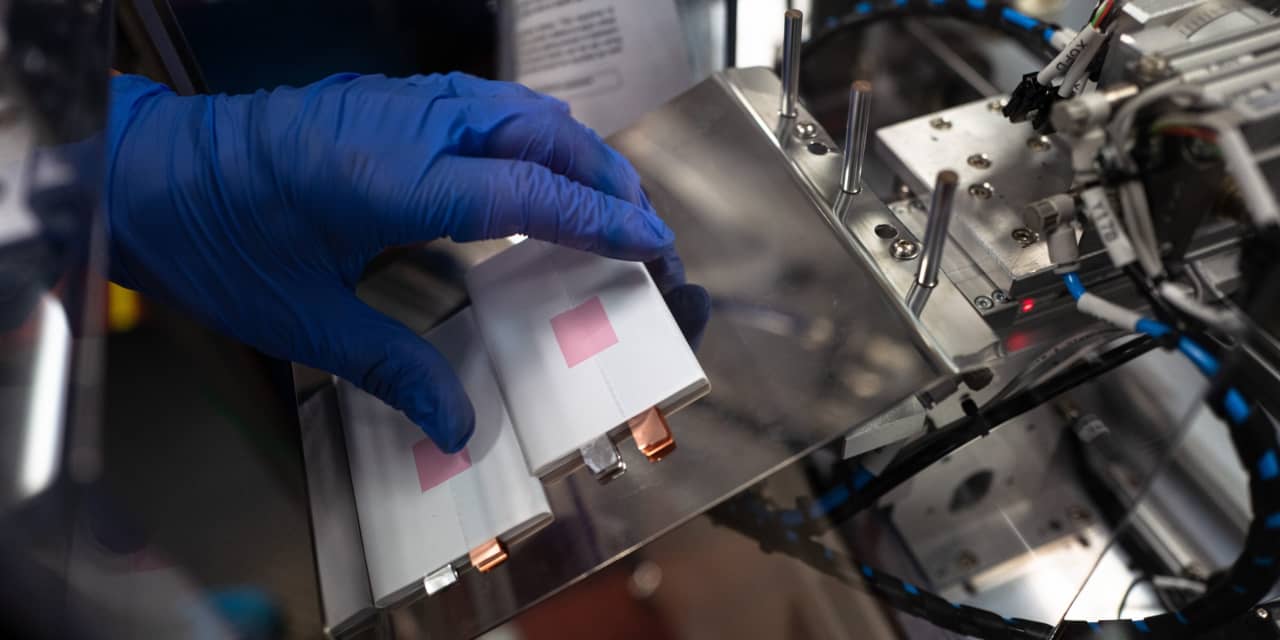

Logan Cyrus/Bloomberg

Shares of lithium miner

Albemarle

are falling again Tuesday, after another analyst downgrade. It has been a terrible 12 months for the lithium mining sector, and Wall Street can’t seem to take any more pain.

Piper Sandler analyst Charles Neivert, on Tuesday, downgraded

Albemarle

shares to Sell from Hold and cut his price target to $128 from $140.

Albemarle stock fell 4.2% to $114.90 in recent Tuesday, while the

S&P 500

and

Dow Jones Industrial Average

were off 0.1% and 0.4%, respectively.

The early declines left Albemarle down 55% over the past 12 months, compared with a 16% rise in the S&P 500 over the same time frame.

The current downgrade comes after a long series of catalysts that have driven shares lower. It reflects a “recognition of the substantial deterioration” in global lithium markets, wrote Neivert. He doesn’t see things rebounding for a few more quarters.

Weakening lithium pricing is the main culprit for stock declines of the lithium miners. Benchmark lithium pricing is down roughly 80% over the past 12 months.

Several factors are to blame. For starters, lithium prices were incredibly high a year ago, at about $80,000 per metric ton. In 2022, before electric-vehicle sales accelerated around the world, lithium cost about $7,000 per metric ton.

High prices led to lithium users, such as EV battery makers, buying less and working off inventories.

Lithium

is a key component in the lithium-ion batteries that power Teslas and other EVs.

What’s more, higher EV sales have led to more capacity being added. More capacity combined with a slowdown in the rate of EV sales growth contributed to the lithium industry’s difficult year.

Neivert isn’t alone in getting more pessimistic on shares of lithium miners. In September, the average analyst target price for Albemarle was about $261 a share. Now it’s about $184.

In the middle of the year, it seemed as if Wall Street believed a turn in lithium markets was imminent. A year ago, about 56% of analysts covering the stock rated shares Buy. Albemarle’s Buy-rating ratio in September had climbed to about 80%. It now stands at 72%.

The average Buy-rating ratio for stocks in the S&P 500 is about 55%.

The turn never in the lithium market never arrived. Lithium prices have continued to slide. Like any commodity though, they won’t slide forever. Lower prices will delay capacity and inventories can only be worked off so far. Eventually, Wall Street, and investors, will look for the rebound again.

Write to Al Root at [email protected]

Read the full article here