Energy stocks are out of favor. Fund managers had less exposure to energy stocks heading into 2024 than at any time since December 2020, according to the latest Bank of America Global Fund Managers Survey. With energy prices slipping, investors went from 4% more exposure to energy stocks than their benchmarks in November to 11% less exposure in December—the largest month-to-month decline since January 2016. They had 23% more exposure to tech than their benchmarks.

Then it got worse. This past Monday, Saudi Arabia cut its selling price for oil, sending Brent crude, the international benchmark, down 3.9%, to $75.73 a barrel. Natural-gas prices fell, too, dropping 4.4%. The

Energy Select Sector SPDR

exchange-traded fund was off 3%;

Exxon Mobil

and

Chevron

fell 2.8% and 1.7%, respectively.

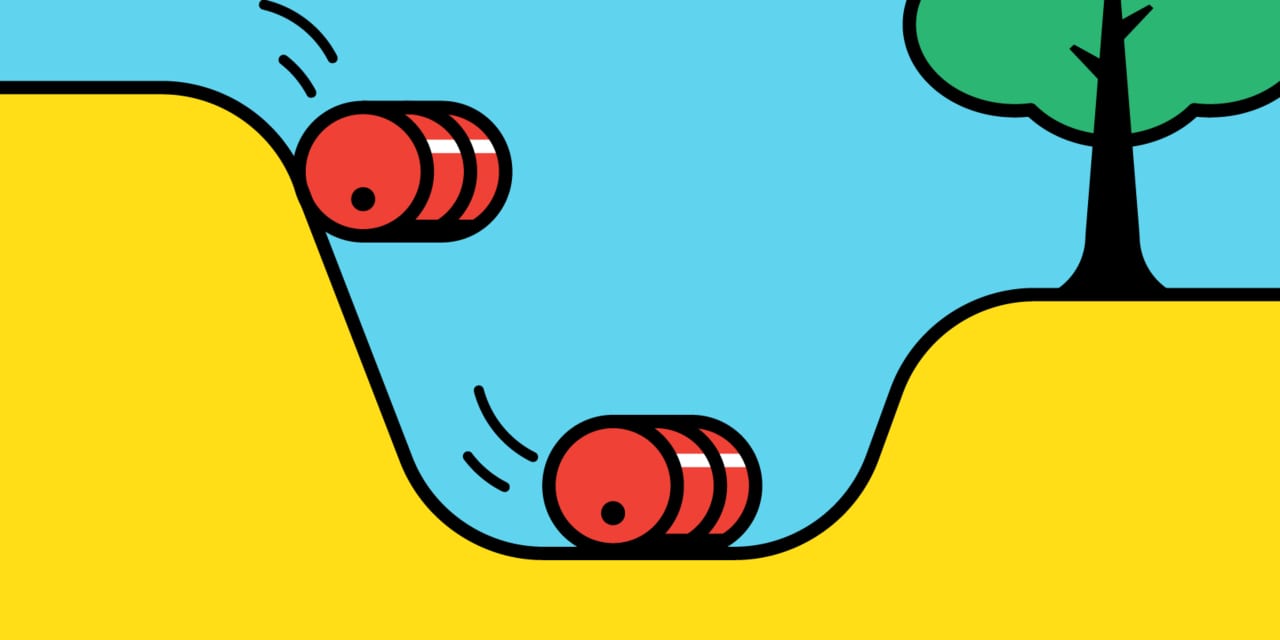

Still, it isn’t always bad for stocks when they’re out of favor. Investors who bought energy stocks in December 2020, the last time they were this out of favor, did very well. The SPDR ETF rose 53% from December 2020 to December 2021.

At least one analyst thinks investors are making a mistake. Roth MKM analyst Leo Mariani wrote that fund managers are “overly bearish” because they are convinced that oil demand is falling fast. Mariani expects demand to pick up, and for Brent crude to average $85 a barrel in 2024. “We would not advocate being underweight energy at this point in time,” he wrote.

Write to Avi Salzman at [email protected]

Last Week

Markets

Congressional leaders reached a spending deal, with only two weeks to pass the full package. Oil fell on Saudi price cuts, surged on Red Sea airstrikes. Core inflation and consumer prices ticked up. On the week, the

Dow Jones Industrial Average

rose 0.34%; the

S&P 500,

1.84%; and the

Nasdaq Composite,

3.1%.

Companies

The U.S. and five allies launched airstrikes against Iran-backed Houthis in Yemen threatening Red Sea shipping. Boeing shares sank after a door blew out on one of its MAX 9 jets, leading to groundings. CEO David Calhoun called it a “mistake.” On Tuesday, a hack of the SEC’s X account falsely said a spot Bitcoin ETF had been approved. On Wednesday, the SEC approved 11 Bitcoin funds and trading began.

Deals

In a deal called by The Wall Street Journal, Hewlett Packard Enterprise agreed to a $14 billion takeover of Juniper Networks…Meanwhile, pharmas were gobbling up biotechs. GSK picked up Aiolos Bio, a three-month-old respiratory specialist, for $1.4 billion, Merck agreed to buy Harpoon Therapeutics for $680 million, and Johnson & Johnson grabbed Ambrx Biopharma for $2 billion…Amedisys shareholders OK’d a $3.3 billion takeover by UnitedHealth. Regulators are looking into it…Boston Scientific bought Axonics for $3.7 billion…Cheseapeake Energy is merging with Southwestern for $7.4 billion…BlackRock said it was buying Global Infrastructure Partners and its $106 billion in assets for $12.4 billion.

Write to Robert Teitelman at [email protected]

Next Week

Monday 1/15

Equity and fixed-income markets are closed in observance of Martin Luther King Jr. Day.

Tuesday 1/16

Financial companies continue to be the majority of early reporters at the start of fourth-quarter earnings season. Goldman Sachs Group, Morgan Stanley, and PNC Financial Services Group announce results on Tuesday. Charles Schwab, Discover Financial Services, and U.S. Bancorp follow suit on Wednesday. Truist Financial reports on Thursday. Fifth Third Bancorp and State Street close out the week on Friday.

Wednesday 1/17

The Census Bureau reports retail sales data for December. Consensus estimate is for U.S. retail and food services sales to increase 0.4% month over month, after a 0.3% rise in November. Excluding autos, retail sales are expected to gain 0.2%, matching the November figure.

Friday 1/19

The University of Michigan releases its Consumer Sentiment survey for January. Consumers’ expectations for year-ahead inflation was 3.1% in December, the lowest level since March of 2021.

Email: [email protected]

Read the full article here