Icahn Enterprises L.P. said Wednesday that its current chief executive, David Willetts, will become CEO of Pep Boys, the automotive aftermarket service chain that it acquired in 2016.

Willetts will be replaced at billionaire activist investor Carl Icahn’s investment arm by Andrew Teno, who is currently an Icahn Capital portfolio manager.

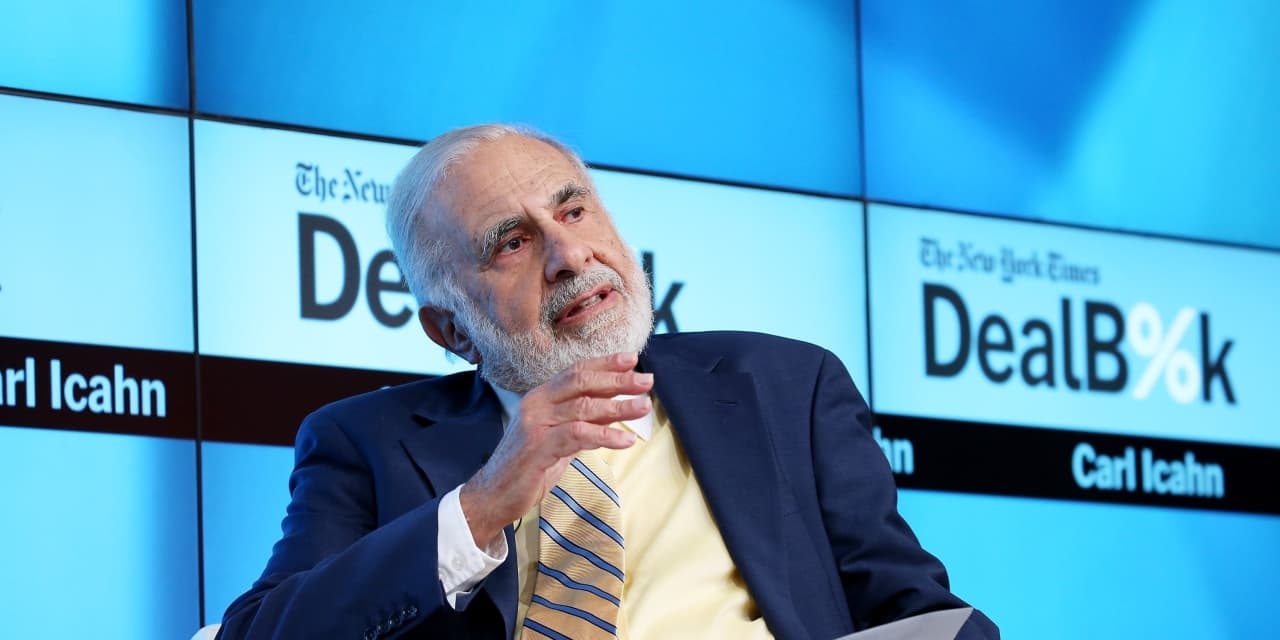

“We believe David’s skill set is particularly suited to work on a day-to-day basis to drive the significant value creation potential in Pep Boys,” Carl Icahn said in a statement.

In the statement, Icahn doubled down on his activist approach to investing, which he called “the best investment paradigm that exists. While this method of investing certainly is somewhat volatile, over the long term the returns cannot be matched.”

The reason it works so well, he said, is that “somewhat unfortunately, many public companies are not well run. It is very difficult and expensive to remove a poorly performing CEO and board.”

Icahn Enterprises currently has 25 board seats in its disclosed public company investments, he added.

Also read: Carl Icahn lands two JetBlue board seats days after disclosing stake in airline

Icahn Enterprises

IEP,

also said its estimated indicative net asset value stood at $4.76 billion as of the end of 2023, down by about $411 million, with the underperformance driven by investment funds and the return of capital to unitholders.

However, the company said it would maintain its quarterly distribution of $1 per depositary unit. That dividend was halved in August after the stock was pummeled when short seller Hindenburg Research on May 2 published a scathing article about the company, accusing it of overstating values and paying a dividend it could not afford, among other things.

Icahn has rebutted the allegations and accused Hindenburg founder and CEO Nate Anderson of writing a misleading and self-serving report.

The stock fell 7.5% Wednesday but has fallen 63% in the last 12 months.

The company has defeased all of its 2024 notes, meaning it has set aside cash or cash and bonds to cover the costs of the debt, according to the statement. It had $2.7 billion in cash as of year-end.

Icahn Enterprises, which is 84% owned by Icahn and his son, Brett, offers exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate. Its unitholders are mostly retail investors.

Read the full article here