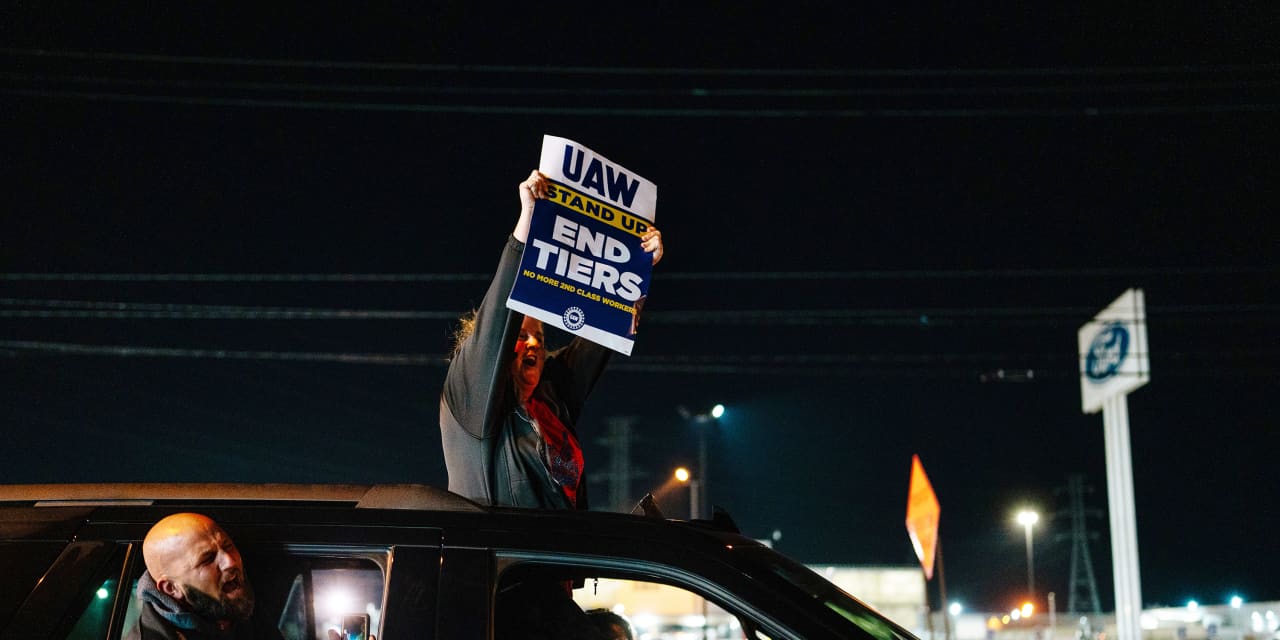

Buying a new car over the past three years has been stressful for many consumers. The United Auto Workers strike may soon throw another wrench in the process.

With more than 12,000 workers striking across three of the biggest U.S. car manufacturers—and the possibility of more joining in coming weeks—vehicle production of some models is set to slow. Depending on how long the strikes last, it could constrain inventories for popular car models at dealers nationwide, making them more expensive and harder to find, expert say.

So far, the strikes have targeted one production plant for each of the Big Three car manufacturers—

Ford Motor

(ticker: F),

General Motors

(GM), and

Stellantis N.V.

(STLA).

The models produced at those plants will likely be the first to come under pressure and could see prices increase early on. This includes the Chevrolet Colorado and Express; the GMC Canyon and Savana; the Jeep Wrangler and Gladiator; and the Ford Ranger and Bronco.

While industry analysts agree that the strikes may lead to price increases, they’re split over how soon they could hit consumers.

Garrett Nelson, analyst at CFRA, argues that price impacts will be “almost immediate,” as fears of a protracted strike could make shoppers rush to buy their cars before they run out, while dealers may use the strike to push for higher prices.

“We think the immediate impact is increased sales and in higher prices,” Nelson said. “Rising tides lift all boats, and so, really, all vehicle brands will benefit from a higher stronger price environment.”

Ivan Drury, director of insights at Edmunds, an online car-shopping resource, said shoppers won’t start to feel the impact for another two or three months. For one, the strikes have hit specific models, mostly midsize trucks and SUVs. While these are profitable models produced by popular brands, they represent a small sliver of the total vehicle market share, he said.

“It’s not so hot that suddenly these vehicles will be all snatched up tomorrow and you won’t be able to find one,” he said. “So if you’re looking the next month or you’re already shopping, I wouldn’t be worried about it.”

What’s more, all three auto makers should have enough supply to meet demand for a few more weeks, Drury added. At the start of September, all Big Three companies had more than 40 days’ supply of inventory on average, according to data from Kelley Blue Book parent Cox Automotive.

Some brands have a bigger cushion than others. Stellantis’ Ram, Chrysler, and Dodge each had more than 100 days of supply. GM’s supply is more restricted overall, and Ford had a few specific models that were more constrained, according to Cox Automotive.

The full extent of the price increases will likely depend on the length of the strike.

“A broad and long-duration strike lasting more than a month will likely materially show up in stores across the country,” wrote Jonathan Smoke, chief economist at Cox Automotive, in a blog post Saturday.

Like Edmunds’ Drury, Smoke believes that any price increases will play out slowly, thanks to the targeted nature of the strikes. He points out that the pandemic was a more drastic disrupter to the car industry than the strikes will be.

Indeed, prices for both new and used cars skyrocketed in the wake of the pandemic thanks to international supply chain snarls. Vehicles were still expensive in 2022, with dealers selling cars at prices 1% higher on average than manufacturers’ suggested prices, according to Edmunds data. That started to reverse in 2023 as supply chains eased up and inventory increased — but a prolonged strike might change that.

On Wall Street, the fear is that the strike may have long-term repercussions for car prices long after a contract is signed.

“If negotiations take place and some of these major proposals come through, the billions of incremental annual costs will be damaging and ultimately increase the prices of EVs rolling out over the next 12 to 18 months to consumers,” wrote Wedbush analyst Daniel Ives in a Friday research note.

The Big Three may also see customers buy cars from foreign brands or nonunion U.S. brands, such as

Tesla

(TSLA), analysts say.

The UAW has pushed back on assertions that the strike will drive up car prices.

“The price of vehicles went up 30% In the last four years,” Fain said talking to the press Friday. “That’s not because of what we do. It’s not because of our wages. They’re putting all this fear out there now, trying to make the public afraid that if we get economic justice, it’s going to increase the price of cars.”

Ford and GM didn’t immediately respond to Barron’s request for comment on whether they saw prices rising as a result of the strike. Stellantis Chief Operating Officer Mark Stewart said Saturday the company will continue to assess its cost structures on a month by month basis.

“We really want to encourage customers, definitely don’t be afraid, please get in the dealerships, we’ve got some very competitive deals for our customers across the lineup, and we’re doing our best to maintain that,” Stewart said on a call with reporters.

Write to Sabrina Escobar at [email protected]

Read the full article here