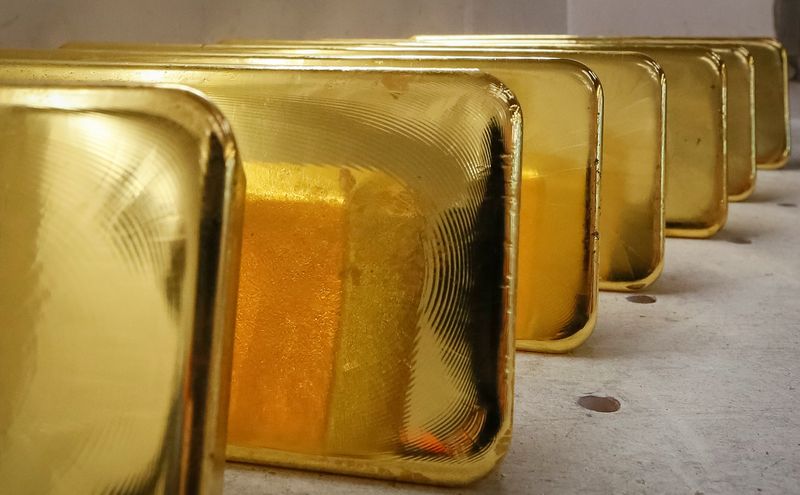

CARACAS (Reuters) – Venezuela’s gold reserves fell by eight metric tons in the year’s first half, central bank data showed on Friday, continuing a years-long reduction in the reserves amid a prolonged economic crisis.

The drop in the first six months of 2023 brought the central bank’s total reserves to 61 tons, down from 69 tons in December 2022.

The gold reserves were valued at $3.65 billion at the end of June, down $261 million from their value in December.

The central bank did not give details for the fall in reserves and did not immediately respond to a request for comment.

The average price for gold, according to estimates by the bank, was $1,862.71 per troy ounce in the year’s first half, up from $1,775.02 per troy ounce in the latter half of 2022.

A share of the central bank’s reserves have been in dispute in London courts. In June, the central bank’s board, controlled by the government of President Nicolas Maduro, lost its latest appeal for control of $1.95 billion of the country’s gold reserves held at the Bank of England.

The central bank for decades held more than 300 tonnes equivalent of gold, but between 2015 and 2017 Maduro’s cash-strapped government began using the precious metal as a collateral for loans with international banks.

A fall in oil production and U.S. sanctions, which have stymied crude exports, have also led the government to use the gold as a funding source, with opponents and analysts claiming the government has sold the gold for cash.

Read the full article here