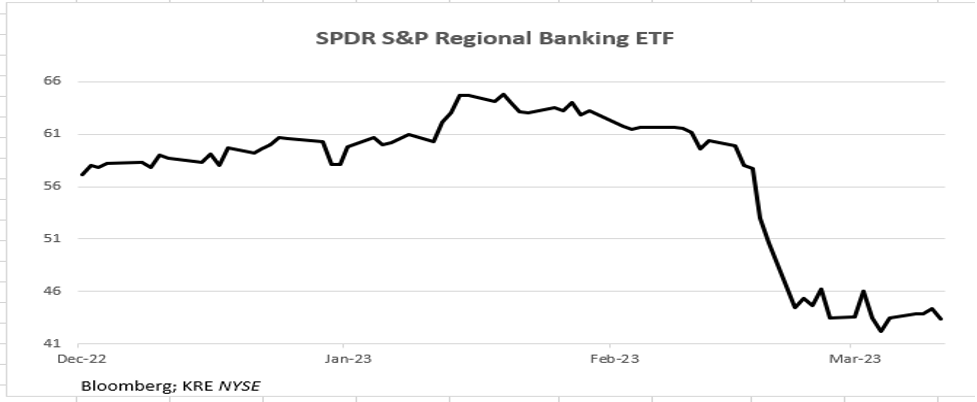

The banking chaos appears to have calmed somewhat this week with no new banks targeted for deposit outflows. The chart shows that, as of close of business on Thursday, March 30, small and mid-sized bank stock prices have stopped falling. Note: they haven’t risen, either. Lest anyone think that this was one-and-done and it’s over – think again! When something in the financial system breaks, it is never a one-off event.

In April ’07, New Century Financial (sub-prime lender), filed BK. In August, liquidity in sub-prime securitized mortgages dried up. (Note, however, that the Fed actually cut rates in September ’07.) New Century was just

just

The chart above shows deposit losses at both large and small banks. Note that beginning with the Fed’s hiking cycle in March 2022, deposit growth at banks (especially large ones) was negative, as interest sensitive deposits left the banking system in pursuit of higher yields (money market funds, T-bills…). Until the SVB

VB

The Fed appears to be caught between a rock and a hard place. On the one hand, despite evidence of falling inflation, it believes it must maintain its credibility in its inflation fight by raising interest rates. On the other hand, it is providing a huge amount of liquidity (cash) to restore confidence in the banking system. The provision of such cash can’t help it in its inflation fighting efforts.

Deeper Recession

The liquidity issues are destined to make the Recession both deeper and longer.

- · Banks hold $3 trillion of Commercial Real Estate (CRE) loans, the largest loan category on their balance sheets and nearly doubling in size since the Financial Crisis.

- Over the past month, we have noted rising foreclosures in this space with yet another Wall Street Journal article appearing on Wednesday (March 29) discussing such issues: “Distress in Office Market Spreads to High-End Buildings.”

- Banks were already tightening lending standards prior to the financial chaos of the past few weeks (see chart above). After the liquidity issues and questions revolving around the value of their bonds and loans, they really have no choice but to bolster their balance sheets. This means even tighter lending standards, making borrowing both more difficult and much more expensive, all at a time when corporations have been limiting their capex plans. Not a positive picture for economic growth.

- Another issue, both for the banks and the economy in general, is the now accelerating fall in home prices. Note from the table that Residential Real Estate is nearly a quarter of bank loan books. The Case-Shiller Home Price Index fell again in January (-0.4% M/M; latest data) and this index has been falling for seven months in a row. Over that period, the annualized rate of contraction is -7.5%

- The major asset on the balance sheets of U.S. consumers is their home. In today’s dollars, homes in the U.S. are worth $48 trillion. In 2007, that number was $26 trillion, so quite the advance. Over the last three years, home prices have risen +36%, so we can expect some price reversion as the Recession unfolds. Just as an exercise, if home prices were to fall -25%, that would wipe out $12 trillion of homeowner equity likely to elicit a large negative wealth effect, perhaps reducing consumption by as much as -5%.

- Back to the banks. If home prices fall by that -25% number, or even less, some recent purchasers of homes will find themselves with negative equity. The loss of a job in such a household is likely to result in non-payment and foreclosure with the mortgage holder eating the loss. Note from the table above that Residential Real Estate has nearly a 25% weight in bank loan portfolios.

- Then, of course, there are those consumer, credit card, and auto loans. As we have discussed in prior blogs, delinquency rates for those categories are already on the rise.

Final Thoughts

The evidence at hand says the banking system has entered one of those “difficult” periods. We think this will likely last for several quarters.

In past cycles, when Recessions lurked, the Fed was the white knight racing to the rescue by cutting rates. The Recessions still occurred, but the rate cuts at least began the healing process. Not this Fed! It appears consumed by lagging indicators. Per Fed Chair Powell:”…inflation remains too high and the labor market continues to be very tight.” This despite a CPI that has risen at a +2.1% annual rate over the past three months, large layoff announcements at major companies, and surveys from the Fed’s own Regional Reserve Banks all pointing to significant economic slowing. (Orders and backlogs are falling in all the surveys, pricing is clearly weakening, and the overall indexes are contracting.)

And into the storm of a distressed banking system, clearly caused by the Fed’s own sky-high interest rates, what do they do? Raise them even higher! As we said in our last blog, “obtuse” is the operative adjective.

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here