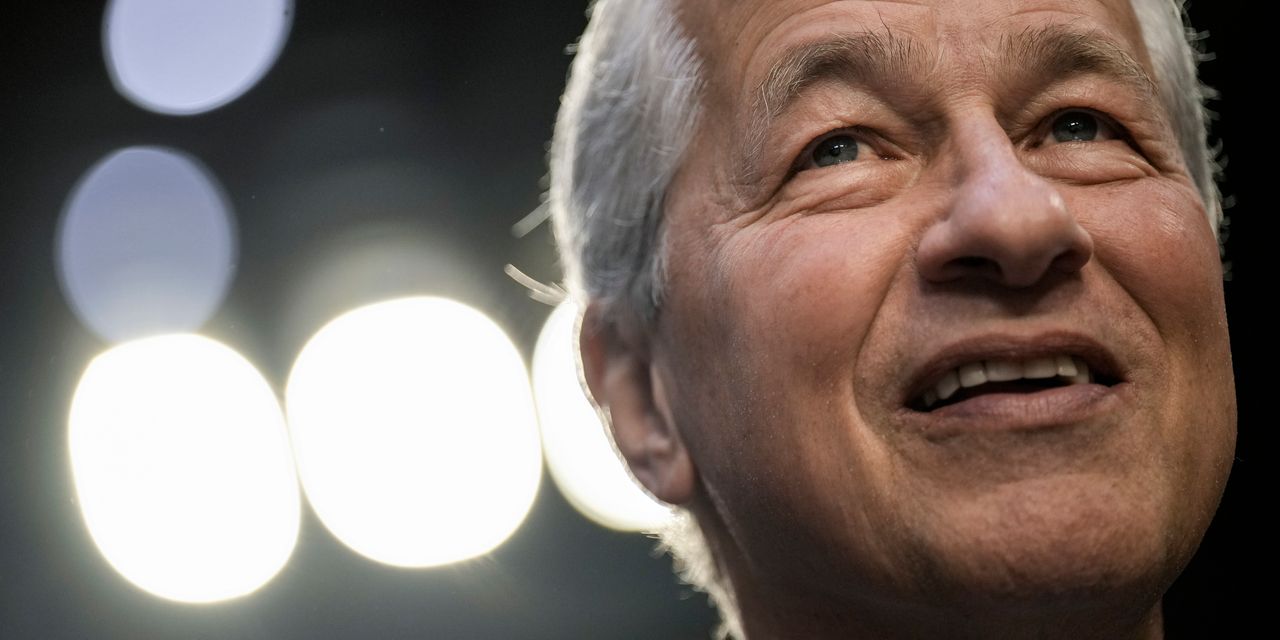

Dimon said the recent troubles at banks make a recession more likely.

Getty Images

JPMorgan Chase

Chief Executive Officer Jamie Dimon said that the recent market jitters for banks make a recession more likely.

The episode is “another weight on the scale” leaning toward economic contraction, he said in an interview with CNN broadcast Thursday. “It won’t necessarily force a recession, but it is recessionary.”

His comments come just days after writing that the banking “crisis” that bubbled up last month isn’t over yet in his annual shareholder letter.

Concerns about banks’ finances led depositors and investors to withdraw funds from some lenders last month, ultimately ending in the collapse of Signature Bank, Silicon Valley Bank, and

Credit Suisse

in Europe. JPMorgan (ticker: JPM) was one of the banks that deposited funds at

First Republic Bank

(FRC) to shore up its finances.

The episode is probably over now, Dimon said, but noted that it had caused banks to restrict lending. He said he had seen estimates that tighter conditions might be equivalent to an extra half-point of interest-rate increases from the Federal Reserve.

As the Fed started tightening last year, Dimon predicted that an “economic hurricane” was coming. He later walked back on that view as output stayed steady and unemployment remained historically low.

Dimon said that the recent bank turmoil was nothing like the crisis more than a decade ago because only a few banks had problems.

In 2008, “it was hundreds of institutions around the world with far too much leverage,” he said. “We don’t have that.” He added that there aren’t big problems in the mortgage market now, either.

Nevertheless, he doesn’t expect the events of the past month to prompt the Fed to change tact.

People should “be prepared for higher rates for longer,” he said. “I don’t know if it’s going to happen, but be prepared for that tide.”

The Fed increased rates by a quarter-point last month despite worries about the banking sector. Its next decision is scheduled for May 3.

Write to Brian Swint at [email protected]

Read the full article here