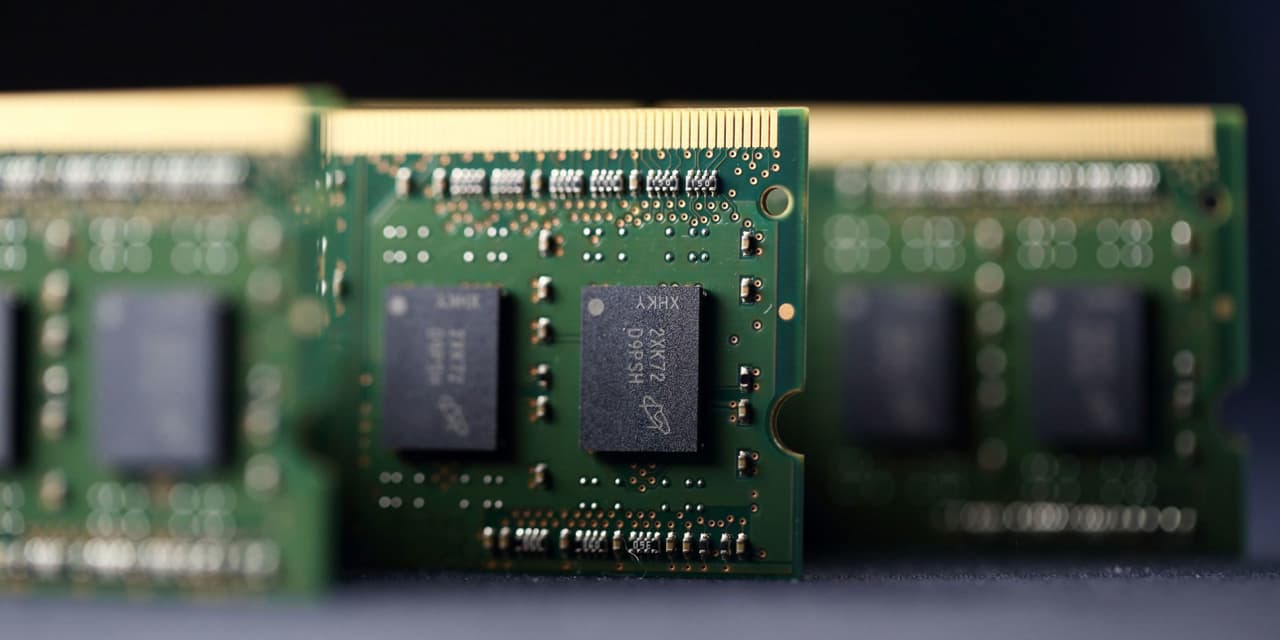

Micron Technology issued sales guidance for the second quarter of about $5.3 billion at the midpoint, higher than expectations of $4.97 billion.

Photograph by Tomohiro Ohsumi/Bloomberg

Stocks rallied Thursday, with small caps leading the way.

These stocks were making moves Thursday:

Micron Technology

posted an adjusted fiscal-first-quarter loss of 95 cents a share, narrower than analysts’ estimates, and issued sales guidance for the second quarter of about $5.3 billion at the midpoint, higher than expectations of $4.97 billion. The semiconductor company also said generative artificial intelligence would spark rising demand for memory chips over the next several years. Shares of Micron jumped 8.6%.

Canadian cybersecurity company

BlackBerry

forecast fourth-quarter revenue of $150 million to $159 million, below analysts’ estimates for $185.6 million. The stock fell 13%. For the third quarter, BlackBerry reported an adjusted profit of 1 cent a share, while analysts had expected an adjusted loss of 4 cents.

Calliditas Therapeutics

received full approval from the Food and Drug Administration for Tarpeyo delayed release capsules as a treatment for adults with primary immunoglobulin A nephropathy, a kidney disease. The stock was up 13%.

JFrog

jumped 9.7% after Morgan Stanley analysts upgraded shares of the software-development-tools company to Overweight from Equal Weight and raised their price target to $42 from $32.

Paychex

declined 7% after the payroll services reported fiscal second-quarter sales that missed analysts’ expectations.

Carnival

was up 6.2% after the cruise operator reported better-than-expected quarterly earnings and said vacation demand remained strong.

Cintas

gained 6.6% after the provider of uniforms, mats, and mops beat earnings and sales estimates and raised its financial guidance.

CarMax

rose 5.2% after the used-car retailer reported better-than-expected fiscal-third quarter earnings and resumed its share repurchase program.

The CEOs of

Warner Bros. Discovery

and

Paramount Global

met this week and discussed a possible merger between the media companies, The Wall Street Journal reported, citing people familiar with the matter. No formal talks between the companies are under way, the Journal added. Warner Bros. owns several studio and television properties, including cable channels CNN and HBO, and streaming platform Max. Paramount also owns a studio, the CBS television network, cable operations including Nickelodeon, and streaming platform Paramount+. Warner Bros. shares dropped 1.5%, while Paramount was down 2.8%.

Spotify Technology

stock rose 2.1% after Pivotal Research upgraded shares of the streaming-audio company to Buy from Hold, and raised the price target to $265 from $170.

Write to Joe Woelfel at [email protected] and Emily Dattilo at [email protected]

Read the full article here