“‘Steve taught me well: never to get married to your convictions of yesterday. To always, if presented with something new that says you were wrong, admit it and go forward instead of continuing to hunker down and say why you’re right.’”

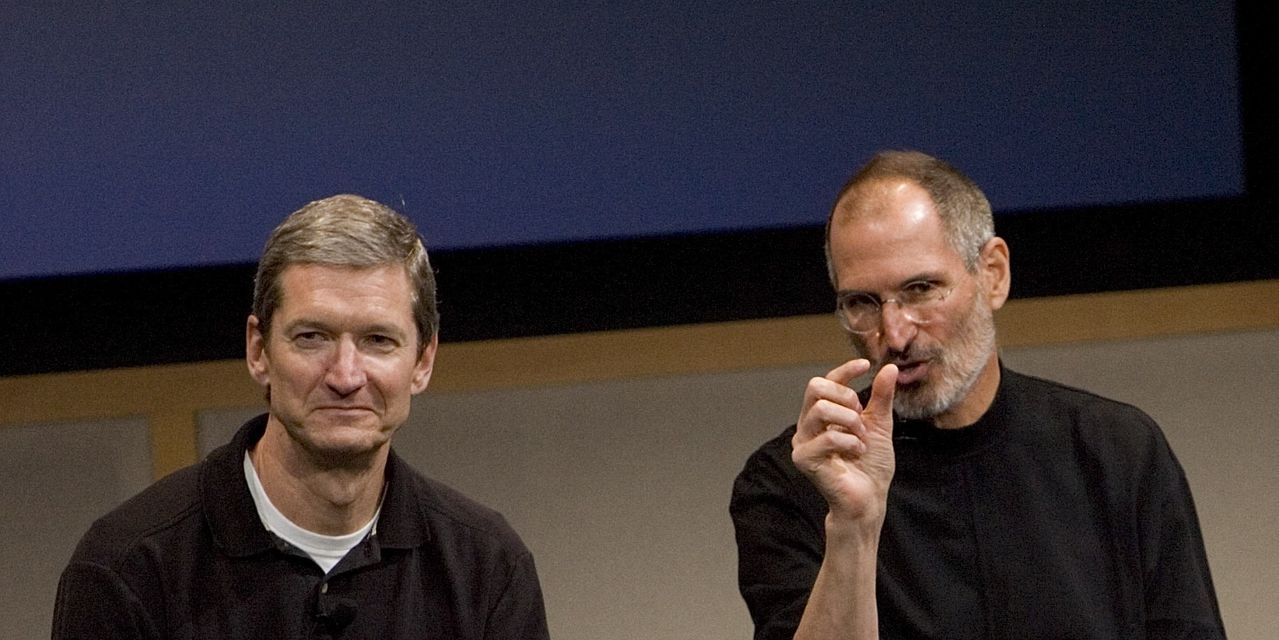

That is one key life lesson that Tim Cook, CEO of Apple

AAPL,

says he learned from the inimitable Steve Jobs before the founder of the Cupertino, Calif.-based company died in 2011.

Cook made the remark in an interview with GQ, published online April 3, in which the current Apple leader offered some insights into the company’s latest tech dalliance — with augmented and virtual reality.

But the notion espoused by Jobs of not being wedded to any one idea is an important piece of plainspoken wisdom and echoes views held by other sages, including Ralph Waldo Emerson, the putative leader of the Romantic and Transcendental movement in American literature in the 19th century.

“A foolish consistency is the hobgoblin of little minds, adored by little statesmen and philosophers and divines,” Emerson wrote in his famous essay “Self-Reliance.”

As GQ documents in its interview, Apple’s inventions, “starting with 1976’s Apple I and 1977’s Apple II, and continuing through the iMac, the iPod, the iPhone, the iPad, the Apple Watch, and AirPods,” have been seen by many as seminal in consumer-focused gadgetry.

Jobs was known as a person who viewed failure as an opportunity for reinvention, especially if you were eager to acknowledge your weakness and figure out ways to fix it.

Despite taking over from a leader who boasted a passionate following, Cook hasn’t wilted in the role, presiding over a hugely popular enterprise. Apple became the first company to be valued at $3 trillion early last year (it is currently valued at around $2.5 trillion), and its share-price increase over the past five years of more than 230% has far outpaced the S&P 500

SPX,

which is up 48%.

April is National Financial Literacy Month, a good time to embrace the lesson Cook absorbed from Jobs, especially as investors navigate a financial landscape that is rapidly shifting from one of superlow rates to a much higher interest-rate regime. Investors will need to avoid dogmatism and remember that the strategies that worked in the past may not be suited for what lies ahead.

That is to say, the ability to be nimble and make adjustments on the fly may be the key to success for leaders and investors.

Take MarketWatch’s 2023 Financial Literacy Quiz. Will you get 10/10?

Check out: Apple seeing ‘stable to improving’ trends in iPhone business, says BofA

See: My father retired with up to $10 million, and bought my sister a rehab center. He said no to my request to pay for my kids’ education. What can I do?

From the archives (October 2011): Steve Jobs: MarketWatch’s CEO of the Decade

April is National Financial Literacy Month. To mark the occasion, MarketWatch will publish a series of “Financial Fitness” articles to help readers improve their fiscal health, and offer advice on how to save, invest and spend their money wisely. Read more here.

Read the full article here