Call it the China conundrum.

Why is a nation with ambitions to become the dominant economic power in the world doing so many things to blunt that potential?

“It’s the question of questions,” Orville Schell, director of the Center for U.S.-China Relations at The Asia Society in New York told CNBC, “because it is so illogical. When you have a good thing going, why do you screw it up?”

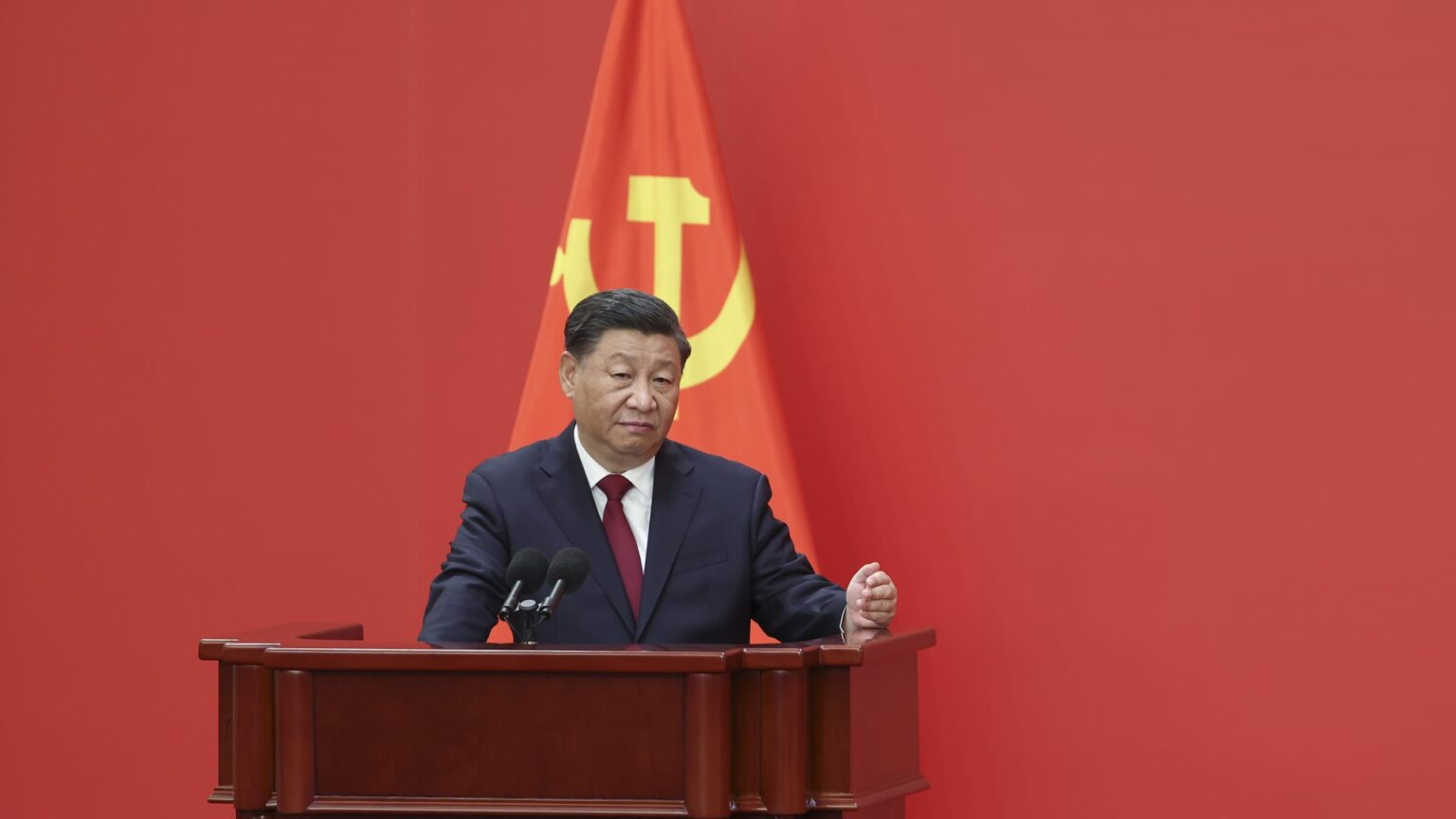

Schell and many eminent China experts debate whether the answer lies in Xi Jinping, leader of China since 2012, or in the very nature of the Chinese Communist Party, which has ruled over China since the Communist Revolution in 1949.

The economic moves are easy to list but hard to explain if one is trying to achieve ever more economic growth: the disappearance of prominent entrepreneurs, a new espionage law making it hard to do business, the dramatic shift of capital and loans away from the private sector to state-owned enterprises, just to name a few.

Those actions and more are leading to predictable results, MIT Sloan School Professor Yasheng Huang told CNBC, “the economy is slowing down, private investment is slowing down. There’s a massive flight of capital.”

The actions also seem to be a turn in the road for a country that, beginning in 1979, pushed through economic reforms which dramatically increased the role of the private sector, led to massive economic growth and lifted almost 800 million people out of poverty.

Xi vs. the CCP

Most, though not all, China watchers point to Xi himself as the instigator of those recent changes. While policy wonks split hairs over whether the U.S. and its allies are “decoupling” or “derisking” from China, Schell says “the real decoupler is Xi Jinping.”

Chinese officials at the U.S. embassy declined to comment to CNBC when asked about the criticism of Xi.

Ryan Hass, director of the China Center at Brookings, cites Xi’s “ideological rigidity and lust for control” which “is at odds with the pragmatism that defined China’s period of reform and opening.”

“China’s private sector, previously the growth engine of the Chinese economy, is paying the consequences,” he told CNBC.

It is Xi who has brought China’s pragmatic era of governance “to a crashing halt,” said Kevin Rudd, the former prime minister of Australia, in the Foreign Policy news publication in December 2022. Rudd, who penned a 420-page thesis on Xi’s worldview for his PhD at Oxford University, says Xi views the world through “Marxism-Leninism,” an ideology many thought dead and that China had left behind.

But it’s back, says Rudd, and Xi’s Marxist vision means greater control over the private sector, an expanding role for state-owned enterprises and industrial policy, and the quest for “common prosperity” through redistribution — all of which is likely to shrink economic growth, he concludes. Rudd is the current Australian ambassador to the United States.

Anne Stevenson-Yang, founder of J Capital Research, is one of the few who think the role of Xi is overstated. Instead, she points to the wider Chinese Communist Party, whose members feared that the rising role of the private sector is reducing their power.

“Xi is a reaction to the weakening of the Party through the expansion of the economy, and a determination to recapture the power of the Party,” says Stevenson-Yang, who testified in front of the U.S. Congress’ China Select Committee earlier this month.

Stevenson-Yang is also one of the few who isn’t puzzled by what’s happening in China, after living there for more than 20 years. The CCP “was always going to decouple. Once the party had acquired enough power, enough resources, enough money, it was always going to decouple,” she told CNBC.

The reforms that began in 1979, she says, “were always meant to be temporary, in order to bring in more resources.”

“As the private economy and entrepreneurs become more powerful, the party will rein them in,” which is the reason she says high-profile business leaders such as Jack Ma have been sidelined. “In the U.S., money flows to power and power flows to money. In China, money is supposed to flow to power, but not the other way around.”

Fall of communism in the USSR

Regardless of whether it is Xi or the CCP driving the bus, almost all China watchers believe the fall of communism in the former Soviet Union in 1989 is a key motivating event that dominates their thinking. Xi said as much when he gave a speech in 2013 in which he dwelled on “the risks of the ideological decay that led to the collapse of Soviet communism.”

Xi doesn’t want to be China’s Mikhail Gorbachev, the final leader of the Soviet Union, says Schell.

To be sure, some of the most important reforms are still in place. Chinese citizens are still allowed to own property, something only codified into law in 2007. They are allowed to start businesses, whereas back in 1949 during the Communist Revolution business owners were at best exiled, and at worst, killed. China still allows and even actively encourages foreign investment.

What Chinese officials are saying

While Chinese officials decline to comment on the criticisms of Xi, they do push back against the suggestion that China’s private sector is being stifled by the government.

“The Chinese government attaches great importance to the development of SMEs and the private sector. By the end of this May, there are over 50 million private companies in China, about 92 percent of all registered companies in the country,” Liu Pengu, spokesperson at Chinese embassy in the U.S., told CNBC.

In addition, he said “in recent months, China’s National Development and Reform Commission has set up a bureau especially for private sector development.”

Chinese officials in the U.S. are eager to counter the West’s extremely pessimistic view of their economy. In a recent meeting with journalists, Chinese embassy officials listed several positive economic data points including a gross domestic product growth rate in the first half of the year they say was 5.5%.

Counselor Yang Fan says consumers and the service sectors are playing an increasingly important role in economic output, something economists have long said was necessary. The counselor told reporters, “about 502 million Chinese went to watch movies this summer.”

They cite external factors for weakness in the Chinese economy, including U.S. tariffs, trade restrictions, sanctions, and the sluggish post-pandemic global economy.

And they also worked to counter the prevailing view that China is turning its back on reforms by providing a long wish list of what Western business leaders and economists say China should be doing.

“China actively promotes high-standard opening-up, strives to foster a world-class business environment that is market-oriented, law-based and internationalized, further relaxes market access, ensures national treatment for foreign-funded companies, maintains and promotes fair competition, and will open its door even wider to the world,” said Counselor Zhang Xinyu.

The skeptics

But skeptics don’t believe it. Liza Tobin of the Special Competitive Studies Project, a think tank founded by former Google CEO Eric Schmidt, is a longtime student of Marxist-Leninist thinking in China, and she says companies doing business there should take heed: “Once China develops indigenous technologies, they will push out foreign companies.”

Journalist Bob Davis was in Beijing for the Wall Street Journal in 2013 when Xi made a much-heralded speech in which he specifically cited “the decisive role of the market.” That led many to believe that Xi would continue to expand the role of the private sector. “It is widely understood that we misinterpreted him. He’s an orthodox Marxist,” says Davis.

Still, the recent changes under Xi are worrisome to Schell, who first started traveling to China as reporter for the New Yorker in the 1970s during China’s Cultural Revolution under Mao Zedong. After so much hard work to raise the prosperity level of the country, Schell says: “We may be witnessing, though I hope it’s not true, a terrible tragedy.”

— Michelle Caruso-Cabrera is a CNBC Contributor. Read her full bio here.

Read the full article here