Our nation is facing a significant shortfall in young people entering the workforce as accountants. Setting aside the joy of accountants wanting to become lion tamers – the impact on the nation is potentially significant. I am seeing first-hand in discussions with our CPA Firm relationships across the country that the dearth of new accountants is having a marked impact to the detriment of small and medium sized businesses as well as non-profit organizations that depend on the finance, tax and accounting skills of these CPA firms.

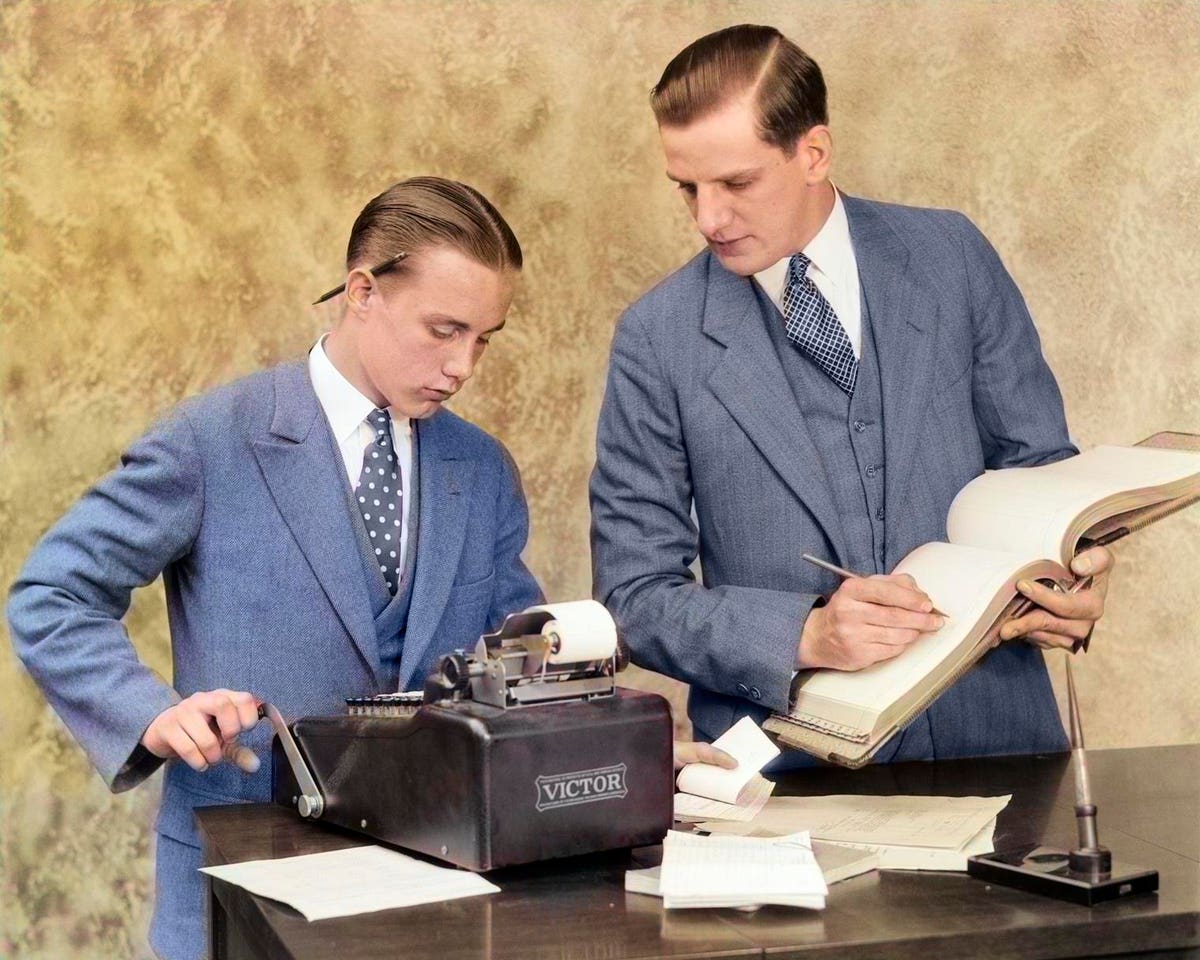

Encouraging More Students To Enter Into the Accounting Profession

The Wall Street Journal has done a number of outstanding articles that have underscored the shortage of accountants in this country and the impact on business: with increased salaries not moving the needle. And if you think CPA firms are having a hard time hiring – the lack of CPAs is a disaster for the IRS as it looks to increase hiring CPAs as auditors and examiners. For the IRS hiring more people to answer phones and move mail is one thing – hiring a significant number of CPAs (while retaining current CPAs on staff) is going to be an enormous challenge.

One major problem for CPA firms and the IRS — the requirement by states that individuals have to have five years of college (150 hours of college credit) to get a CPA license. What particularly stunned me from the first-rate WSJ article was that the extra year of college – the student isn’t required to take any accounting or financial courses (hello French poetry).

Requiring this fifth year of college looks to be absolutely a sham – nothing but a revenue enhancer program for college administrators. For policy makers concerned about skyrocketing tuition costs and student debt – ending this costly, burdensome and, most importantly, useless requirement should be a priority. Congress should consider intervening if the states won’t make this commonsense change. According to the WSJ article, Ohio has long-required only four years for college for a CPA and the Ohio CPAs practice nationally – and the world still turns.

Overseas Talent As A Partial Solution

Historically, the big four accounting firms have looked overseas – particularly India — to address hiring shortages of American workers in accounting (the big four can have north of 50,000 professionals each in India).

For the vast majority of CPA firms looking on their own to hire accounting support in India has understandably not been practical given economies of scale and other barriers. In response to this reality, and at the request of CPA partners – my shop decided to doing something about it and formed alliantTALENT a number of years ago to essentially serve as a bridge between CPA firms and professional talent in India. The response has been strong – and we now have approximately 1000 employees in India assisting US CPA firms.

The range of work that can be performed to support US CPA firms includes: in audit — financial statement audits, review and compilations; employee benefit plan audits; single audits and not-for-profit audits; and assurance services. For tax, the work can include individuals and trusts; passthroughs; corporations and international. In addition, the CPA firm can look to assistance in business advisory – such as control assurance; valuation; process automation; and data analytics – as well as a host of accounting managed services. In short, the overseas employees are essentially an extension of the US CPA firm.

I’m particularly pleased that our creating this bridge allows CPA firms to compete effectively for talent with the big four – and frees up CPAs to focus on their clients and their top priorities. In practice, CPA firms that are between $8 million and $150 million are possibly good candidates for considering expanding their workforce overseas – with expansion helping the CPA firm remain competitive.

The crunch for hiring new accountants is real, and will only be getting worse – with real ramifications for both CPA firms and the American businesses they serve.

Congress and state legislators (and Treasury and IRS should be just as interested in addressing this problem) can do the easy thing of ending the worthless fifth-year requirement. The IRS in particular needs to be all in in thinking creatively of offering extensive training/education incentives for new hires (especially suggest looking at a program for former military). That’s a start. In the meantime, CPA firms that want to continue to grow and thrive need to look and consider how the big four have addressed their workforce challenges.

Read the full article here