Confusing investors everywhere, one mutual fund may have multiple share class offerings. Multiple versions of a share class are often used to differentiate between the types of fees that the fund carries. In the commission-based world, those include front-end fees, back-end feeds, sales charges, 12b-1 fees, and more.

Other share class differences are explained by the minimum initial investment requirements. For example, one share class might have a higher minimum initial investment but a lower expense ratio while another has no minimum investment and a higher expense ratio.

The fee structure is important, but ignoring the fee structure, all mutual funds of the same share class are the same fund at their core.

Selling one mutual fund share class in order to buy another one can be costly though. For example, selling a mutual fund in a taxable account may realize capital gains which are taxable at qualified rates on your next tax return. If the gains are significant, this might be a barrier to reducing fees through a share class change.

This is why an interclass exchange (ICE) exists. An interclass exchange (ICE) is a non-taxable exchange of one share class of a fund for a different share class of the exact same fund. This allows you to switch from one share class to another without realizing capital gains or worrying about wash sale rules.

However, interclass exchanges are not necessarily free of charge. While the trading costs on ETFs have effectively dropped to $0 thanks to custodian competition, mutual fund sales and purchases often still carry trading costs. And those transaction fees still exist for an interclass exchange.

For example, American Funds has several different share classes of the exact same funds. When Charles Schwab allowed the F3 share class of American Funds on the Schwab platform, it also allowed interclass exchanges between the share classes. Here is how that worked at Schwab:

- The Growth Fund of America A Shares (AGTHX) is a no-transaction-fee mutual fund at Schwab which normally has a sales charge and an expense ratio of 0.64% per year.

- The Growth Fund of America F3 Shares (GAFFX) is a transaction-fee mutual fund at Schwab which has no sales charge and a lower expense ratio of 0.30% per year.

- At the time of writing this, the transaction fee Schwab would charge our clients for the F3 share class would be $24.

- An interclass exchange from A shares to F3 shares would cost $0 for the sell but would cost $24 for the buy.

- In an interclass exchange, the cost basis of the original fund would be used for the new purchase and no capital gains would be realized.

Our guess is that Charles Schwab and American funds have reached some sort of revenue-sharing agreement over the A share class which has purchased its placement on Schwab’s no-transaction-fee list. Meanwhile for the lower cost F3 shares, Schwab has agreed that they will hold that share class, but they will charge a transaction fee for buys or sells of it.

The A shares have a 0.64% expense ratio and the F3 shares have a 0.30% expense ratio plus a $24 transaction fee. These extra costs are one reason we typically prefer exchange-traded funds (ETFs) over mutual funds. However, sometimes our new clients bring mutual funds from prior management and ask for our assistance in deciding what to do with the funds.

Assuming that you can exchange your shares of A Class AGTHX for shares of F3 Class GAFFX without owing any capital gains tax, you would reduce your expense ratio by 0.34% (0.64% – 0.30%). If you had $14,118 invested in the fund, the lower cost share class would earn you approximately $48 of better return in the first year ($14,118 * 0.34%). This would offset the cost of the $24 transaction fee at Schwab to purchase GAFFX as well as the same fee when it comes time to sell the position.

Investment Advisors are allowed to make these exchanges. Hidden behind a Schwab Institutional Login, there exists Schwab’s “Essential Information” and Schwab’s “Procedures” pertaining to these exchanges. There are also “Exchange Dates” when such exchanges are allowed. Advisors at Schwab can also request an “ICE Report” of all the potential share class exchange opportunities available to your advisory firm.

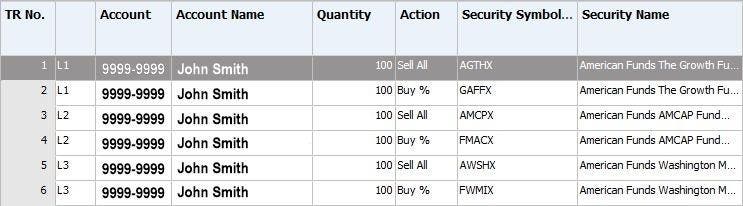

Schwab’s current procedures require the advisor to enter trades in the form of a SELL ALL of the existing mutual fund along with a SWAP SYMBOL for the buy of the lower expense ratio share class. In the Schwab trading system, that turns into something that looks like this:

Currently, this trading file must be submitted after 4pm and before 5pm on one of the days when exchanges are allowed. This helps the Schwab mutual fund desk distinguish between normal mutual fund trades (which must be received before 4pm) and these share class exchanges. The trades will be executed the following day, and show up in client portfolios the day after that.

Share class exchanges can create small savings for investors who have found themselves invested in the wrong share class. However, it is better to buy the lower cost funds in the first place.

Read the full article here