“If this is left to stand, how can you trust any debt security issued in Switzerland, or for that matter wider Europe, if governments can just change laws after the fact.”

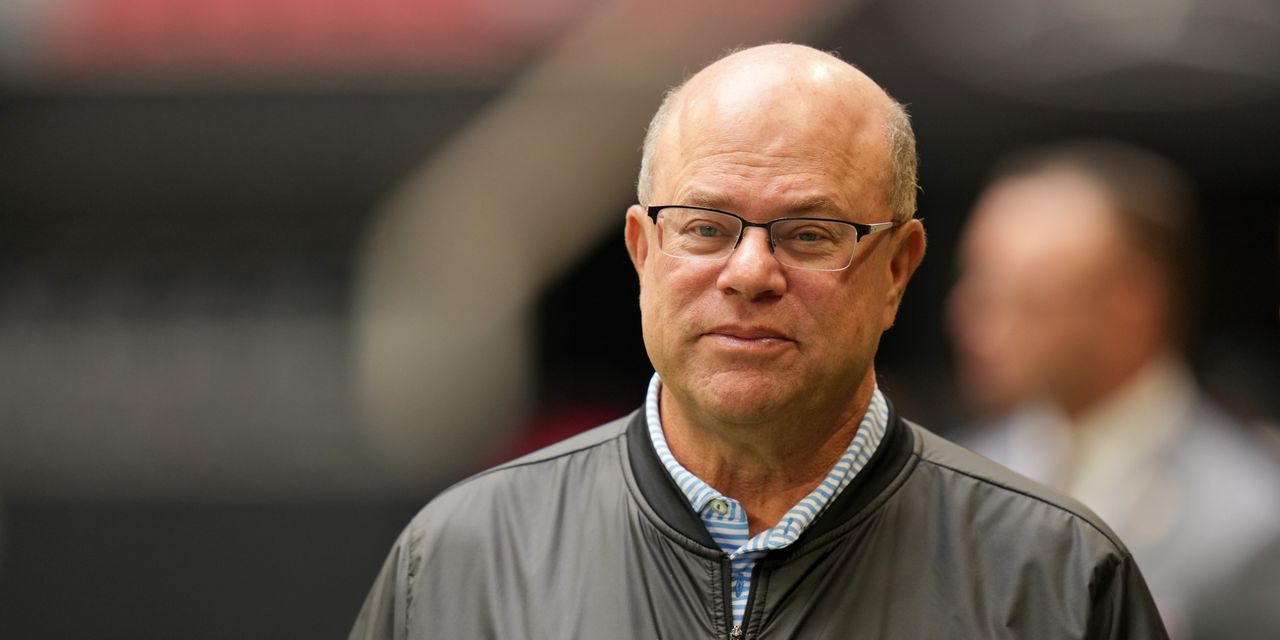

That was Appaloosa Management’s co- founder David Tepper, venting his frustration to the Financial Times on Thursday over the Swiss regulators’ decision to going against the normal pecking order and write down Credit Suisse’s CoCo bonds to zero over the weekend.

The U.S. hedge fund manager billionaire, who is known for buying up distressed debt, had bought an array of Credit Suisse’s senior and junior debt as crisis hit the troubled Swiss lender, the report said. Additional Tier 1 (AT1 or contingent convertible or CoCo) bonds are a form of junior debt, that were engineered in the wake of the 2008 financial crisis to protect taxpayers and transfer risk to investors if banks were to enter turmoil.

Bondholders have been infuriated over losing out from Finma’s emergency measure to write down $17 billion worth of CoCo bonds as part of its deal to merge Credit Suisse

CS,

CSGN,

with UBS

UBS,

UBSG,

which would pay over $3 billion to shareholders.

“Contracts are made to be honored,” Tepper added.

But Finma has defended its decision for the wipeout, saying that the contract for AT1s at Credit Suisse could be fully written down in a viability event.

“The AT1 instruments issued by Credit Suisse provide contractually that they are written off in full in the event of a trigger event (viability event), in particular when extraordinary government support is granted,” the regulator said in a statement on Thursday.

Read: What are CoCos and why are Credit Suisse’s now worth zero?

CoCo bonds are structured to absorb a bank’s losses in stressful times. When a bank’s capital falls below a certain threshold, they are automatically converted into equity. But usually, they are not the first instruments to be triggered, rather they are normally written down or converted after equity instruments are erased. As equity shareholders were set to receive over $3 billion as part of the deal, the move has irritated bondholders.

Statements by Eurozone organizations appeared to distance themselves from Swiss authorities’ write-down.

“Common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier 1 be required to be written down,” said the Single Resolution Board, the European Banking Authority and ECB Banking Supervision in a joint statement on Monday.

“This approach has been consistently applied in past cases and will continue to guide the actions of the SRB and ECB banking supervision in crisis interventions,” they added.

The move has also sparked legal action to contest the decision. Quinn Emanuel Urquhart & Sullivan is one of the law firms representing bondholders and held a call on Wednesday with 750 bondholder participants.

“You know something has gone wrong when other regulators come and politely point out that in a resolution [they] would have respected ordinary priorities,” Quinn partner Richard East told the Financial Times.

The report added that the law firm was looking into challenging Finma’s actions on the grounds of violating investor property rights or an “arbitrary exercise of discretion” and even if Credit Suisse could be liable of mis-selling to investors.

Also: Pimco and Invesco had the biggest holdings in Credit Suisse CoCo bonds: report

Read the full article here